The perfect jobs report to end the 2010s: Morning Brief

Monday, December 9, 2019

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

The November jobs report was the whole decade in one report

Friday’s November jobs report marked the BLS’ final monthly jobs report of the decade.

The report showed that more jobs were created than had been expected by economists. The unemployment rate unexpectedly fell. Wages rose faster than expected. Stocks reacted on Friday by surging to near record highs.

And in many ways, this one event defines what markets and the economy were all about in the 2010s.

It was a decade that saw markets and data routinely exceed bearish expectations, leaving the bears dejected as the bulls endured with cautious optimism.

Almost every year of this decade had some version of the perilous moments we seemed to be facing this summer and early fall — when an inverted yield curve and a slump in global manufacturing seemed to signal the most anticipated recession in history would finally arrive.

The decade began with a double-dip recession in Europe in 2010 and the first of what would be rolling peripheral eurozone crises. A breakup of the eurozone by decade’s end seemed inevitable.

In 2011, the U.S. debt downgrade sent stocks into their first bear market since the crisis.

In 2012 and ‘13, the fiscal cliff seemed to imperil a still-feeble expansion being helped along by QE3.

In 2014, a flash crash in the bond market and the beginning of a two-year slump in oil prices sent investors a stern warning. A redux of the Greek crisis in 2015 and a global slowdown in 2016 put the biggest scare into global markets since the early decade eurozone crisis.

In 2016, Brexit and Trump’s election sent markets on wild rides and opened investors up to previously unimagined political risks.

In 2018, volatility implosions at the beginning of the year, the Fed’s policy mistakes in the back half of the year, and Donald Trump’s trade war all seemed to set the global economy and markets on a collision course with the decade’s long-awaited recession.

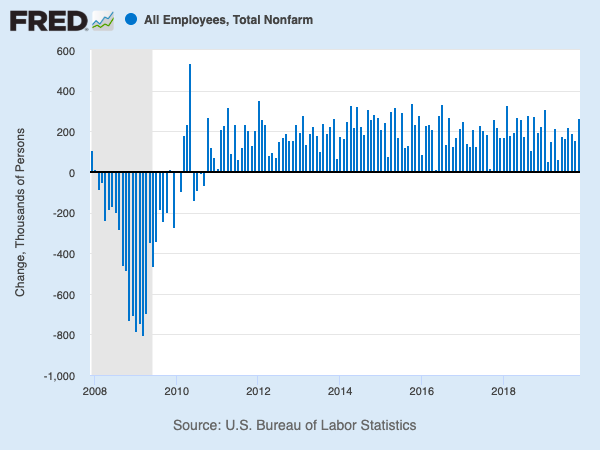

And yet we finish this decade with the longest U.S. expansion on record and markets near record highs. The last time we saw a month with negative nonfarm payroll growth was September 2010. The unemployment rate hasn’t been above 5% since November 2015.

The current environment, of course, does not come without its complications.

Mario Draghi’s pledge to do “whatever it takes” to save the eurozone in 2012 led to the ECB adopting negative interest rates. The amount of negative-yielding debt around the globe totaled $17 trillion as of August. The Federal Reserve finishes this decade cutting rates three times in 2019, admitting that raising rates in 2018 was a mistake. No major central bank currently has a benchmark rate above 2%.

Stock market valuations are also quite elevated relative to historical levels. According to data from Robert Shiller, the S&P 500’s multiple is sitting at 23 right now, 7 turns higher than the historical average of 15.

The U.S.-China trade war still leaves investors facing a number of unanswered questions and no clear path to a resolution. And while global PMI data suggests the global economy has stabilized, the downshift earlier this year and the drag from trade uncertainty suggests “progress will remain slow overall,” according to analysts at JPMorgan.

And then there’s the 2020 U.S. presidential election. And maybe, just maybe, Brexit will happen. Or it won’t.

So, while many of these risks or concerns are unique, novel, and potentially disruptive to the current economic cycle, it’s also clear that we’ve never not been staring out at a collection of similar worries.

Both known and unknown.

But it’s worth reminding ourselves what jobs reports look like in the throes of a real downturn, not a period where the risks to the outlook appear abundant. In March 2009, the economy lost 663,000 jobs. The unemployment rate rose to 8.5% from 8.1% the prior month. The labor market wouldn’t bottom out for more than a year.

We all of course hope that the next downturn, when it comes, won’t be as severe as the financial crisis. But we revisit the scars left by the last downturn to again remind ourselves that there’s no doubting recessions. Even if there remain seemingly endless reasons to doubt this market.

By Myles Udland, reporter and co-anchor of The Final Round. Follow him @MylesUdland

What to watch today

Earnings

Post-market

From Yahoo Finance

We name Target (TGT) the Company of the Year for 2019. Read also how The Yahoo Finance Company of the Year is usually a good stock bet.

Top News

House Democrats, USTR nearing deal to pass modified USMCA agreement: WSJ [Reuters]

China's potential growth below 6% over next five years - central bank adviser [Reuters]

France's Sanofi to buy biotech firm Synthorx for $2.5 billion [Reuters]

YAHOO FINANCE HIGHLIGHTS

Top DoubleLine investor sees opportunity in Brazil amid tariff threat

Nasdaq CEO: US markets should keep 'doors open' to foreign listings

'My life has been good': An 11-year-old reflects on the past decade

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance