Petrobras (PBR) Q2 Earnings Beat on High Gas Margins, Up Y/Y

Petrobras PBR announced second-quarter earnings per ADS of 74 cents, surpassing the Zacks Consensus Estimate of 34 cents. Solid contribution from its Gas & Energy segment and divestment gains from the TAG pipeline led to the outperformance. The bottom line also increased from the year-earlier earnings of 44 cents.

The Brazilian state-run energy giant reported revenues of $18,502 million, lagging the Zacks Consensus Estimate of $22,351 million and the year-earlier sales of $20,753 million.

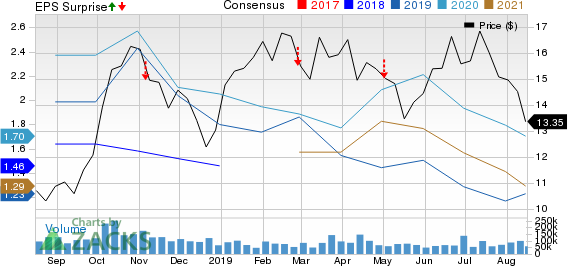

Petroleo Brasileiro S.A.- Petrobras Price, Consensus and EPS Surprise

Petroleo Brasileiro S.A.- Petrobras price-consensus-eps-surprise-chart | Petroleo Brasileiro S.A.- Petrobras Quote

Segmental Performance

Upstream: The Rio de Janeiro-headquartered company’s total oil and gas production during the second quarter came in at 2,633 thousand oil-equivalent barrels per day (MBOE/d), down from 2,659 MBOE/d in the corresponding period of 2018.Brazilian oil and natural gas production — constituting 97% of its overall output — decreased to 2,553 MBOE/d from 2,563 MBOE/d in the prior-year quarter.

In addition to the output decline, Petrobras bore the brunt of weak oil price realizations. During the quarter, oil price realizations came in at $68.82, down 7.4% from the year-earlier figure of $74.35 per barrel.

Resultantly, the segment’s revenues declined to $12,660 million in the quarter under review from $13,383 million in the year-ago period. However, the segment’s profits rose to $3,515 million from the year-ago figure of $3,215 million due to the decrease in pre-salt lifting costs.

Downstream: Revenues from the segment totaled $16,675 million, lower than the year-ago figure of $18,148 million. Petrobras' downstream earnings tankedto $286 million from the year-ago level of $1,457 million, owing to weaker oil products sales margins and a sharp increase in operating expenses amid high impairment costs.

Gas & Energy: While revenues from the segment declined 10.4% y/y to $2,575 million, improved margins for natural gas lifted earnings of the unit from $76 million to $3,890 million in the quarter under review. Better commercial conditions in the international LNG market drove its margins.

Costs

During the period, Petrobras’ selling, general and administrative expenses were $1,494 million, lower than the year-ago period’s $1,663 million. Selling expenses also fell 15.4% from a year ago to $935 million. However, gains from asset sales, particularly from the TAG pipeline, more than offset its total operating costs. As a result, total operating expenses declined by a whopping 157% year over year.

Financial Position

During the three months ended Jun 30, 2019, Petrobras’ capital investment and expenditure totaled around $2,587 million, 17.5% lower than $3,138 million incurred in the comparable year-ago period.

While the company generated positive free cash flow for the 17th consecutive quarter, the metric declined to $2,874 million from $4,305 million recorded in the year-ago period. Adjusted EBITDA also declined to $8,326 million from the year-ago figure of $8,340.

At the end of the quarter, the company had a net debt of $83,674 million, increasing from $73,662 million a year ago. Its net debt-to-capitalization ratio stands at 51%. Petrobras ended the second quarter with cash and cash equivalents of $16,714 million.

Zacks Rank and Key Picks

Petrobras currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked players in the energy space are NuStar Energy NS, Delek Logistics Partners DKL and BP Midstream Partners BPMP. While NuStar and Delek Logistics sport a Zacks Rank #1, BP Midstream holds a Zacks Rank #2 (Buy).

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delek Logistics Partners, L.P. (DKL) : Free Stock Analysis Report

Petroleo Brasileiro S.A.- Petrobras (PBR) : Free Stock Analysis Report

NuStar Energy L.P. (NS) : Free Stock Analysis Report

BP Midstream Partners LP (BPMP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance