Parsley Energy (PE) Q1 Earnings Top on Output Gain, Sales Miss

Parsley Energy, Inc. PE reported first-quarter 2020 results wherein earnings surpassed the Zacks Consensus Estimate.

The company posted adjusted net earnings per share of 29 cents, beating the Zacks Consensus Estimate of 25 cents. Moreover, the bottom line improved from 22 cents per share in first-quarter 2019, attributable to higher year-over-year production volumes.

However, Parsley Energy’s total revenues of $564.8 million lagged the Zacks Consensus Estimate for sales of $590 million due to weak commodity price realization. Meanwhile, the top line surged 32% from $427.67 million a year ago.

Production Data and Realized Prices (Minus Derivatives’ Impact)

Parsley Energy's average quarterly volume expanded 57.1% year over year to 197 thousand barrels of oil equivalent per day (comprising 84.5% liquids), backed by the rising production of oil, natural gas and natural gas liquids (NGLs). In the quarter under review, the company placed 46 gross horizontal wells on production.

Average realized oil price declined 12.6% from the year-ago quarter to $45.32 per barrel and natural gas price realization decreased 77.5% to 31 cents per thousand cubic 8. Realized price for NGLs in the quarter was $8.95 per barrel, lower than the year-ago level of $17.97.

Total Expenses

Total operating expenses shot up to $5,421.3 million from the year-ago figure of $311.1 million. Further, lease operating costs climbed to $73.6 million from $41.2 million in the prior year. Depreciation costs also jumped to $274.7 million from $173.7 million in the corresponding quarter of last year.

Capex & Balance Sheet

Capital expenditure totaled $379 million, of which 98.2% was allotted to drilling and completion activities while the remaining was spent on water infrastructure and non-operated development operations.

As of Mar 31, 2019, Parsley Energy had cash and cash equivalents of $45.3 million. Its long-term debt was $2,998.7 million, representing total debt to total capital of 41.8%.

The company’s board of directors declared a quarterly dividend of 5 cents per share, payable June 19, 2020 to its shareholders of record on June 9.

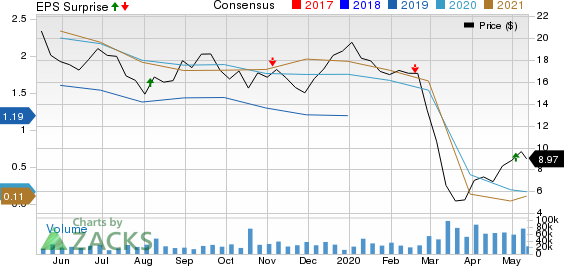

Parsley Energy Inc Price, Consensus and EPS Surprise

Parsley Energy Inc price-consensus-eps-surprise-chart | Parsley Energy Inc Quote

Acquisition

In the last reported quarter, Parsley Energy reached an agreement to acquire smaller rival Jagged Peak Energy in an all-stock deal. The transaction was completed on Jan 10, 2020 for worth $1.8 billion.

This strategic move provides Jagged Peak Energy’s stockholders with 0.447 shares of Parsley Energy Class A common stock for each share held.

Per Parsley Energy, this “low premium” deal will be immediately accretive to its 2020 cash flow along with net asset value and returns on invested capital. Additionally, this Permian pure play will be able to curb its general and administrative costs by almost $25 million in the first year followed by its annual savings worth $40-$50 million.

This all-stock deal will help the combined entity maintain a strong balance sheet with a pro forma net leverage ratio of 1.6X LTM adjusted earnings before interest, income taxes, depreciation, depletion, amortization and exploration expense.

Guidance

The oil industry is battered big time by the coronavirus pandemic that pervaded most sectors until now. Fuel demand took a huge hit following large-scale travel constraints imposed globally.

In response to the bearish oil price trend, Parsley Energytrimmed its 2020 capital spending to below $700 million, more than 50% of which is already spent in the first quarter. Further, the company deferred all its new drilling and completion activity for the time being.

Notably, this Midland, TX-based company anticipates generating a minimum free cash flow of $300 million from operations if WTI Crude prices average between $20 and $30 per barrel for the remaining year.

Zacks Rank & Key Picks

Parsley Energy has a Zacks Rank #3 (Hold). Some better-ranked players in the energy space are CNX Resources Corporation CNX, Cheniere Energy Inc. LNG and KLR Energy Acquisition Corp. ROSE, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CNX Resources Corporation (CNX) : Free Stock Analysis Report

Cheniere Energy Inc (LNG) : Free Stock Analysis Report

KLR Energy Acquisition Corp (ROSE) : Free Stock Analysis Report

Parsley Energy Inc (PE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance