Pax Global Technology Stock Gives Every Indication Of Being Significantly Overvalued

- By GF Value

The stock of Pax Global Technology (OTCPK:PXGYF, 30-year Financials) is believed to be significantly overvalued, according to GuruFocus Value calculation. GuruFocus Value is GuruFocus' estimate of the fair value at which the stock should be traded. It is calculated based on the historical multiples that the stock has traded at, the past business growth and analyst estimates of future business performance. If the price of a stock is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. On the other hand, if it is significantly below the GF Value Line, its future return will likely be higher. At its current price of $1.14 per share and the market cap of $1.2 billion, Pax Global Technology stock shows every sign of being significantly overvalued. GF Value for Pax Global Technology is shown in the chart below.

Because Pax Global Technology is significantly overvalued, the long-term return of its stock is likely to be much lower than its future business growth, which averaged 17% over the past five years.

Link: These companies may deliever higher future returns at reduced risk.

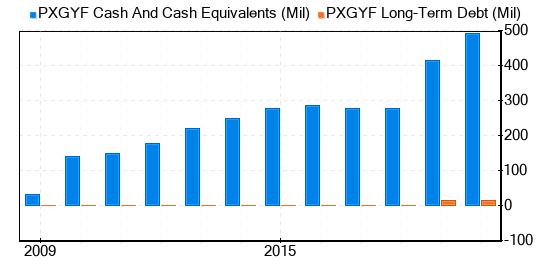

Investing in companies with poor financial strength has a higher risk of permanent loss of capital. Thus, it is important to carefully review the financial strength of a company before deciding whether to buy its stock. Looking at the cash-to-debt ratio and interest coverage is a great starting point for understanding the financial strength of a company. Pax Global Technology has a cash-to-debt ratio of 31.23, which is better than 84% of the companies in Industrial Products industry. GuruFocus ranks the overall financial strength of Pax Global Technology at 8 out of 10, which indicates that the financial strength of Pax Global Technology is strong. This is the debt and cash of Pax Global Technology over the past years:

It is less risky to invest in profitable companies, especially those with consistent profitability over long term. A company with high profit margins is usually a safer investment than those with low profit margins. Pax Global Technology has been profitable 10 over the past 10 years. Over the past twelve months, the company had a revenue of $729 million and earnings of $0.106 a share. Its operating margin is 19.39%, which ranks better than 91% of the companies in Industrial Products industry. Overall, the profitability of Pax Global Technology is ranked 9 out of 10, which indicates strong profitability. This is the revenue and net income of Pax Global Technology over the past years:

Growth is probably one of the most important factors in the valuation of a company. GuruFocus' research has found that growth is closely correlated with the long-term performance of a company's stock. If a company's business is growing, the company usually creates value for its shareholders, especially if the growth is profitable. Likewise, if a company's revenue and earnings are declining, the value of the company will decrease. Pax Global Technology's 3-year average revenue growth rate is better than 85% of the companies in Industrial Products industry. Pax Global Technology's 3-year average EBITDA growth rate is 22.8%, which ranks better than 80% of the companies in Industrial Products industry.

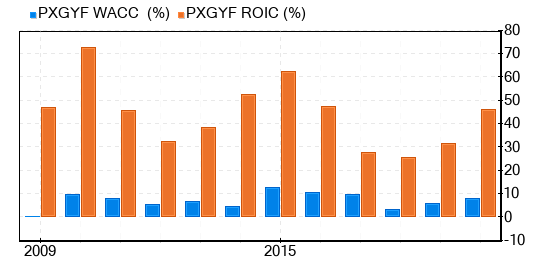

Another method of determining the profitability of a company is to compare its return on invested capital to the weighted average cost of capital. Return on invested capital (ROIC) measures how well a company generates cash flow relative to the capital it has invested in its business. The weighted average cost of capital (WACC) is the rate that a company is expected to pay on average to all its security holders to finance its assets. When the ROIC is higher than the WACC, it implies the company is creating value for shareholders. For the past 12 months, Pax Global Technology's return on invested capital is 46.32, and its cost of capital is 8.62. The historical ROIC vs WACC comparison of Pax Global Technology is shown below:

To conclude, the stock of Pax Global Technology (OTCPK:PXGYF, 30-year Financials) gives every indication of being significantly overvalued. The company's financial condition is strong and its profitability is strong. Its growth ranks better than 80% of the companies in Industrial Products industry. To learn more about Pax Global Technology stock, you can check out its 30-year Financials here.

To find out the high quality companies that may deliever above average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance