The Pharmadrug (CSE:BUZZ) Share Price Is Down 43% So Some Shareholders Are Getting Worried

It is doubtless a positive to see that the Pharmadrug Inc. (CSE:BUZZ) share price has gained some 240% in the last three months. But that doesn't change the fact that the returns over the last year have been less than pleasing. After all, the share price is down 43% in the last year, significantly under-performing the market.

See our latest analysis for Pharmadrug

With just CA$572,658 worth of revenue in twelve months, we don't think the market considers Pharmadrug to have proven its business plan. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. Investors will be hoping that Pharmadrug can make progress and gain better traction for the business, before it runs low on cash.

Companies that lack both meaningful revenue and profits are usually considered high risk. You should be aware that the company needed to issue more shares recently so that it could raise enough money to continue pursuing its business plan. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt.

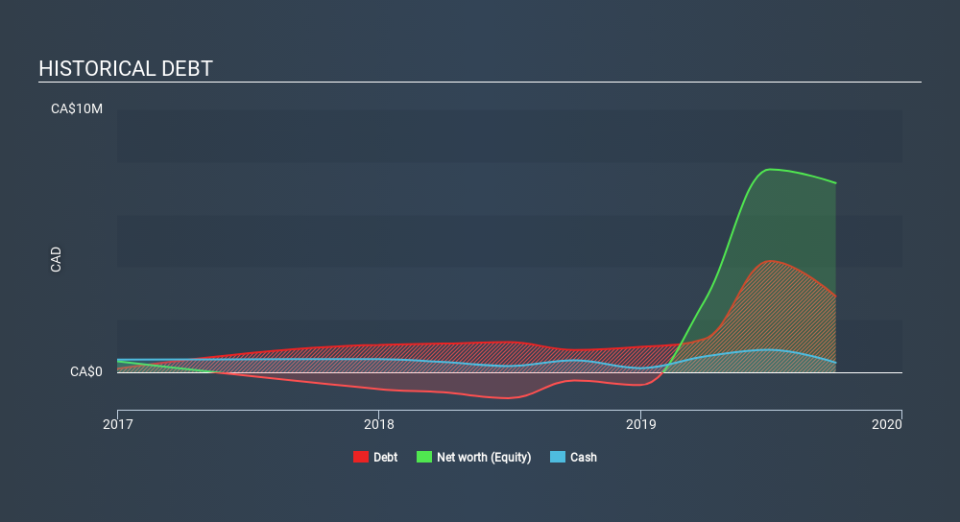

Pharmadrug had liabilities exceeding cash when it last reported, according to our data. That put it in the highest risk category, according to our analysis. But with the share price diving 43% in the last year , it's probably fair to say that some shareholders no longer believe the company will succeed or they are worried about dilution with the recent cash injection. You can click on the image below to see (in greater detail) how Pharmadrug's cash levels have changed over time.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. What if insiders are ditching the stock hand over fist? It would bother me, that's for sure. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

A Different Perspective

Pharmadrug shareholders are down 43% for the year, even worse than the market loss of 12%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. It's great to see a nice little 240% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Pharmadrug (at least 3 which make us uncomfortable) , and understanding them should be part of your investment process.

But note: Pharmadrug may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance