Posthaste: Remember those recession warnings for Canada? They're back and they are flashing red

Good morning,

Remember all those recession warnings awhile back. Whatever happened to those?

Canada’s economy has shown a surprising amount of resilience so far this year. After stalling at the end of 2022, it likely grew in the first quarter. Job numbers have repeatedly beat expectations, suggesting that the labour market is still going strong. And perhaps the icing on the cake was a slight uptick in inflation, this past month.

But according to these economists, if you think we’ve escaped with a soft landing you are looking at the wrong data.

“Despite the Canadian economy’s resiliency early this year, several key leading indicators paint a downbeat picture and suggest a recession is looming,” Oxford Economics said in a report this week.

Just because the economy outperformed expectations in the first quarter doesn’t mean it will continue to do so, said Oxford economist Michael Davenport.

It all depends on what you look at. Take the labour market for example. It is a lagging indicator that says more about where the economy was in late 2022 than where it is heading, he said.

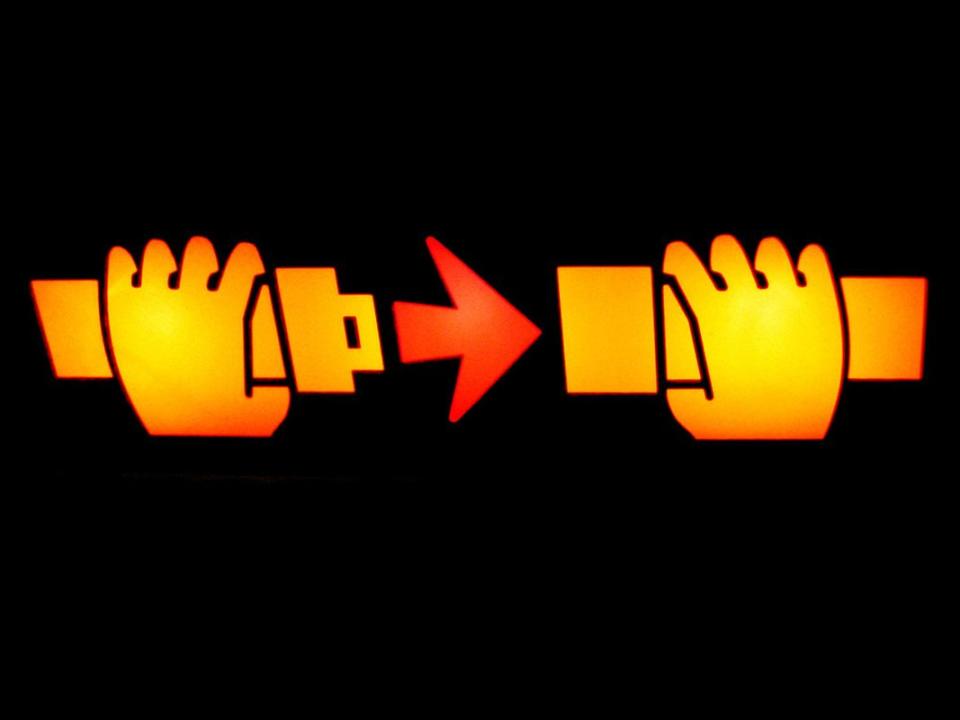

Oxford bases its recession probability model on leading indicators, such as financial conditions, how tight lending is, corporate spread, money supply and yield curves. All but one of its 12 indicators for Canada are flashing red.

Their model suggests there is an 84 per cent chance of a recession in the second half of this year. That’s the highest probability since 1981, and higher than the odds before four of the past six recessions.

Oxford’s model has now surpassed the threshold breached before four of the past five recessions (pandemic excluded) for nine straight months, said Davenport. Typically, recessions begin four months after the threshold is breached, “suggesting a recession is imminent.”

One of Oxford’s key leading indicators, financial conditions, hits the economy with a lag. Financial conditions tightened in 2022 as the Bank of Canada and United States Federal Reserve aggressively raised interest rates. They improved slightly early in the year because of stronger equity markets and Canadian dollar, but then deteriorated again after the U.S. banking scare.

Oxford calculates that the financial environment in Canada is now the most restrictive it’s been since the global financial crisis — and since this tightening takes a while to work through the economy the full impact won’t be felt until the second half of this year.

This impact will be particularly acute in Canada, compared with other advanced economies, because of its high household debt and vulnerable housing sector.

“The deterioration in financial conditions is a key reason why we think the Canadian economy will slip into recession this year,” said Davenport.

This impact alone could shave almost a percentage point off Canada’s GDP by early 2024, Oxford predicts.

Oxford’s model also points to the Bank of Canada’s own senior loan officer survey out recently that showed tighter lending conditions for households and businesses. Lending conditions for business are the tightest since the start of the pandemic, and the tightest on records going back to 2017 for households.

“We expect lending conditions will tighten further as global banking stress lingers and the full impact of last year’s aggressive monetary policy tightening continues to flow through to the Canadian economy,” said Davenport. “This will constrict business investment, help drive another leg down in house prices, and restrain household spending, particularly for durable goods.”

Another source Oxford uses is the Organisation for Economic Co-operation and Development’s composite leading indicator. Built to detect turning points in business cycles, this indicator has also proven to be a good predictor of recessions, Oxford says.

The OECD’s indicator for Canada is now at its lowest level since the worst days of the pandemic, and before that the financial crisis, falling below a threshold that in the past has only been breached prior to recessions.

Oxford says, except for the pandemic and downturn that followed the oil crash of 2015, its model has correctly predicted all recessions since the late 1970s.

“We put more stock in leading indicators to help guide our forecasts, and several key leading indicators continue to strongly suggest a recession is on the horizon,” said Davenport.

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________________

Canadians who took out mortgages at rock-bottom rates during the pandemic face a serious reckoning when they renew, the Bank of Canada reminded us yesterday.

In its Financial System Review, the Bank ran a mortgage simulation to estimate just how bad the reckoning will be.

Variable-rate borrowers not on fixed payments have already experienced the pain, with payments rising close to 50 per cent over the past year. Variable-rate borrowers on fixed payments are looking at an increase of about 40 per cent if they renew in 2025 or 2026 and want to keep their original amortization schedule.

For fixed-rate mortgages the average increase in payments at renewal will be greatest in 2025-2026, ranging from 20 to 25 per cent.

“More households are expected to face financial pressure in the coming years as their mortgages are renewed,” the review said. “The decline in house prices has also reduced homeowner equity, and some signs of financial stress — particularly among recent homebuyers — are beginning to appear.”

Prime Minister Justin Trudeau will attend the G7 summit taking place in Hiroshima, Japan

Industry Minister Francois-Philippe Champagne and International Trade Minister Mary Ng update the media on their visit to Washington

Morgan Stanley holds annual general meeting

Today’s Data: Retail sales

Earnings: John Deere & Co.

___________________________________________________

_______________________________________________________

Why Canada’s two big railways are livid over Justin Trudeau’s attempt to force competition

Bank of Canada sees signs Canadians are having trouble keeping up with their debt

Massive TFSA overcontribution lands taxpayer in trouble with the CRA

FP Answers: What kind of CPP split can I expect from my former spouse?

Kids are heading into the last month of school and making plans to keep them busy for the two-month summer break can be challenging. If money were no object, jet setting from one adventure to the next would be no issue. But the reality for most families is the exact opposite.

Keeping your kids busy within a budget can be challenging and the key is to start planning now. Sandra Fry offers some tips.

____________________________________________________

Today’s Posthaste was written by Pamela Heaven, @pamheaven, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Yahoo Finance

Yahoo Finance