Pool Corp (POOL) Stock Up on Q3 Earnings Beat & Upbeat View

Pool Corporation POOL reported solid third-quarter 2021 results, with earnings and revenues surpassing the Zacks Consensus Estimate as well as increasing on a year-over-year basis. While the bottom line beat the consensus estimate for the 10th straight quarter, the top line surpassed the same for the ninth consecutive time.

The results were mainly driven by solid demand coupled with strategic inventory purchases and capacity-creation initiatives. The company raised its 2021 earnings guidance. Following the robust results and an upbeat view, shares of the company moved up 7.7% during trading hours on Oct 21.

Earnings & Revenue Discussion

During third-quarter 2021, the company reported adjusted earnings of $4.51 per share surpassing the Zacks Consensus Estimate of $3.87 by 16.5%. In the prior-year quarter, the company had reported adjusted earnings per share of $2.71.

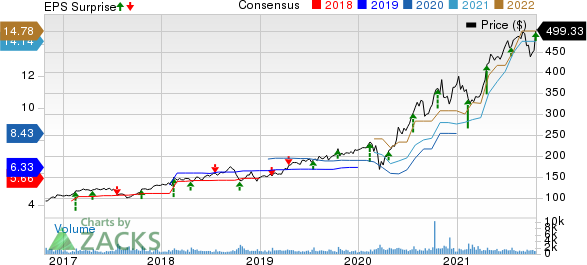

Pool Corporation Price, Consensus and EPS Surprise

Pool Corporation price-consensus-eps-surprise-chart | Pool Corporation Quote

Quarterly net revenues of $1,411.4 million surpassed the consensus mark of $1,368 million and increased 23.9% year over year. The upside can be primarily attributed to solid performance by the Base business and Excluded segments. The company witnessed a solid demand for outdoor living products. Also, strong growth in terms of maintenance, repair and construction activities added to the positives.

Segmental Performance

Pool Corp reports operations under two segments — The Base Business (constituting majority of the business) and the Excluded (sale centers excluded from the Base business).

During the third quarter, revenues in the Base Business segment increased 18.6% year over year to $1,348.8 million. Operating income rose 56% year over year to $231.2 million. Operating margin expanded 410 basis points (bps) from the year-ago quarter’s level to 17.1%.

The Excluded segment reported net revenues of $62.7 million in the third quarter, up from $2.3 million in the prior-year quarter. During the quarter under review, the segment reported operating income of $6.1 million compared with $83 million in the prior-year quarter. The segment’s operating margin came in at 9.7% compared with 3.6% reported in the prior-year quarter.

Operating Highlights & Expenses

Cost of sales in the third quarter increased 19.6% from the prior-year quarter’s levels. During the quarter, gross profit (as a percentage of net sales) increased 240 bps year over year to 31.3% from 28.9% reported in the year-ago quarter. Selling and administrative expenses (including the recovery of goodwill and other assets) increased 13% year over year to $204.6 million.

During the third quarter, operating income soared 60.1% year over year to $237.3 million. Operating margin rose 380 bps to 16.8% from the prior-year quarter’s level.

Net income during the quarter totaled $184.7 million, up from $119.1 million in the year-ago quarter.

Balance Sheet

As of Sep 30, 2021, Pool Corp’s cash and cash equivalents amounted to $83.5 million compared with $74.7 million as on Sep 30, 2020. As of September end, total net receivables (including pledged receivables) rose 30% year over year. During the quarter, total debt outstanding amounted to $362.8 million, up 6.7% from the prior-year quarter’s level. Goodwill increased to $281.3 million from $199.4 million in the prior-year quarter.

For the nine months ended Sep 30, 2021, net cash provided by operating activities amounted to $359.1 million compared with $388.9 million in the prior-year period.

2021 Guidance

For 2021, Pool Corp expects adjusted earnings per share to be $14.85-$15.35, up from the prior estimate of $13.75-$14.25. The Zacks Consensus Estimate for 2021 earnings is currently pegged at $14.14.

Zacks Rank & Key Picks

Pool Corp currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the Zacks Consumer Discretionary sector include Academy Sports and Outdoors, Inc. ASO, MasterCraft Boat Holdings, Inc. MCFT and Crocs, Inc. CROX, each sporting a Zacks Rank #1.

Academy Sports has a three-five year earnings per share growth rate of 14%.

MasterCraft has a trailing four-quarter earnings surprise of 47.4%, on average.

Crocs 2021 earnings are expected to rise 114.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pool Corporation (POOL) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

MASTERCRAFT BOAT HOLDINGS, INC. (MCFT) : Free Stock Analysis Report

Academy Sports and Outdoors, Inc. (ASO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance