Perrigo's (PRGO) Q2 Earnings Misses by a Cent, Sales Beat

Perrigo Company plc PRGO reported second-quarter 2022 adjusted earnings of 43 cents per share, which missed the Zacks Consensus Estimate of 44 cents. Earnings declined 14% year over year. The downside was due to unfavorable currency movements and higher operating expenses, partially offset by higher sales volumes and improved pricing.

Net sales increased 14.3% year over year to $1.12 billion, beating the Zacks Consensus Estimate of $1.07 billion. The year-over-year increase was driven by sales from the newly acquired HRA Pharma, a continued strong rebound in sales of cough/cold products globally and higher demand for infant formula in the United States. These were partially offset by unfavorable currency movements and divested businesses. Organic net sales (excludes the effects of acquisitions and divestitures and the impact of currency) were up 17.2% year over year.

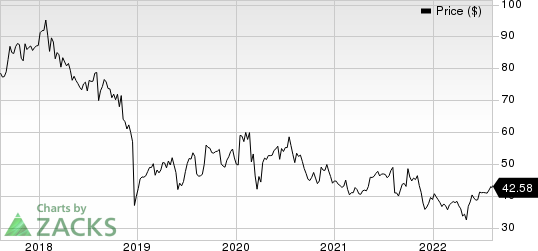

Shares of Perrigo have declined 9.5% so far this year against the industry’s decrease of 40.7%

Image Source: Zacks Investment Research

Segment Discussion

Perrigo reports its results under the following segments — Consumer Self Care Americas (“CSCA”) and Consumer Self Care International (“CSCI”).

CSCA: Net sales of the segment in the second quarter of 2022 came in at $728 million, up 17.0% year over year. Sales increased due to a strong rebound in cough/cold sales, higher sales of oral allergy products and strong demand for store brand infant formula and Women’s Health products.

CSCI: The segment reported net sales of $394 million, up 9.7% from the year-ago period. Currency movements had an unfavorable impact of 16.1 percentage points on sales growth. Organically sales increased 10.6%. Segment revenues benefitted from the higher sales of HRA Pharma brands, higher store brand consumption in the United Kingdom, cough/cold products and Women’s Health products, partially offset by lower sales of products from the Healthy Lifestyle and VMS categories. Sales were negatively impacted by unfavorable currency movement and loss of sales in Russia and Ukraine.

2022 Guidance Revised

Perrigo decreased its earnings guidance for 2022. The company now expects adjusted earnings per share to be in the range of $2.25-$2.35, down from the previous guidance of 2.30-$2.40, to account for the worse than previously-expected impact of currency translation. It reaffirmed total revenues in 2022 to grow 8.5%-9.5%.

The company also raised its guidance for organic growth from the range of 8-9%.to 9-10%

Perrigo Company plc Price

Perrigo Company plc price | Perrigo Company plc Quote

Zacks Rank & Stocks to Consider

Perrigo currently has a Zacks Rank #4 (Sell).

A few better-ranked stocks in the overall healthcare sector include Alkermes ALKS, Geron GERN and Morphic MORF. While Geron and Morphic sport a Zacks Rank #1 (Strong Buy) at present, Alkermes carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, estimates for Geron’s 2022 loss per share have narrowed from 38 cents to 36 cents. Loss estimates for 2023 have narrowed from 36 cents to 35 cents during the same period. Shares of Geron have surged 83.6% in the year-to-date period.

Earnings of Geron beat estimates in three of the last four quarters and missed the mark just once, witnessing a surprise of 1.07%, on average. In the last reported quarter, GERN delivered an earnings surprise of 18.18%.

In the past 30 days, estimates for Morphic’s 2022 loss per share have narrowed from $3.47 to $2.90. Loss estimates for 2023 have narrowed from $3.96 to $3.90 during the same period. Shares of Morphic have lost 33.1% in the year-to-date period.

Earnings of Morphic beat estimates in three of the last four quarters and missed the mark just once, witnessing a surprise of 48.29%, on average. In the last reported quarter, MORF delivered an earnings surprise of 183.95%.

Alkermes’ stock has risen 10.7% this year so far. Alkermes’ estimates for 2022 have improved from a loss of 17 cents per share to earnings of 20 cents per share. The consensus estimate for 2023 earnings has increased from 31 cents per share to 50 cents per share in the past 30 days.

Alkermes beat earnings estimates in each of the last four quarters, delivering an average earnings surprise of 325.48%, on average. In the last reported quarter, ALKS reported an earnings surprise of 50.00%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Geron Corporation (GERN) : Free Stock Analysis Report

Alkermes plc (ALKS) : Free Stock Analysis Report

Perrigo Company plc (PRGO) : Free Stock Analysis Report

Morphic Holding, Inc. (MORF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance