Outpatient & Home Healthcare Stock Outlook: Prospects Bright

Artificial intelligence (AI) has been a roaring success in healthcare, taking the outpatient and home healthcare space by storm as well!

These days, patients prefer bots for home-based medical services for easy, pocket friendly and faster recovery. Per a research report by the International Federation of Robotics, about 37,500 elderly-assistance medical robots will be sold worldwide by 2019 for home-based care.

Apart from elderly care, AI has a role to play in United States’ fight against sexual offence, depression and cognitive-behavioral disorder. Such emergencies call for maintenance of privacy, anonymity and outpatient care.

Further, the recent national epidemic of opioid abuse and President Trump’s fresh “tough on crime” policies are likely to drive the demand for outpatient rehab centers in the nation.

Despite these factors, analysts apprehend that regulatory hurdles might slightly weigh on the global outpatient markets. Further, any slowdown in global economic growth, especially in the MedTech domain, might hurt demand for outpatient and home healthcare procedures.

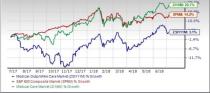

Industry Performance vs. S&P 500

Despite the favorable socio-economic scenario, investors aren’t quite upbeat about the industry at the moment. Moreover, outpatient rehab centers do not provide assured cure for opioid abuse and drug overdose till now.

This reflects in the underperformance of the Zacks Medical - Outpatient And Home Healthcare industry, which is a 16-stock group within the broader Zacks Medical Sector, with respect to both the S&P 500 and its sector over the past year.

While stocks in this industry have collectively gained 3.1%, the Zacks S&P 500 Composite and Zacks Medical Sector have rallied a respective 14.2% and 20.7%.

One-Year Price Performance

Outpatient and Home Healthcare Stocks Trading Cheap

Given the industry’s underperformance so far this year, the valuation looks cheap now. Valuation is a tricky business for the Outpatient and Home Healthcare companies. Not to forget, these companies spend a lot on unplanned R&D and hence it is difficult to account for such high expenses.

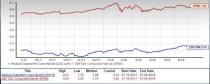

However, one might gain a fair idea of the industry’s relative valuation from its Price/Book ratio.

The industry currently has a Price/Book TTM ratio of 2.14, which is toward the high end of the past year as well as the last five years. When compared to the high of 2.21 and median level of 1.95 over the past year, we believe investors should wait for a dip to enter the market.

The space also looks inexpensive when compared to the Medical market at large, as the current Price/Book TTM ratio for the Medical sector is 2.56 and the median Price/Book TTM ratio is 2.39.

Price-to-Book Trailing Twelve Months (TTM)

Compared to the Zacks S&P 500 Composite, the space looks inexpensive. The current ratio for the S&P 500 of 3.92 and the median level is 3.75. So, both the figures are above the Medical - Outpatient And Home Healthcare industry’s respective ratios.

Price-to-Book Trailing Twelve Months (TTM)

Price Under Pressure Due to Bleak Earnings View

The ratio analysis shows that the industry has a solid value-oriented path ahead.

The major factors driving this are mostly macroeconomic along with cost effectiveness. Middle-class Americans, i.e. more than 62% of the total population, generally avoid high service costs of expensive healthcare centers. They prefer treatments at home or at outpatient clinics to cut down on out-of-pocket expenses.

One reliable metric that can give investors an idea of the industry’s future price performance is its earnings outlook. Empirical research shows that earnings outlook for the industry, showing the earnings revision trend for the constituent companies, has a direct bearing on its stock market performance.

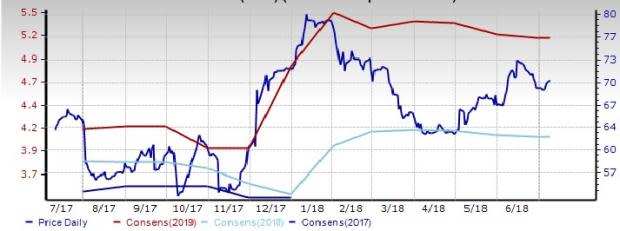

The Price & Consensus chart for the industry shows the market's evolving bottom-up earnings expectations for it and the industry's aggregate stock market performance. The red line in the chart represents the Zacks measure of consensus earnings expectations for 2019, while the light blue line represents the same for 2018.

Price and Consensus: Medical - Outpatient And Home Healthcare industry

Please note that the $3.08 EPS estimate for the industry for 2018 is not the actual bottom-up EPS estimate for every company in the Zacks Medical - Outpatient And Home Healthcare industry, but rather an illustrative aggregate number created by our proprietary analytics model. The key factor to keep in mind is not the earnings per share of the industry for 2018, but how this estimate has been moving recently.

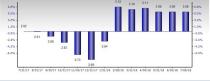

This becomes clear by focusing on the aggregate EPS revisions trend. The chart below shows the evolution of aggregate consensus expectations for 2018.

Current Fiscal Year EPS Estimate Revisions

As you can see, the $3.08 EPS estimate for 2018 has remained steady since May, declining from $3.11 at April-end. Looking at the earnings estimate revisions, it appears that analysts are losing confidence in this group’s earnings potential. This could possibly be due to the regulatory hurdles in the outpatient industry.

However, earnings estimates have risen sharply since last December.

Zacks Industry Rank Indicates Solid Prospects

The group’s Zacks Industry Rank is basically the average of the Zacks Rank of all member stocks.

The Zacks Medical - Outpatient And Home Healthcare industry currently carries a Zacks Industry Rank #116, which places it within the top 45% of more than 250 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Moreover, our proprietary Heat Map shows that the industry’s rank was consistently in the top 50% for the past eight weeks.

Outpatient And Home Healthcare Promises Long-Term Growth

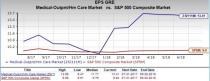

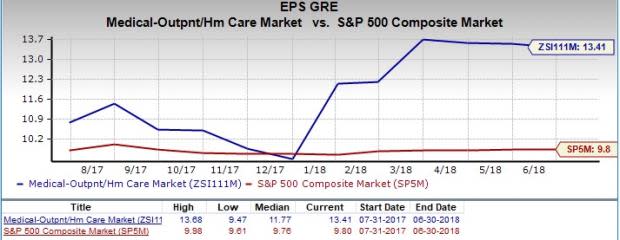

The long-term prospects for the industry indicate steady growth. When compared with the broader Zacks S&P 500 composite, the long-term (3-5 years) EPS growth estimate for the Zacks Medical - Outpatient And Home Healthcare industry of 13.4% appears promising. The corresponding figure for the Zacks S&P 500 composite is 9.8%.

Though the group’s mean estimate of long-term EPS growth rate has declined sharply from the high of 13.7% achieved in March and April 2018, it has been steady ever since and is above the low of 9.5% over a year.

Mean Estimate of Long-Term EPS Growth Rate

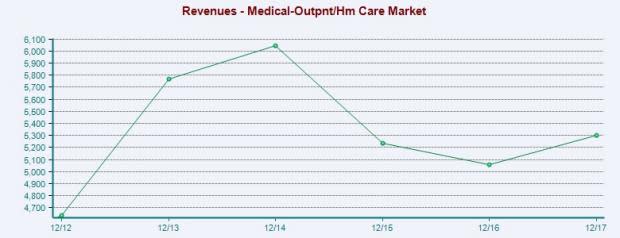

In fact, the basis of this long-term EPS growth could be a steady increase in top line that the Medical - Outpatient And Home Healthcare industry has seen since the end of 2016.

Bottom Line

The rapid adoption of outpatient services can be attributed to technological advancements, which have made procedures shorter and less complicated.

A research report by the Transparency Market Research suggests that Americans are increasingly succumbing to drug addiction, which is affecting health and family life to a large extent. Outpatient rehabs have a major role to play since treatment is comparatively cheaper than inpatient and residential treatments. On the flip side, healthcare markets are facing innumerable regulations and interventions, which might mar the long-term prospects of the industry.

However, keeping the long-term expectations in mind, investors could advantage from the cheap valuation and bet on a few outpatient and home healthcare stocks that have a strong earnings outlook.

Here we pick two stocks from the Medical - Outpatient And Home Healthcare industry with a Zacks Rank #1 (Strong Buy) or 2 (Buy), out of which one has seen positive earnings estimate revision.

DaVita Inc (DVA): Headquartered in Denver, CO, DaVita is a leading provider of dialysis services in the United States to patients suffering from chronic kidney failure. The stock has a Zacks Rank #2.

The Zacks Consensus Estimate for current-year earnings inched down 0.2% in the last 60 days. DaVita has returned 13.2% in a year’s time.

Price and Consensus: DVA

Amedisys, Inc. (AMED): Amedisys provides home health and hospice services throughout the United States to the growing chronic, co-morbid, and aging American population. The stock sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for current-year earnings rose 3% in the last 60 days. Amedisys has returned 53.5% in a year’s time.

Price and Consensus: AMED

Investors may also hold onto these couple of stocks that have been seeing positive earnings estimate revision and hold strong long-term growth potential.

Quest Diagnostics Inc. (DGX): Headquartered in Madison, NJ, Quest Diagnostics is one of the largest providers of commercial laboratory services in North America. The Zacks Consensus Estimate for current-year earnings moved up 1.7% in the last 60 days. Quest Diagnostics, a Zacks Rank #3 (Hold) stock, has returned 2% in a year’s time.

Price and Consensus: DGX

Chemed Corp. (CHE): Chemed’s VITAS Healthcare segment provides hospice and palliative care services to patients with terminal illnesses. This category of care is provided for making a terminally ill patient’s final days more comfortable and painless.

The Zacks Consensus Estimate for current-year earnings remained stable in the last 60 days. Chemed has returned 59.9% in a year’s time. The stock has a Zacks Rank #3.

Price and Consensus: DGX

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Quest Diagnostics Incorporated (DGX) : Free Stock Analysis Report

Chemed Corporation (CHE) : Free Stock Analysis Report

Amedisys, Inc. (AMED) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance