Packaging Corporation (PKG) Bets on E-commerce Demand, Costs High

Packaging Corporation of America PKG is poised to benefit from the ongoing demand strength in its packaging segment backed by e-commerce, and rising requirements for meat, fruit and vegetables, processed food, beverages, medicine and other consumer products. This will help offset the impact of inflated material costs, labor shortage and supply chain issues currently plaguing the industry. However, lower paper consumption due to the impact of the pandemic and increased digitization remains a woe.

Packaging & E-Commerce Demand to Boost Revenues

Demand in the Packaging segment, which accounts for 89% of Packaging Corporation’s revenues, continues to be strong. Packaging products are essential for the distribution of food, beverage and pharmaceutical products. Hence, the Packaging segment continues to benefit from the elevated demand for meat, fruit and vegetables, processed food, beverages, medicine and other consumer products owing to the coronavirus crisis.

Both containerboard and corrugated products demand remains very strong across most of the company’s end markets. It set a new all-time quarterly record for total box shipments and a second-quarter record for shipments per day in the second quarter of 2021. This momentum is expected to continue through the balance of the year.

Rising e-commerce sales have increased the importance of packaging since the products need to be delivered in the best of conditions to the consumer. Further, with consumers forced to stay at home amid the coronavirus crisis, the consequent surge in e-commerce demand is working in favor of Packaging Corporation and other packaging solution providers.

Strong Balance Sheet Bodes Well

Over 2016-2020, Packaging Corporation’s debt has declined at a CAGR of 1%, while its cash flow has witnessed a CAGR of 46% in the same time frame. The company’s liquidity as of Jun 30, 2021 was close to $1.5 billion. Its total debt to total capital ratio has gone down over the past few quarters and was 0.42 as of Jun 30, 2021 — much lower than the industry’s 0.68. Its times interest earned ratio was at 9.7 at the end of second-quarter 2021, higher than the industry’s 6.2. The company maintains a balanced approach toward capital allocation in order to boost growth and maximize returns for shareholders.

Weak Paper Demand Remains a Woe

The pandemic has impacted paper consumption in schools, offices and businesses, thus straining paper demand. Also, the paper segment competes with electronic data transmission, e-readers and electronic document storage alternatives. Increasing preference for these alternatives will continue to have an adverse effect on traditional print media and paper usage, and lower demand for communication papers. This remains a headwind for the paper segment.

High Costs to Dent Margins

The company is encountering some material and chemical availability issues, a tight labor market, and various freight and logistics challenges. Higher operating costs, and escalating freight and logistic costs due to historically high load to truck ratios, driver shortages and increases in fuel costs remain headwinds for the balance of the year. Energy costs will spike on higher seasonal usage, while wood costs in the southern mills are expected to go up on account of wet weather, low inventory and high demand.

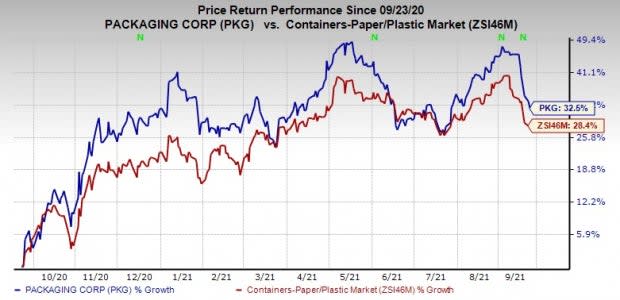

Price Performance

Image Source: Zacks Investment Research

The company’s stock has gained 32.5% in the past year compared with the industry’s growth of 28.4%.

Zacks Rank & Stocks to Consider

Packaging Corporation currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Industrial Products sector include Encore Wire Corporation WIRE, Lincoln Electric Holdings, Inc. LECO and Deere & Company DE. While Encore Wire and Lincoln Electric sport a Zacks Rank #1 (Strong Buy), Deere carries a Zacks Rank #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Encore Wire has a projected earnings growth rate of 332.6% for fiscal 2021. The company’s shares have gained 93% in a year.

Lincoln Electric has an expected earnings growth rate of 45.1% for 2021. In a year’s time, the stock has appreciated 49%.

Deere has an estimated earnings growth rate of 117.5% for fiscal 2021. The company’s shares have rallied 57% over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Packaging Corporation of America (PKG) : Free Stock Analysis Report

Deere & Company (DE) : Free Stock Analysis Report

Lincoln Electric Holdings, Inc. (LECO) : Free Stock Analysis Report

Encore Wire Corporation (WIRE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance