Pattern Energy (PEGI) Incurs Loss in Q1, Misses Revenues

Pattern Energy Group PEGI reported a loss of 31 cents in the first quarter 2019, versus earnings of $1.32 per share in the year-ago quarter. The Zacks Consensus Estimate for earnings was pegged at 12 cents.

The downside was caused by losses at existing projects, divestitures in 2018, derivative losses and net loss in the development investment segment.

Total Revenues

First-quarter revenues amounted to $135 million, which lagged the Zacks Consensus Estimate of $150 million by 10%. However, the figure improved 20.5% from $112 million reported in the prior-year quarter.

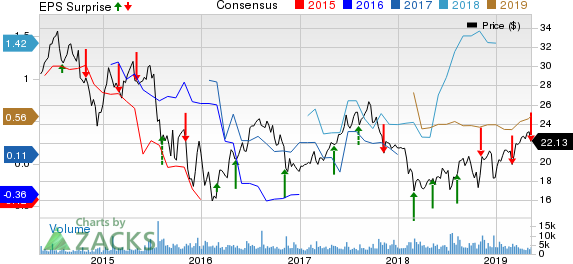

Pattern Energy Group Inc. Price, Consensus and EPS Surprise

Pattern Energy Group Inc. price-consensus-eps-surprise-chart | Pattern Energy Group Inc. Quote

Quarterly Highlights

Pattern Energy sold 2,115,855 megawatt hours (MWh) of electricity on a proportional basis compared with 2,135,715MWh in the year-ago quarter. The 1% decline was primarily caused by volume decreases stemming from divestitures in 2018 and unfavorable wind conditions.

Total operating expenses amounted to $15 million in line with the year-ago quarters level.

The company incurred interest expenses of $26 million compared with $25 million in the year-ago quarter.

Financial Highlights

As of Mar 31, 2019, the company had cash and cash equivalents of $93 million compared with $101 million Dec 31, 2018.

Its long-term debt was $2,045 million as of Mar 31, 2019, up from the Dec 31, 2018 level of $2,004 million.

The company’s cash flow from operating activities in the first quarter was $8 million, down from $28 million recorded in the year-ago quarter.

Guidance

Pattern Energy reaffirmed 2019 annual cash available for distribution in the range of $160-$190 million. The company also reaffirmed 2020 cash available for distribution in the band of $185-$225 million.

Other Utility Releases

DTE Energy Company DTE delivered first-quarter 2019 operating earnings per share of $2.05, which exceeded the Zacks Consensus Estimate of $1.95 by 5.1%

NextEra Energy, Inc NEE generated first-quarter 2019 adjusted earnings of $2.20 per share, which beat the Zacks Consensus Estimate of $2.01 by 9.4%.

FirstEnergy Corporation FE delivered first-quarter 2019 operating earnings of 67 cents per share, which beat the Zacks Consensus Estimate of 66 cents by 1.52%.

Zacks Rank

Currently, Pattern Energy has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 7 stocks to watch. The report is only available for a limited time.

See 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

FirstEnergy Corporation (FE) : Free Stock Analysis Report

DTE Energy Company (DTE) : Free Stock Analysis Report

Pattern Energy Group Inc. (PEGI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance