Do Penn National Gaming's (NASDAQ:PENN) Earnings Warrant Your Attention?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Penn National Gaming (NASDAQ:PENN). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Penn National Gaming

How Fast Is Penn National Gaming Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. Who among us would not applaud Penn National Gaming's stratospheric annual EPS growth of 39%, compound, over the last three years? Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

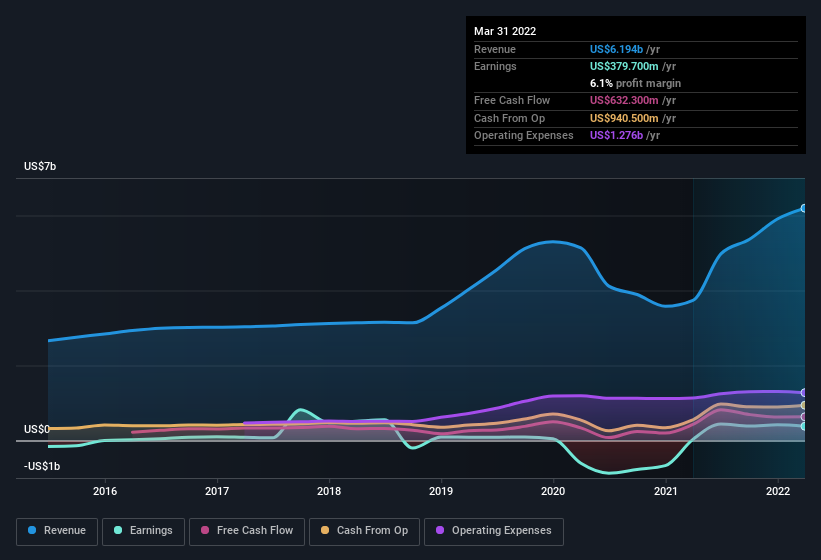

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Penn National Gaming is growing revenues, and EBIT margins improved by 8.7 percentage points to 19%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Penn National Gaming's forecast profits?

Are Penn National Gaming Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Penn National Gaming top brass are certainly in sync, not having sold any shares, over the last year. But my excitement comes from the US$98k that Independent Director Jane Scaccetti spent buying shares (at an average price of about US$49.71).

On top of the insider buying, it's good to see that Penn National Gaming insiders have a valuable investment in the business. Notably, they have an enormous stake in the company, worth US$100m. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

Does Penn National Gaming Deserve A Spot On Your Watchlist?

Penn National Gaming's earnings have taken off like any random crypto-currency did, back in 2017. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest Penn National Gaming belongs on the top of your watchlist. It is worth noting though that we have found 2 warning signs for Penn National Gaming that you need to take into consideration.

As a growth investor I do like to see insider buying. But Penn National Gaming isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance