Pilgrim's Pride (PPC) Q3 Earnings Beat Estimates, Sales Up Y/Y

Pilgrim's Pride Corporation PPC reported impressive third-quarter 2022 results, with the top and the bottom line increasing year over year. Earnings in the quarter surpassed the Zacks Consensus Estimate.

Q3 in Detail

The company reported adjusted earnings of $1.09 a share, up significantly from 67 cents in the year-ago quarter. Quarterly earnings also surpassed the Zacks Consensus Estimate of 87 cents per share.

The producer, marketer and distributor of fresh, frozen and value-added chicken and pork products generated net sales of $4,469 million, which increased 16.8% from the year-ago quarter’s level. Net sales increased in Europe and the U.S. operations.

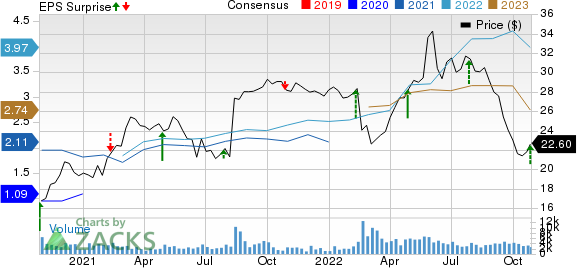

Pilgrim's Pride Corporation Price, Consensus and EPS Surprise

Pilgrim's Pride Corporation price-consensus-eps-surprise-chart | Pilgrim's Pride Corporation Quote

Net sales in the U.S. operations were $2,836.9 million, up from $2,466.9 million reported in the year-ago quarter. Management highlighted that its diversified U.S. portfolio across bird sizes and the Key Customers strategy supported its performance amid changing market conditions. Strength in the Case Ready and Small Bird businesses and momentum in the Prepared Foods business helped the company counter volatility in Big Bird Debone. It witnessed continued brand momentum in the U.S. retail, with Just Bare and Pilgrim’s prepared products increasing more than 45% year over year. E-commerce in the U.S. branded portfolio surged more than 65%.

Mexico operations generated net sales of $429 million in the reported quarter, down from $430.3 million in the prior-year quarter. The company’s Mexico business saw softness in overall sales and profitability due to seasonality, weakened market conditions and major challenges in live operations at its locations.

Net sales from the U.K. and Europe operations rose to $1,203.1 million in the quarter under review from $930.4 million in the prior year. Despite a tough consumer environment and extensive cost escalation, the company’s U.K. and Europe businesses witnessed sequential profit growth via a continued focus on Key Customer partnerships and operational efficiencies.

Pilgrim's Pride’s cost of sales increased to $3,972 million from $3,455.7 million reported in the year-ago quarter. Gross profit climbed to $497.3 million from $371.8 million. Adjusted EBITDA of $460.5 million increased 32.7% from $346.9 million reported in the year-ago quarter. Adjusted EBITDA margin increased 120 basis points (bps) year over year to 10.3%.

Image Source: Zacks Investment Research

Other Financial Details

The Zacks Rank #3 (Hold) company ended the quarter with cash and cash equivalents of $654.2 million, long-term debt (less current maturities) of $3,184 million and total shareholders’ equity of $2,740.2 million. The company generated $790.6 million of cash from operating activities for nine months ended Sep 25, 2022.

PPC’s shares have plunged 30.4% in the past three months compared with the industry’s decline of 18.2%.

Some Solid Food Bets

Some better-ranked stocks are TreeHouse Foods THS, Lancaster Colony LANC and The J. M. Smucker SJM.

TreeHouse Foods, which manufactures and distributes private-label foods and beverages, sports a Zacks Rank #1 (Strong Buy) at present. TreeHouse Foods has a trailing four-quarter earnings surprise of 45.2%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for THS’ current financial-year sales and EPS suggests growth of 16.8% and 15.1%, respectively, from the year-ago reported numbers.

Lancaster Colony, which manufactures and markets food products for the retail and foodservice markets, currently carries a Zacks Rank of 2 (Buy). LANC delivered an earnings surprise of 170% in the last reported quarter.

The Zacks Consensus Estimate for Lancaster Colony’s current financial year sales and EPS suggests growth of 9.6% and 38.3%, respectively, from the corresponding year-ago reported figures.

J. M. Smucker, which manufactures and markets branded food and beverage products, carries a Zacks Rank #2. J. M. Smucker delivered a trailing four-quarter earnings surprise of 20.8%, on average.

The Zacks Consensus Estimate for SJM’s current financial year sales suggests growth of 4.6% from the year-ago period’s reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

Pilgrim's Pride Corporation (PPC) : Free Stock Analysis Report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

Lancaster Colony Corporation (LANC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance