Pot sector claims it's shut out of Ottawa’s COVID-19 business loans

Cannabis firms are being barred from part of Ottawa’s plan to shore up the economy as the COVID-19 virus continues to spread, forcing more businesses to reduce activity or close down by the day.

Export Development Canada (EDC) and the Business Development Bank of Canada (BDC) announced a joint strategy last Friday to inject additional liquidity for businesses, pledging to increase loans typically issued on commercial terms by $10 billion. The crown corporations have yet to detail exactly how the new Business Credit Availability program will work.

Dan Sutton, chief executive officer of B.C.-based cannabis producer Tantalus Labs, said a BDC senior account manager told him, “We do not do business with cannabis firms at this time.”

George Smitherman, president and CEO of the Cannabis Council of Canada, told Yahoo Finance Canada that response “fits with what the industry has been told to date.”

“We are forced to remind people that more than 300 Health Canada licences are all new businesses in a fledgling, complicated sector, and that like other Canadian businesses, we badly need support from governments due to the added tumult onset by COVID-19,” he wrote in an email on Tuesday.

“We will be seeking to mobilize the cannabis sector to speak up about this unfair situation by calling their MPs. It’s a good chance to remind policy makers of the $8 billion contribution we have made to GDP so far, and the thousands of employees our member companies employ.”

BDC spokesperson Jean Philippe Nadeau told Yahoo Finance Canada on Wednesday that EDC and BDC will increase the amount of financing available as the situation develops.

“The impact of the COVID-19 outbreak will vary by sector. We are evaluating the situation as it evolves, including the needs of entrepreneurs, Canadian export companies and the impact on specific industries,” he wrote in an email. “We are working on the details on how the program will work, and will share an update in the coming days.”

An EDC spokesperson said she is unclear on which types of businesses will have access to the program, and promised to look into the issue.

Canada legalized recreational cannabis sales on October 17, 2018. Medical use was legalized nationwide in 2001.

Sutton echoed Smitherman’s point about the cannabis sector’s contribution to Canada’s economic growth, and warned about challenges such as crop losses that could arise because of the virus.

“Cannabis companies may face quarantine-related operational shutdowns leading to crop loss. Small companies rely on selling cannabis as it is harvested, and an interruption of this cashflow reasonably puts us at risk of continuing to operate. With millions of dollars locked in biological assets currently in cultivation, companies like Tantalus Labs need the ability to ramp down and ramp back up over quarters, not months,” he said.

“Come to our aid so that we do not have to choose between employee safety or protecting their jobs.”

The cannabis sector is showing signs of stress as COVID-19 spreads. Canada’s largest pot company, Smiths Falls, Ont.-based Canopy Growth (WEED.TO)(CGC), said on Tuesday that will will shut its 23 corporately-owned Tokyo Smoke and Tweed retail stores at 5 p.m. local time on March 17.

Cannabis retailer Superette also announced it will temporarily close its flagship store in Ottawa beginning Tuesday due to concern surrounding the virus.

This is the most critical time for the containment of COVID-19 and flattening the curve. Our Ottawa flagship store at 1306 Wellington Street W will be temporarily closing as of March 17. 🌹Full statement: https://t.co/r6UF3WZxIf #COVIDOntario #COVIDCanada pic.twitter.com/pD05UMraTj

— superette (@superette_shop) March 17, 2020

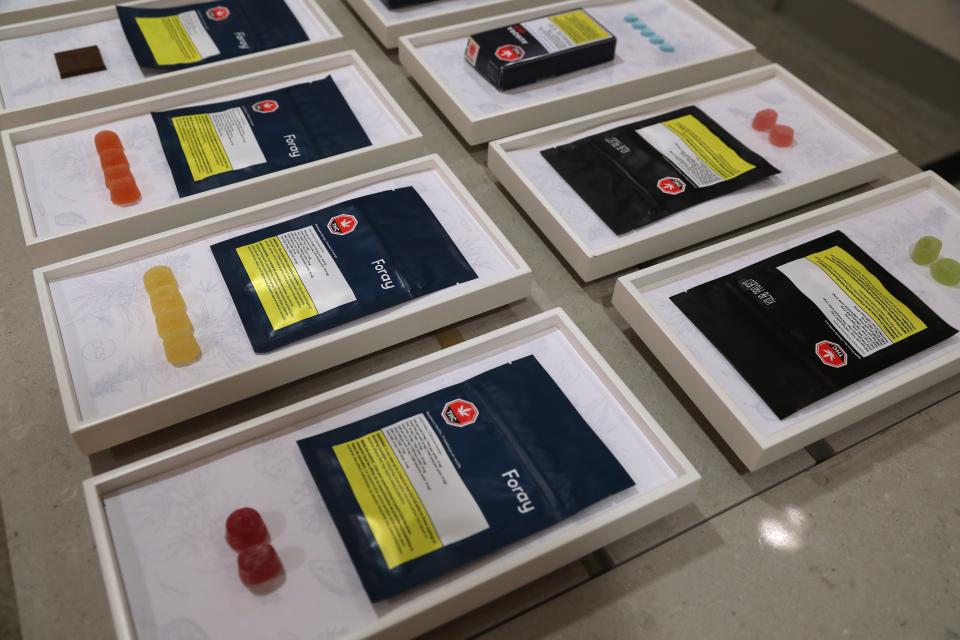

The closures come as Canadians add cannabis to the list of consumer goods to stock up on.

Ontario’s provincial cannabis retailer said it has seen a marked increase in sales as concerns about COVID-19 intensified in recent days.

“Saturday saw almost 3,000 orders, an 80 per cent increase over an average Saturday. Sunday saw more than 4,000 orders, a 100 per cent increase from the previous week. Yesterday there were more than 6,000 orders,” communications director Daffyd Roderick wrote in an emailed statement.

He said authorized physical retail stores have also seen a higher volume of customers.

Quebec’s provincial retailer, Société québécoise du cannabis, said it has seen sales increase in recent days. Spokesperson Fabrice Giguère said on Tuesday morning that supply levels are stable, and stores will remain open during normal business hours.

Yahoo Finance

Yahoo Finance