Pandora's Turnaround Is Taking Shape

For the most part, Pandora (NYSE: P) has not navigated the broad shift to on-demand streaming very well. It was late to the market with its own on-demand streaming service, Pandora Premium, while Spotify cemented itself as a dominant force. However, the internet radio pioneer just reported better-than-expected second-quarter earnings, and the company's turnaround is starting to take shape.

Here's what investors need to know.

Image source: Getty Images.

How Pandora fared in Q2

Revenue in the second quarter rose 12% (when excluding Australia, New Zealand, and Ticketfly from the year-ago quarter) to $384.8 million, which was comprised of $113.7 million in subscription revenue and $271.1 million in ad revenue. Pandora's listener base has long been overwhelmingly ad-supported users, but the company has been making progress in growing paying subscribers. That all led to a non-GAAP net loss of $38.9 million, or $0.15 per share.

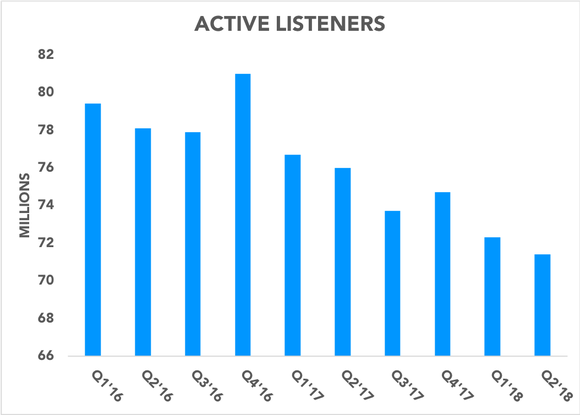

Pandora added roughly 351,000 net subscribers during the quarter, bringing total paid subscribers of Pandora Plus and Pandora Premium to 6 million, which pales in comparison to Spotify's 83 million premium subscribers. There were 71.4 million active users at the end of the quarter, and listener hours totaled 5.09 billion.

The company also launched Premium Family Plans during the quarter. It's worth noting that family plans have helped rival Spotify improve user retention over the years. CEO Roger Lynch said the new family plans "will steer a greater share of new subscribers to direct high-margin billing plans," and a student plan is also in the pipeline.

The company also closed its acquisition of AdsWizz during the quarter, which facilitated the launch of Pandora's new programmatic audio ad platform, Audio Programmatic. Pandora's ad pricing has been improving, with ad RPM (revenue per thousand impressions) hitting a Q2 record of $68.75, up from $66.15 a year ago.

Pandora still focusing mostly on the ad business

While the music industry continues to shift toward paid subscriptions, Pandora is oddly still betting on growth to come from advertising. Given the dynamics of its user base, it makes sense that Pandora is bolstering its ad platform with programmatic buying, but it still seems that the company may still be focusing too heavily on the ad-supported segment of the market. Responding to an analyst question during the earnings call, Lynch noted (emphasis added):

So what I mean by that is we're obviously seeing strong growth in our subscription business and we expect that, that will continue, and there's strong growth overall in subscription music. But we also know that the bigger revenue pie today is actually advertising. There's more ad-supported listening, hundreds of millions of listeners in the U.S. There's more ad revenue in audio than there is subscription revenue. And we think that, that is right for us to go after.

So it really is about meeting consumers. It's like I talked about transacting with advertisers, the way they want to transact, it's the same for consumers. We want to transact with consumers in the way they want to transact. So it may be a consumer who has a propensity to pay for a subscription service. That's great. We've got 2 tiers of subscription. But we think there will be a very large segment of the market for whom subscription is not the right answer and will be a leader in the ad-supported side of that.

But Pandora's overall active user base continues to shrink.

Data source: SEC filings. Chart by author.

Pandora's turnaround is ongoing, but it clearly still has a lot of work cut out for it.

More From The Motley Fool

Evan Niu, CFA owns shares of SPOT. The Motley Fool owns shares of and recommends Pandora Media. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance