Pharming (PHAR) Rare Disease Drug Joenja Gets FDA Nod, Stock Up

Leiden-based Pharming Group N.V. PHAR announced the FDA approval, under priority review, of leniolisib for the treatment of activated phosphoinositide 3-kinase delta (PI3Kδ) syndrome (APDS) in adult and pediatric patients aged 12 years and older. Leniolisib will be marketed in the United States under the brand name Joenja. Joenja, Pharming’s oral, selective PI3Kδ inhibitor, is the first and only treatment approved in the United States for APDS. The stock of the company was up about 33% on Friday following the news.

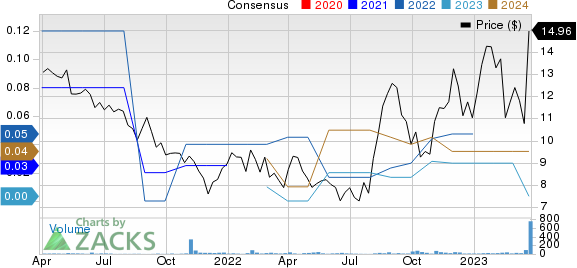

In the past year, the shares of the company have shot up to 80.3% against the industry’s decline of 14.9%.

Image Source: Zacks Investment Research

The FDA approval of leniolisib was based on findings from a multinational, triple-blind, placebo-controlled and randomized phase II/III study, evaluating the drug’s efficacy and safety in 31 patients diagnosed with APDS aged 12 years and older. Results showed that Joenja 70 mg twice daily met its co-primary endpoints evaluating improvement in lymphoproliferation as measured by the reduction in lymph node size and increase in naïve B cells, reflecting the impact on immune dysregulation and normalization of immunophenotype in these patients with statistical significance.

The new drug application also included data from a long-term and open-label extension study in which 38 patients received Joenja for a median of two years.

The FDA granted PHAR a priority review voucher (PRV) following the approval of Joenja as a treatment for a rare pediatric disease. This now becomes a factor of consideration in the 2019 exclusive license agreement between Pharming and Novartis NVS for leniolisib. Per the terms of the agreement, Novartis has the right to purchase the PRV from Pharming for a small minority share of the value of the PRV. Pharming, in turn, will make milestone payments to Novartis and another third party for the approval and first commercial sale for Joenja totaling $10.5 million.

Pharming had also agreed to certain additional milestone payments to Novartis, bringing the total amount up to $190 million, upon the achievement of certain leniolisib sales milestones. Pharming is also liable to pay tiered royalty payments to Novartis, ranging between a low double-digit and a high-teen double-digit percentage of net sales of leniolisib.

APDS is a rare primary immunodeficiency that is caused by variants in either of two genes, PIK3CD or PIK3R1, that regulate the maturation of white blood cells. Approximately, 1-2 people per million are affected by APDS causing severe, recurrent sinopulmonary infections, lymphoproliferation, autoimmunity and enteropathy. Currently, there are no approved treatments for this rare disease.

Pharming expects to launch Joenja in the United States in early April and it will be available for shipment in mid-April. Leniolisib is currently under review by the European Medicines Agency’s Committee for Human Medicinal Products (CHMP) for marketing authorization in the European Union. Pharming expects a decision from the CHMP in the second half of 2023.

Pharming Group N.V. Sponsored ADR Price and Consensus

Pharming Group N.V. Sponsored ADR price-consensus-chart | Pharming Group N.V. Sponsored ADR Quote

Zacks Rank and Stocks to Consider

Pharming currently has a Zacks Rank #4 (Sell).

Some better-ranked stocks in the same industry are Aptinyx APTX and Annovis Bio ANVS, both carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 90 days, the estimate for Aptinyx’s 2023 loss per share has narrowed from 77 cents to 56 cents. In the year so far, the shares of Aptinyx have fallen by 93.9%.

APTX’s earnings witnessed an average earnings surprise of 9.53%, beating all four estimates in the trailing four reported quarters.

In the past 90 days, the consensus estimate for Annovis’ 2023 loss per share has narrowed from $2.94 to $2.93. In the year so far, the shares of Annovis have increased by 37.5%.

ANVS’ reported loss per share was narrower than the estimated loss per share in the last reported quarter, delivering an earnings surprise of 20.51%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novartis AG (NVS) : Free Stock Analysis Report

Aptinyx Inc. (APTX) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report

Pharming Group N.V. Sponsored ADR (PHAR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance