PetroChina (PTR) Incurs Q1 Loss on Downstream Weakness

Chinese energy giant PetroChina Company Limited PTR announced first-quarter 2020 loss of RMB 16.2 billion or RMB 0.089 per diluted share against profit of RMB 10.2 billion or RMB 0.056 per diluted share a year earlier.

Loss per ADR came in at around $1.27. Moreover, China’s dominant oil and gas producer’s total revenue for the quarter fell 14.4% from the year-ago period to RMB 509.1 billion.

One of China’s big three oil giants, the other two being Sinopec SNP and CNOOC Limited CEO, PetroChina’s results were dragged down by lower commodity prices and weakness in the company’s domestic refining operations. These factors were partly offset by higher oil and gas production and drop in lifting costs.

Forced by the historic oil market crash and the coronavirus-induced demand destruction for the fuel, PetroChina announced a cut to its 2020 capital spending plan by around 30% from last year’s outlay to RMB 200 billion. The company also warned about a sharp decline in first-half profits.

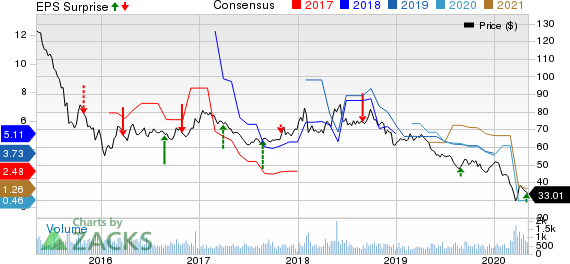

PetroChina Company Limited Price, Consensus and EPS Surprise

PetroChina Company Limited price-consensus-eps-surprise-chart | PetroChina Company Limited Quote

Segment Performance

Upstream: PetroChina posted higher upstream output during the three months ended Mar 31, 2020. In particular, crude oil output – accounting for 56% of the total – rose 4.2% from the year-ago period to 232.7 million barrels. Meanwhile, marketable natural gas output was up by 8.7% to 1,086.9 billion cubic feet. As a result, PetroChina’s total production of oil and natural gas increased 6.1% year over year to 413.9 million barrels of oil equivalent.

However, average realized crude oil price during the first quarter of 2020 was $54.39 per barrel, 8.6% lower than the year-ago period. Natural gas realizations – at $5.10 per thousand cubic feet – decreased 23.1%.

Despite lower commodity prices, the upstream (or exploration & production) segment posted an operating income of RMB 14.9 billion, rising 3.9% from the year-ago profit of RMB 14.3 billion on production growth. A tight leash on oil and gas lifting cost, that decreased 8.9% on a per unit basis compared with the same period of last year, also helped results.

Downstream: The Beijing-based company’s ‘Refining & Chemicals’ business recorded an operating loss of RMB 8.7 billion as against the year-earlier period earnings of RMB 3 billion. The decline in the downstream division result was due to depressed domestic product demand, lower refined products sales and drop in prices.

PetroChina’s refinery division processed 276.5 MMBbl of crude oil during the three-month period, down 9.6% from 2019. The company produced 2,473 thousand tons of synthetic resin in the period (a fall of 1.4% year over year), besides manufacturing 1,539 thousand tons of ethylene (down 1.3%). It also produced 25,208 thousand tons of gasoline, diesel and kerosene during the period against 29,252 thousand tons a year earlier.

Natural Gas & Pipelines: Lower sales volume and price of natural gas adversely impacted the Chinese behemoth’s segment earnings. Not only did PetroChina lose money to the tune of RMB 3.9 billion on the sales of imported natural gas and liquefied natural gas from Central Asia and Myanmar, the losses were RMB 644 million wider compared with the first quarter of 2019.

As a result of these factors, the group’s natural gas business earned RMB 11.4 billion in the period under review, deteriorating from the year-earlier profit of RMB 12.6 billion.

Marketing: In marketing operations, the state-owned group sold 35,478 thousand tons of gasoline, diesel and kerosene during the quarter, down 15.9% year over year. The effects of lower volumes were aggravated by the dip in domestic refined products demand. Consequently, PetroChina posted a loss of RMB 16.6 billion compared to an income of RMB 3.5 billion recorded in the same period last year.

Liquidity & Capital Expenditure

At the end of the quarter, the group’s cash balance was RMB 77.3 billion, while cash flow from operating activities was RMB 1 billion. Capital expenditure for the three months reached RMB 48.9 billion.

Zacks Rank & Stock Picks

PetroChina currently carries a Zacks Rank #3 (Hold). Meanwhile, investors interested in the energy space could look at a better option like Murphy USA MUSA, carrying a Zacks Rank #1 (Strong Buy).

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Murphy USA’s 2020 earnings indicates year-over-year improvement of 48.2%.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CNOOC Limited (CEO) : Free Stock Analysis Report

PetroChina Company Limited (PTR) : Free Stock Analysis Report

China Petroleum & Chemical Corporation (SNP) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance