Posthaste: What downturn? Canadians across all generations still bullish on real estate

Dropping home prices and economic uncertainty hasn’t turned Canadians off the housing market, with people across all age groups bullish on real estate, new research suggests.

Members of the baby boomer, generation X, millennial and generation Z cohorts are confident owning a home is a good financial investment, and 49 per cent think a home purchase will produce a similar or better return than other investments over the next 12 months, according to a generational trends report released March 15 from Mustel Group and Sotheby’s International Realty Canada. People are even more bullish about real estate’s performance in the long term, the survey said, and 60 per cent think property will match or exceed other financial investments in the next 10 years.

As a result, Canadians of all ages are eager to get into the housing market, and the survey suggests the pandemic may have helped accelerate homeownership dreams. Across all generations, 35 per cent say they are more likely to buy a house than they were in January 2020. Homeowners are also more eager to sell. One-third say they are more likely to put their house on the market within the next five years than they were before the pandemic started.

Those findings come amid a housing market that has cooled significantly from its peak as elevated inflation and resulting higher interest rates weighed on prices. The average price of a home fell 12 per cent in 2022, and is expected to fall another six per cent this year, according to the Canadian Real Estate Association. The economy is also softening, and many economists predict the country will tip into a recession sometime this year. To add to that, a rising cost of living is boosting every-day expenses, and many people are taking on more debt to help make ends meet. Higher interest rates have also made the prospect of paying down a mortgage much more expensive, putting homeownership out of reach for many.

Still, that’s not enough to put people off wanting to buy real estate, Sotheby’s Canada said.

“Confidence in our real estate market remains high,” Don Kottick, chief executive of Sotheby’s Canada said in a press release, adding, “Demand for housing and housing mobility across every generation is more pressing than ever.”

The pandemic played a key role in stoking the desire to own a home. While lockdowns during the pandemic initially pushed people to seek out more space, fuelling sales and prices, the pandemic also highlighted the value of including property in a financial plan. Stock market volatility during the pandemic made real estate an attractive alternative to traditional investments, Sotheby’s Canada said.

“One of the most transformative and enduring social and economic outcomes of the pandemic is that Canadians now place a heightened importance on primary home ownership,” Kottick said, “not only as an investment in their lifestyle and personal security, but as an investment in their financial future.”

Baby boomers are the most bullish on owning property, the survey found, and 28 per cent think real estate will outperform other investments within the next 12 months. Forty-four per cent also think homeownership will bring higher returns than other investments over the next decade. In comparison, 34 per cent of gen X-ers, 32 per cent of millennials and 30 per cent of gen Z-ers expect the same in the long term.

And while a third of Canadians say they’re more likely to buy a house in the next five years than they were pre-pandemic, intentions differ among generations. Baby boomers say they’re 29 per cent more likely to buy a house, but 23 per cent say they’re less likely. Among gen X, 35 per cent are more likely to make a home purchase, with 23 per cent less likely. Millennials are a bit more eager to get in on homeownership, and 36 per cent say they’re now more likely to buy a house. Similarly, gen Z-ers say they’re 40 per cent more likely to become homeowners.

However, some members of the younger generations are also more turned off homeownership, the survey said. A “notable” 31 per cent of millennials and 33 per cent of gen Z-ers say they’re less likely to buy a house than they were pre-pandemic, much higher than baby boomers and generation X-ers.

Mustel Group and Sotheby’s Canada polled 2,000 people aged 18-77 living in Vancouver, Calgary, Toronto and Montreal.

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________

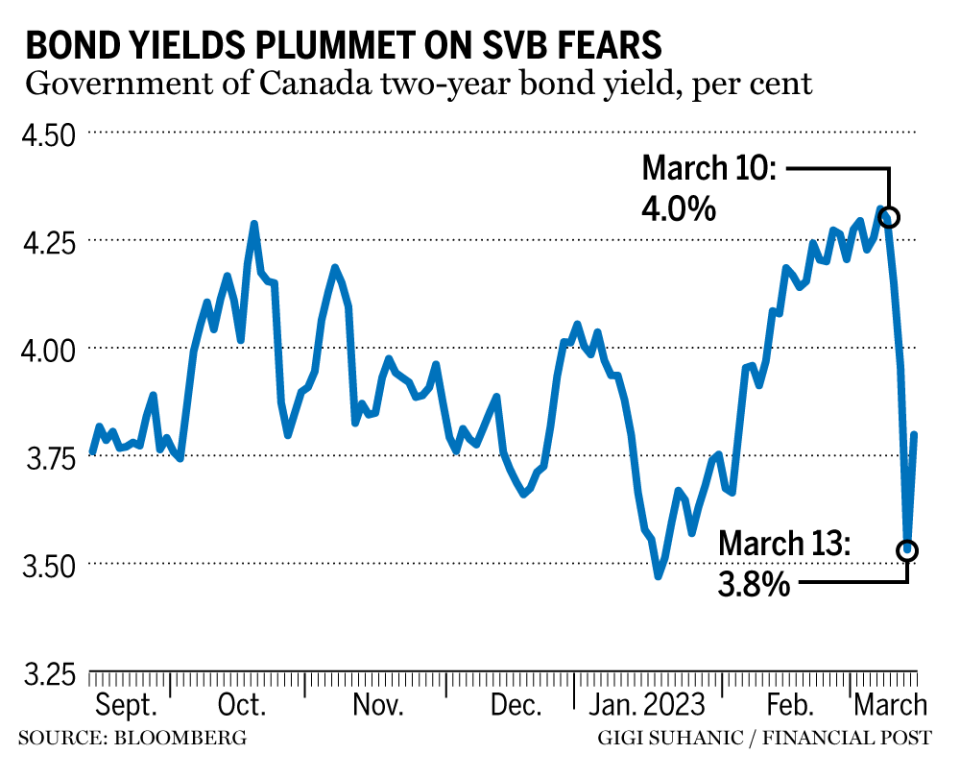

The yield on short-term Canada bonds is falling at the fastest rate in decades, as investors bet the Bank of Canada will cut rates in coming months to counter fallout from the collapse of United States regional banks.

Canada’s two-year benchmark yield tumbled 42 basis points Monday to 3.532 per cent, bringing its total decline since Wednesday to about 77 basis points. The last time the benchmark dropped that much over three trading sessions was in May 1995, according to data compiled by Bloomberg.

Traders in overnight interest swaps are now pricing in rate cuts from the Bank of Canada by June. Last week, traders were expecting the next move to be a hike.

___________________________________________________

Natural Resources Minister Jonathan Wilkinson will deliver remarks and make a funding announcement at the Saskatoon Chamber of Commerce

Manitoba Premier Heather Stefanson; Jeff Wharton, minister of economic development, investment and trade; Mike Pyle, CEO and director of the Exchange Income Corporation; Grant Kook, CEO and founder of Westcap Mgt. Ltd.; and Larry Davey, CEO of Access Credit Union, take part in an announcement about the Venture Capital Fund

U.S. Surface Transportation Board announces decision on CP Rail takeover of Kanas City Southern, the deal’s final regulatory hurdle

Prime Minister Justin Trudeau will participate in a town hall with members of the local business community, hosted by the Clarenville Chamber of Commerce, in Newfoundland and Labrador. Labour Minister Seamus O’Regan will also be in attendance

Today’s data: Canadian housing starts, existing home sales, MLS home price index; U.S. retail sales, producer price index, Empire State manufacturing survey, NAHB housing index, business inventories

Earnings: Alimentation Couche-Tard Inc., Adobe Inc., Fortuna Silver Mines Inc., Canada Nickle Company Inc.

___________________________________________________

_______________________________________________________

OSFI has control of Silicon Valley Bank’s assets in Canada. Here’s what comes next

Safety Net: Cybersecurity staff shortage looms if Canada fails to develop homegrown talent

Canadian body that insures bank deposits is looking to hire a crisis communications officer

____________________________________________________

As gas prices continue to climb, hitting a record average of $2.09 a litre in mid-June, many drivers may feel like they’re passengers, buckled in against their will for a bumpy ride. But while the cost of fuel isn’t likely to decelerate for a while, there are tangible things drivers can do to wrestle back a little control over what they pay at the pump. Here’s what our content partner MoneyWise Canada says you can expect when filling up for the rest of the year, and how you can lessen its impact on your wallet.

____________________________________________________

Today’s Posthaste was written by Victoria Wells (@vwells80), with additional reporting from Financial Post staff, The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Listen to Down to Business for in-depth discussions and insights into the latest in Canadian business, available wherever you get your podcasts. Check out the latest episode below:

Yahoo Finance

Yahoo Finance