Pacifico Minerals (ASX:PMY) Will Have To Spend Its Cash Wisely

Want to participate in a short research study? Help shape the future of investing tools and earn a $40 gift card!

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

Given this risk, we thought we'd take a look at whether Pacifico Minerals (ASX:PMY) shareholders should be worried about its cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

View our latest analysis for Pacifico Minerals

How Long Is Pacifico Minerals' Cash Runway?

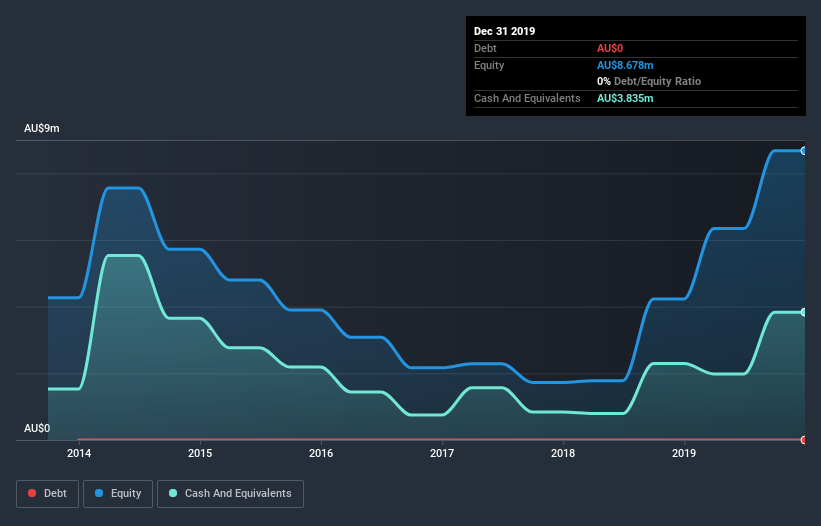

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. In December 2019, Pacifico Minerals had AU$3.8m in cash, and was debt-free. In the last year, its cash burn was AU$7.2m. Therefore, from December 2019 it had roughly 6 months of cash runway. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. You can see how its cash balance has changed over time in the image below.

How Is Pacifico Minerals' Cash Burn Changing Over Time?

Whilst it's great to see that Pacifico Minerals has already begun generating revenue from operations, last year it only produced AU$247k, so we don't think it is generating significant revenue, at this point. Therefore, for the purposes of this analysis we'll focus on how the cash burn is tracking. Remarkably, it actually increased its cash burn by 239% in the last year. With that kind of spending growth its cash runway will shorten quickly, as it simultaneously uses its cash while increasing the burn rate. Admittedly, we're a bit cautious of Pacifico Minerals due to its lack of significant operating revenues. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

How Hard Would It Be For Pacifico Minerals To Raise More Cash For Growth?

Given its cash burn trajectory, Pacifico Minerals shareholders should already be thinking about how easy it might be for it to raise further cash in the future. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Pacifico Minerals' cash burn of AU$7.2m is about 23% of its AU$32m market capitalisation. That's fairly notable cash burn, so if the company had to sell shares to cover the cost of another year's operations, shareholders would suffer some costly dilution.

How Risky Is Pacifico Minerals' Cash Burn Situation?

We must admit that we don't think Pacifico Minerals is in a very strong position, when it comes to its cash burn. Although we can understand if some shareholders find its cash burn relative to its market cap acceptable, we can't ignore the fact that we consider its increasing cash burn to be downright troublesome. Once we consider the metrics mentioned in this article together, we're left with very little confidence in the company's ability to manage its cash burn, and we think it will probably need more money. On another note, we conducted an in-depth investigation of the company, and identified 6 warning signs for Pacifico Minerals (3 are concerning!) that you should be aware of before investing here.

Of course Pacifico Minerals may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance