Potential Upside For Farfetch Limited (NYSE:FTCH) Not Without Risk

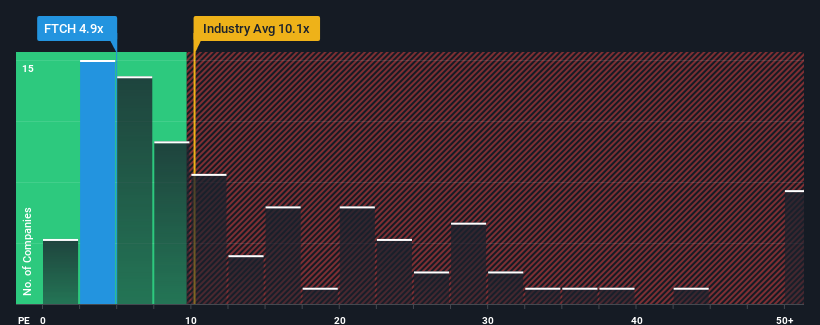

Farfetch Limited's (NYSE:FTCH) price-to-earnings (or "P/E") ratio of 4.9x might make it look like a strong buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 15x and even P/E's above 30x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

While the market has experienced earnings growth lately, Farfetch's earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Farfetch

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Farfetch.

How Is Farfetch's Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Farfetch's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 77%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

The Bottom Line On Farfetch's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

You should always think about risks. Case in point, we've spotted 5 warning signs for Farfetch you should be aware of, and 1 of them shouldn't be ignored.

If these risks are making you reconsider your opinion on Farfetch, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance