Pets at Home makes £100m by selling five specialist centres

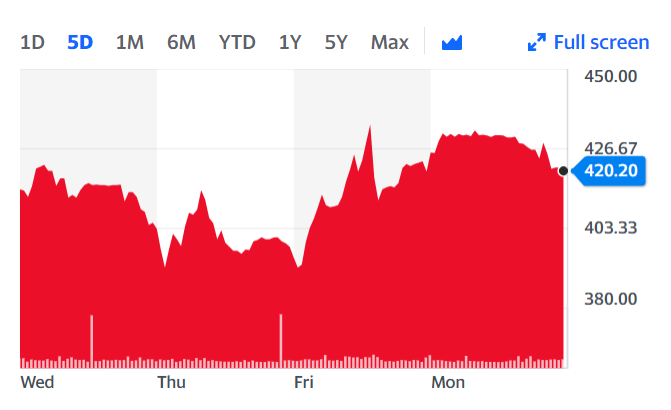

Pets at Home Group (PETS.L) said it sold five specialist referral practices to veterinary company Linnaeus Group for £100m ($133.9m) in cash as part of efforts to focus on “customer-facing activities.” Pets’ shares were down roughly 1% on Tuesday morning.

The practices include Dick White Referrals in Cambridgeshire, Anderson Moores in Hampshire, Northwest Veterinary Specialists in Cheshire, Eye Vet in Cheshire and Veterinary Specialists Scotland in Livingston, Scotland.

Linnaeus Group, a subsidiary of Mars Veterinary Health, is a veterinary group operating around 150 clinics across the UK.

The disposal of the practices “is for consideration of up to £100m, comprising £80m in cash on completion and deferred cash consideration of £20m, payable upon certain financial milestones being met in the future,” Pets said.

The cash proceeds will be retained by the group for general corporate purposes, it said. The disposal is expected to complete in the first quarter of 2021 and is subject to a limited number of customary conditions and approvals.

READ MORE: Pets at Home acquires animal telehealth provider for £15m

Pets at Home Group’s CEO Peter Pritchard said the move “does not deviate from our core focus of providing customers with affordable, convenient, engaging and flexible pet care solutions.

“For our shareholders, the disposal proceeds provide the group with additional resource to accelerate growth across our customer-focused pet care platform,” he said.

The news comes a day after Pets said it was to acquire The Vet Connection, an independent veterinary telehealth provider, for £15m.

The cash consideration is being financed using Pets at Home's existing cash reserves, the company said.

Earlier in the month Pets said it swung to a double digit revenue growth in its full-year 2021 interim results, driven by a boost in sales.

People working at home during the pandemic has meant an increase in pet ownership, as people consider what they can do to improve their surroundings.

The FTSE 250-listed firm also noted its allocation as an “essential” retailer amid widespread COVID-19 lockdowns for its 12.5% like-for-like revenue growth in Q2, saying it had an “exceptional period of demand” during lockdown.

WATCH: How to keep pets protected during winter

Yahoo Finance

Yahoo Finance