Posthaste: Canada's housing market seen as 'main casualty' of looming credit squeeze

Good Morning,

Credit Suisse’s historic rescue appears to have quieted fears that the world is tumbling toward a global financial crisis — for now.

But as the dust settles on more than a week of fear and turmoil sparked by the collapse of the Silicon Valley Bank, there is one impact most economists agree will linger — credit conditions are going to tighten.

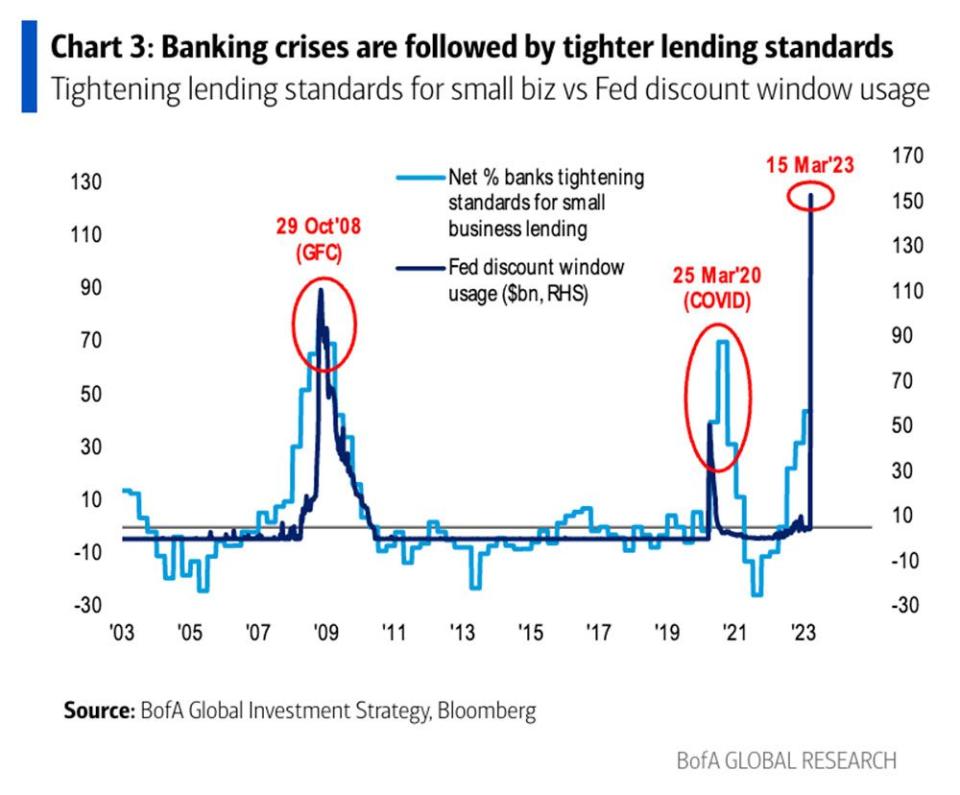

“2023 = credit crunch = recession,” wrote the team of BofA Global Research strategist Michael Hartnett in their signature shorthand. “Banking crises are followed by tighter lending standards (they have been getting tighter in recent quarters) and lower risk appetite.”

Even before the second biggest failure of an American bank, the flow of bank credit to the private sector in major developed markets had turned negative, says Capital Economics. Some of this is because people are borrowing less, but higher interest rates have also “soured banks’ appetite to lend, causing them to tighten lending standards and restrict the availability of credit.

“It stands to reason that the recent banking sector jitters will prompt a more aggressive tightening of credit conditions ahead.”

Data out last week showed that U.S. banks borrowed a record US$152.85 billion from the Federal Reserve’s discount window, a traditional liquidity backstop, in the week after SVB’s collapse, topping the high reached during the 2008 financial crisis. BofA’s chart below shows how peaks in usage of this discount window relate to peaks in the percentage of banks tightening lending standards for small business.

While Canadian banks are at far less risk, they could be forced to tighten credit conditions as well if recent events lead to a U.S. credit crunch, said Capital.

One concern is that Canadian banks have increased their exposure to the U.S. since the Great Financial Crisis, said Capital economist Stephen Brown.

“The increase in exposure means that, in the event of broader contagion in the U.S., Canadian banks could face more pressure than in the past to rein in domestic lending,” he said.

“The main casualty would be the housing market, which has so far been insulated from the impact of higher interest rates due to lenders’ willingness to significantly extend mortgage amortization periods.”

CIBC data recently showed that 20 per cent of its residential mortgage book was in negative amortization, where the monthly payment was not even covering the interest on the loan. The unpaid interest is added to the principal.

“If a negative global shock forced lenders to change strategy, it would greatly increase the risk of forced home sales,” said Brown.

Then there’s the fact that the impact of the Bank of Canada’s aggressive interest rate hiking over the past year is still working its way through the economy.

Capital Economics thinks two-thirds of the drag on economic activity from higher monetary policy is still to come in 2023.

“Advanced economies are set to incur the biggest increase in private sector interest expenses as a share of income since the 1980s, with most of this hit yet to come through,” it said.

While some speculate that this month’s global banking troubles reduce the chance that Canada’s central bank will resume raising rates, homeowners will still come under increasing strain as roughly 20 per cent of borrowers are forced to renew their mortgage this year.

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________________

Oil isn’t in the financial sector, but that hasn’t stopped it from being swept up in the recent banking turmoil. Panic, apparently, infects all.

“There’s a lot of fear-based movement (in oil prices),” Price Futures Group analyst Phil Flynn told Reuters yesterday. “We’re not moving at all on supply and demand fundamentals, we’re just moving on the banking concerns.”

Last week, both benchmarks shed more than 10 per cent as the banking crisis deepened, and Monday West Texas Intermediate fell about US$3 a barrel sinking at one point below US$65. It perked up with markets later in the day.

Day One of the Federal Reserve’s FOMC meeting; the rate decision comes out tomorrow

Attention shoppers: Nordstrom liquidation sales in Canada begin today after the U.S. retailer’s Canadian branch received the court’s permission to start selling off its merchandise.

Quebec and New Brunswick release their budgets

Today’s Data: Canadians get the latest reading on inflation today with February’s Consumer Price Index report. Economists at Desjardins and RBC both expect a drop in the inflation rate to 5.4 per cent, down from 5.9 per cent in January.

Also U.S. existing home salesEarnings: Nike, GameStop

___________________________________________________

_______________________________________________________

Nearly half a million dollars paid to ‘insider’ whistleblower in Ontario case

Mining lobby warns Ottawa against taking miners for granted in push for more aid

Bank of Canada and its peers stir memories of the 2008 financial crisis: What you need to know

Marine commerce group calls for green shipping corridor to help cut emissions

The next federal budget will be released on March 28, but tax expert Jamie Golombek says we can glean some insight on its potential impact on our pocketbooks from the 226-page pre-budget Report of the Standing Committee on Finance, which contained 230 separate recommendations for tax changes and spending. Here’s what he’s watching for.

Silicon Valley Bank shook up Canadian tech lending. Will the big banks fill the void?

Bank of Canada and its peers stir memories of the 2008 financial crisis: What you need to know

____________________________________________________

Today’s Posthaste was written by Pamela Heaven, @pamheaven, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Yahoo Finance

Yahoo Finance