Pfizer: Anticipated Growth at a Fair Value

- By Margaret Moran

Before the market opened on May 4, Pfizer Inc. (NYSE:PFE) released its earnings results for the first quarter of 2021.

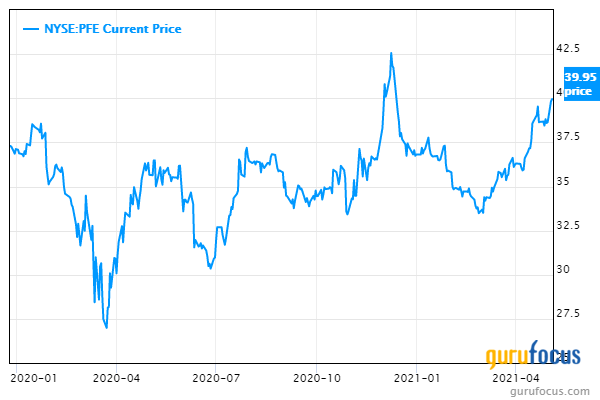

Driven by Covid-19 revenue, Pfizer post earnings and revenue that blew away Wall Street's expectations. The stock gained some momentum in the morning before beginning to drop again, closing at $39.95 with a gain of 0.3% for the day.

Earnings highlights

Pfizer reported revenue of $14.58 billion, up 45% compared to the prior-year quarter. Meanwhile, earnings per share came in at 86 cents on a GAAP basis, up from 60 cents in the first quarter of 2020, and adjusted earnings per share was 93 cents, up from 63 cents. Analysts had been expecting revenue of $13.60 billion and adjusted earnings of 78 cents.

The company achieved 42% operational growth primarily due to Pfizer and BionNTech's (NASDAQ:BNTX) Covid-19 vaccine, BNT162b2, which contributed $3.5 billion to global revenues. Excluding the vaccine, operational revenue grew 8%. Aside from the Covid-19 vaccine, other drivers of operational growth included:

Eliquis, up 25% on continued increased adoption in non-valvular atrial fibrillation and oral anti-coagulant market share.

Vyndaqel/Vyndamax, up 88% due to the February 2020 approval of the transthyretin amyloid cardiomyopathy (ATTR-CM) indication in the EU.

Xeljanz, up 18% due to higher volumes within the rheumatoid arthritis, psoriatic arthritis and ulcerative colitis indications.

Xtandi, up 28% in the U.S. on continued strong demand in the metastatic and nonmetastatic castration-resistant prostate cancer indications.

Inlyta, up 34% on increased demand in the U.S. and developed Europe following 2019 approvals for combinations of certain immune checkpoint inhibitors.

Biosimilars, up 79% to $530 million driven by recent oncology monoclonal antibody biosimilar launches.

Hospital products, which grew 10% operationally to $2.3 billion.

Pfizer attributed the majority of revenue declines for certain drugs to complications caused by Covid-19 as patients put off voluntary procedures and people were less inclined to go for general wellness or preventative care visits.

First-quarter 2021 cost of sales increased 9.7% compared to the prior-year quarter due to factors such as the BNT162b2 gross margin split with BioNTech, unfavorable product mix changes, an increase in deferred compensation savings plan expenses and the costs of certain cost reduction and productivity initiatives undertaken by the company.

During the first three months of 2021, Pfizer paid $2.2 billion of cash dividends, or 39 cents per share of common stock. In April, the board of directors declared another 39 cents per share dividend for the second-quarter payment. No share repurchases have been made year to date, and Pfizer's remaining share repurchase authorization is $5.3 billion, though the company said its guidance does not currently reflect any share repurchases in 2021.

Looking forward

Pfizer raised its guidance for full-year 2021. The company now expects revenue in the range of $70.5 billion to $72.5 billion and adjusted earnings between $3.55 and $3.65 per share, primarily reflecting impacts related to the BNT162b2 vaccine.

The Covid-19 vaccine revenue is expected to total $26 billion, with 1.6 billion doses projected to be delivered in 2021 under contracts signed as of mid-April. The company has entered into contracts to supply BNT162b2 to Canada and Israel for periods beyond 2021 and is working to negotiate similar contracts with other countries. In April, Pfizer and BioNTech began requesting regulatory authorities worldwide to expand approval of the use of BNT162b2 to adolescents 12 to 15 years of age following successful trials.

Valuation

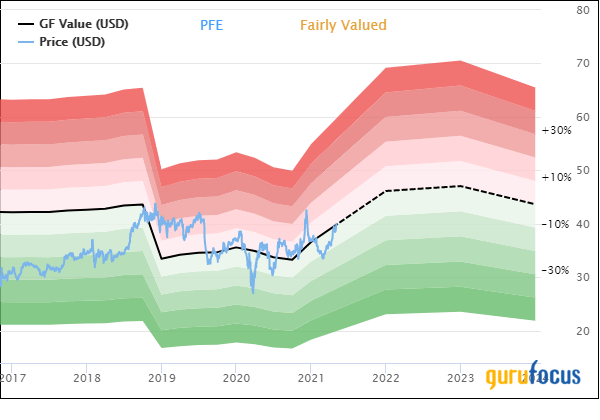

As of May 4, Pfizer's stock trades with a price-earnings ratio of 23.29, a financial strength rating of 5 out of 10 and a profitability rating of 7 out of 10. The GuruFocus Value chart rates the stock as fairly valued due to the combination of the stock's historical returns and expected growth in the top and bottom lines over the next couple of years.

Pfizer will likely continue to see a strong earnings upside due to its Covid-19 vaccine, especially with boosters expected to be necessary. The costs necessary for related research and development will be more than offset by strong sales.

With strong anticipated earnings growth and a fair valuation, Pfizer could be an attractive buy at current levels. The positive news could result in a price breakout at some point. The company also posted operational growth even excluding the Covid-19 vaccine, which is also a positive sign. However, as with all companies looking to see a breakout on good news, there is the possibility of bad news tanking the stock as well, so investors interested in Pfizer should keep a close eye on the vaccine development front.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Portfolio updates reflect only common stock positions as per the regulatory filings for the quarter in question and may not include changes made after the quarter ended.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance