'People still need toothpaste, toilet paper and groceries': Why consumer staples top the TSX

It’s been a rough year for the TSX, but consumer staples are once again a shining star within the universe of Canadian stocks.

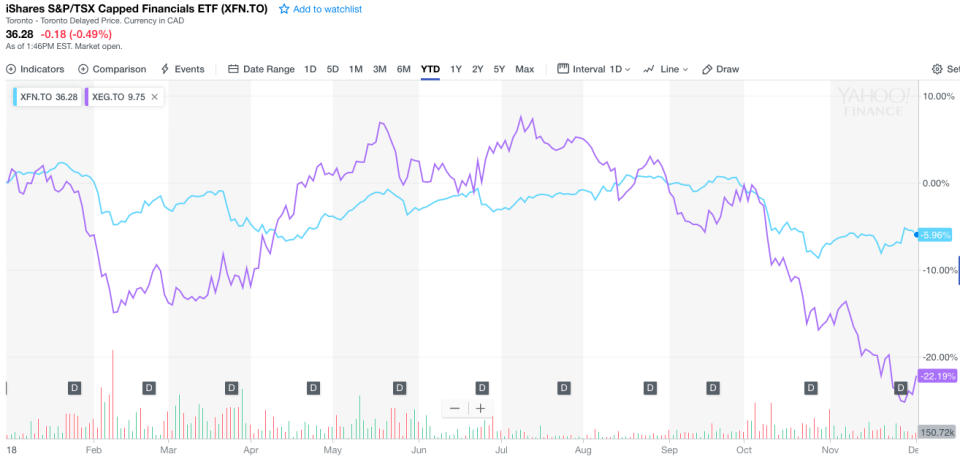

Canada’s benchmark stock index is down around 6 per cent year to date. More than half of its stocks are financials or energy, so the TSX (^GSPTSE) pretty much lives and dies on the strength of those two sectors. Both have struggled this year.

Consumer staples are faring much better, eking out a gain of about 2 per cent for the year. But since the sector only represents 3.8 per cent of the TSX, it has done little to buoy the broad market.

Consumer staples have made up a lot of ground over the last 3 months, during which time a number of hot stocks faltered.

“Our view is that as the growth stocks have rolled over (FAANGs in the U.S., cannabis stocks in Canada), and markets have become more volatile, the natural place for those dollars to go is into more stable, lower volatility stocks, and consumer staples are representative of these characteristics,” Jason Mann, chief investment officer at EHP Funds, told Yahoo Finance Canada. “It’s a fairly typical response of markets to ‘hide out’ in more defensive or lower beta sectors until the period of volatility passes.”

Tariff tit for tats have been a big source of that volatility. U.S. President Donald Trump and Chinese President Xi Jinping called a truce in their trade war during the G20.

“We may certainly see more of a ‘risk-on’ trade for the next while with the cyclicals moving faster ahead.” Stan Wong, director at Scotia Wealth Management, told Yahoo Finance Canada. “So far today, consumer staples in both the TSX and S&P 500 (^GSPC) are lagging.”

But the ceasefire could be short-lived, and the fallout prolonged. Fears of a global economic slowdown could push investors right back into the arms of defensive sectors like consumer staples.

“Defensive stocks generally have more stable and predictable earnings profiles. During the late-cycle and slowdown phases of an economic cycle, it is typical to see defensive sectors (consumer staples, health care and utilities) outperform the broader equity market,” says Wong. “The old saying goes that in an economic slowdown, people still need toothpaste, toilet paper and groceries.”

For exposure to the sector, Wong likes the iShares S&P/TSX Capped Consumer Staples Index ETF (XST-T) or Alimentation Couche-Tard (ATD-B.TO).

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance