Pilgrim's Pride (PPC) Q4 Earnings Miss Estimates, Rise Y/Y

Pilgrim's Pride Corporation PPC reported decent fourth-quarter 2020 results, wherein both the top- and bottom-line increased year over year, courtesy of product portfolio strategy, operational endeavors and Key Customer strategy that helped mitigate the impact of tough market conditions. Undeniably, healthy performance across European and Mexican operations also contributed to the results. However, surprisingly quarterly earnings fell short of analysts’ expectations.

Well, we note that shares of this Zacks Rank #3 (Hold) company have surged 29.6% in the past three months compared with the industry’s growth of 9.9%.

Q4 in Detail

Pilgrim's Pride reported fourth-quarter adjusted earnings of 25 cents a share that increased significantly from 14 cents posted in the year-ago period. However, the quarterly earnings missed the Zacks Consensus Estimate of 34 cents.

This producer, marketer and distributor of fresh, frozen, and value-added chicken and pork products generated net sales of $3,117.8 that increased roughly 1.8% from the year-ago period. While sales improved in Europe and Mexico, the same declined in the United States.

Net sales in the U.S. operations amounted to $1,876.2 million, down 1.5% year over year. The company pointed out that commodity sector continued to remain challenging, however, it is trying to improve operating efficiency in the same. Further, management highlighted that within case-ready and small bird businesses, robust Key Customer demand from QSR and retail customers remained stellar. Moreover, U.S. Prepared Foods business continues to gain traction.

Mexican operations generated net sales of $392.5 million in the reported quarter, up 14.2% year over year. Management notified that normalization in economic activities, balanced supply/demand scenario, increased share of non-commodity products, fewer imported chicken, and operational efficiency favorably impacted Mexican operations. Markedly, demand for Prepared Foods in the region also improved.

Net sales from European operations rose 4.1% year over year to $849.2 million. Effective operational strategies, strong pork exports and robust domestic demand have been contributing to the company’s performance in the region. Management stated that improved operational efficiencies, investments made in automation, focus on higher yields, and better management of input costs will continue to favorably impact the results.

Pilgrim's Pride’s cost of sales in the reported quarter increased 1% year over year to $2,890.4 million. We note that gross profit climbed 12.9% year over year to $227.4 million, while gross margin expanded 70 basis points to 7.3%. Additionally, adjusted EBITDA came in at $205.4 million, up 27.1% year over year. Notably, adjusted EBITDA margin increased 130 basis points to 6.6%.

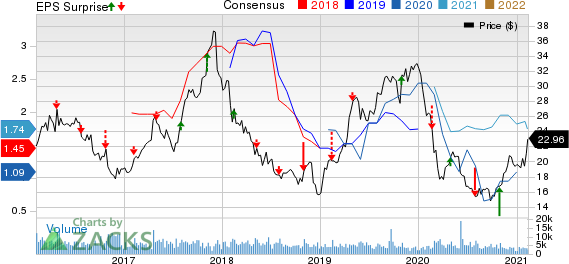

Pilgrims Pride Corporation Price, Consensus and EPS Surprise

Pilgrims Pride Corporation price-consensus-eps-surprise-chart | Pilgrims Pride Corporation Quote

Other Financial Details

Pilgrim's Pride ended the quarter with cash and cash equivalents of $547.6 million, long-term debt (less current maturities) of $2,255.5 million and total shareholders’ equity of $2,563.8 million, excluding non-controlling interest of $11.6 million. Further, the company generated $724.2 million as cash from operating activities for the year ended on Dec 27, 2020.

3 Stocks to Consider

Sanderson Farms SAFM, with a Zacks Rank #1 (Strong Buy), has a long-term earnings growth rate of 48.4%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Hain Celestial HAIN with a Zacks Rank #2 (Buy), has a trailing four-quarter earnings surprise of 26.7%, on average.

Celsius Holdings CELH carries a Zacks Rank #2. The company’s bottom line outperformed the Zacks Consensus Estimate by a significant margin in the last reported quarter.

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Click here to download this report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sanderson Farms, Inc. (SAFM) : Free Stock Analysis Report

Pilgrims Pride Corporation (PPC) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance