Paychex (PAYX) Q3 Earnings & Revenues Beat, Adjusts FY23 View

Paychex, Inc. PAYX reported better-than-expected third-quarter fiscal 2023 results.

Adjusted earnings of $1.29 per share beat the Zacks Consensus Estimate by 4% and increased 12.2% on a year-over-year basis.

Total revenues of $1.4 billion also beat the Zacks Consensus Estimate by 1.5% and increased 8.2% year over year. Service revenues of $1.3 billion were up 7% year over year.

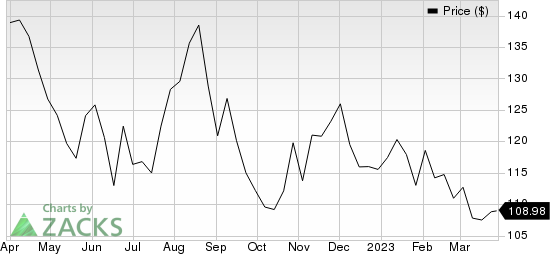

Paychex shares have declined 20.4% in the past year compared with the 10.6% decline of the industry it belongs to.

Paychex, Inc. Price

Paychex, Inc. price | Paychex, Inc. Quote

Quarter Details

Revenues from the Management Solutions segment increased 7% year over year to $1 billion. The segment benefited from growth in the number of clients and client’s employees served for human capital management (“HCM”), and additional worksite employees for HR Solutions. Also, strong demand for HR Solutions, retirement and time and attendance solutions, price realization, higher product penetration, and expansion of HCM ancillary services acted as tailwinds to the segment.

Professional employer organization (“PEO”) and Insurance Solutions’ revenues were $321.2 million, up 6% from the year-ago quarter’s level. The uptick was due to growth in the number of average worksite employees, a rise in average wages per worksite employee, and an increase in state unemployment insurance revenues. Interest on funds held for clients increased more than 100% year over year to $35.3 million.

EBITDA of $655.8 million increased 7% year over year. Operating income increased 9% year over year to $611.9 million.

Paychex exited the quarter with cash and cash equivalents of $1.3 billion compared with $1.1 billion reported at the end of the prior quarter. Long-term debt was $798.1 million compared with $797.9 million in the prior quarter.

The company generated $604.2 million of cash from operating activities and capital expenditures were $31.1 million. PAYX paid out $284.8 million as dividends in the quarter.

Fiscal 2023 View Tweaked

Paychex updated its adjusted earnings per share view with respect to year-over-year growth for fiscal 2023. Adjusted EPS is now expected to register 13-14% growth compared with the prior expectation of 12-14% growth.

PAYX continues to expect total revenues to register 8% growth.

Management Solutions’ revenues are expected to grow around 8% (prior view: 7%-8%). PEO and Insurance Solutions’ revenues are expected to grow 5-7%. Interest on funds held for clients is now anticipated to be in the range of $100-$105 million (prior view: $100 million to $110 million).

Currently, Paychex carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Performances of Some Other Business Services Companies

Gartner, Inc. IT reported better-than-expected fourth-quarter 2022 results, wherein both earnings and revenues surpassed the respective Zacks Consensus Estimate. Adjusted earnings (excluding 49 cents from non-recurring items) per share of $3.70 beat the Zacks Consensus Estimate by 44% and increased 23.8% year over year. IT’s revenues of $1.5 billion beat the Zacks Consensus Estimate by 2.6% and improved 15.2% year over year on a reported basis and 20% on a foreign-currency-neutral basis.

Aptiv PLC APTV reported better-than-expected fourth-quarter 2022 results. Adjusted earnings (excluding 41 cents from non-recurring items) of $1.27 per share beat the Zacks Consensus Estimate by 6.7% and increased more than 100% on a year-over-year basis. APTV’s revenues surpassed the Zacks Consensus Estimate by 6% and increased 12.2% year over year.

Equifax EFX reported stellar fourth-quarter 2022 results. The company’s earnings and revenues surpassed the Zacks Consensus Estimate. EFX’s adjusted earnings of $1.52 per share beat the Zacks Consensus Estimate by 2.7% but decreased 17.4% on a year-over-year basis. Revenues of $1.2 billion beat the Zacks Consensus Estimate by 1.5% but decreased 4.4% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Paychex, Inc. (PAYX) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

Gartner, Inc. (IT) : Free Stock Analysis Report

Aptiv PLC (APTV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance