Palo Alto Buys Aporeto, Boosts Profile with Microsegmentation

Palo Alto Networks PANW recently completed the acquisition of machine identity-based microsegmentation entity Aporeto. With this, the company further strengthens its Cloud Native Security Platform delivered by Prisma Cloud.

The addition of Aporeto to its portfolio will help the company identify workloads and apply microsegmentation across all infrastructures, which will ensure better application of security to customers.

In November this year, Palo Alto Networks had announced that it will pay approximately $150 million in cash to acquire Aporeto.

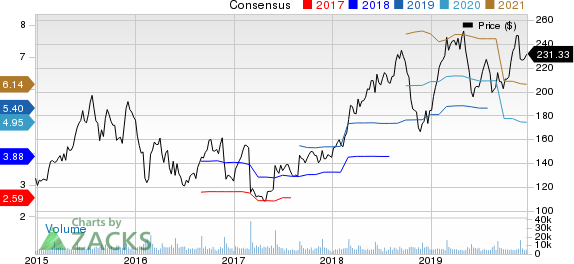

Palo Alto Networks, Inc. Price and Consensus

Palo Alto Networks, Inc. price-consensus-chart | Palo Alto Networks, Inc. Quote

Growing Efforts in Kubernates Network Security

As the development of containerized applications (which are likely to soon run on Kubernetes clusters) continues to accelerate, the pressure on cybersecurity teams to find ways to secure those applications is expected to mount. This gives Palo Alto Networks an opportunity to devote more efforts to this area.

The company already took important steps to boost its Kubernates network security capabilities. Notably, in August this year, it partnered with Tigera to provide its zero-trust framework for cloud-native applications for bridging the gap between the latter’s Kubernetes and traditional firewalls.

Notably, Aporeto will help Palo Alto Networks boost its Kubernates network security capabilities with the Aporeto Zero Trust Cloud Security Platform.

Looking Away from Firewall?

Palo Alto Networks is majorly known for its next-generation firewall technology. However, the gradual fall of popularity of perimeter-focused, firewall-based security is making the company shift its security offerings to a more emerging technology-centric approach.

In its most recent earnings call, management mentioned that firewall revenues for the quarter were not satisfactory. Notably, firewall as a platform grew only 11% year over year during the first quarter of fiscal 2020.

The buyout of Aporeto was in line with the company’s strategic initiatives in “zero trust” approach. Zero trust or microsegmentation is better suited for the current cloud and hybrid data center environment. Additionally, identity-based solutions like Aporeto’s machine-based identities are easier to manage and scale than firewall-based security services.

Per Gartner, all organizations must move toward a zero-trust approach for better security of their cloud infrastructure.

The concerted efforts of this security giant to expand its cloud-centric security offerings encourage us about its prospects.

Zacks Rank and Key Picks

Palo Alto Networks currently has a Zacks Rank #3 (Hold). A few better-ranked stocks in the broader technology sector are Fortinet, Inc. FTNT, Marchex, Inc. MCHX and Baidu, Inc. BIDU, each flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Fortinet, Marchex and Baidu is currently pegged at 14%, 15% and 2.27%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

Marchex, Inc. (MCHX) : Free Stock Analysis Report

Baidu, Inc. (BIDU) : Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance