Ormat Technologies (ORA) Q2 Earnings Beat, Revenues Up Y/Y

Ormat Technologies Inc.’s ORA second-quarter 2019 adjusted earnings per share (EPS) came in at 40 cents, which surpassed the Zacks Consensus Estimate of 31 cents by 2%. The bottom line also improved 25% from 32 cents registered in the prior-year quarter.

Including a one-time tax benefit, the company reported GAAP earnings of 66 cents per share against a loss of a penny incurred in the year-ago quarter.

The year-over-year improvement in the bottom line can be attributed to higher revenues as well as gross profit generated in the quarter under review.

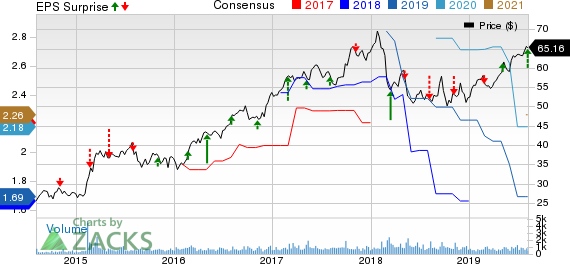

Ormat Technologies, Inc. Price, Consensus and EPS Surprise

Ormat Technologies, Inc. price-consensus-eps-surprise-chart | Ormat Technologies, Inc. Quote

Revenues

Ormat Technologies’ second-quarter revenues of $184.1 million exceeded the Zacks Consensus Estimate of $176 million by 4.6%. The top line also improved 3.2% on a year-over-year basis, particularly driven by revenue growth at its Electricity segment.

Segment Revenues

Electricity Segment: Revenues at this segment increased 5.6% year over year to $129.1 million from $122.2 million. The upside was primarily driven by the expanded operations at McGuinness Hills and Olkaria. Also, contributions from the USG acquisition provided a boost to this unit’s top line.

Product Segment: Revenues at this segment decreased 5.3% year over year to $52 million from $54.9 million.

Other Segment: Revenues at this division amounted to $3 million compared with $1.2 million in the prior-year quarter.

Operational Update

In the reported quarter, Ormat Technologies’ total cost of revenues was $118.9 million, down 1.6% year over year.

The company’s total operating expenses totaled $18.3 million, down 12.3% year over year.

Consequently, operating income surged 28% year over year to $46.9 million.

Interest expenses were $21.6 million, up 35.8% year over year.

Financial Condition

Ormat Technologies had cash and cash equivalents of $110.7 million as of Jun 30, 2019, compared with $98.8 million as of Dec 31, 2018.

Total liabilities amounted to $1.69 billion as of Jun 30, 2019, compared with $1.67 billion as of Dec 31, 2018.

Guidance 2019

Ormat Technologies continues to expect 2019 total revenues in the $720-$742 million band. The Zacks Consensus Estimate for the same, pegged at $733.1 million, lies above the midpoint of the company’s guided range.

Segment-wise, the company still expects revenues at the Electricity segment to be in the range of $530-$540 million, excluding any impact from Puna during 2019. Likewise, the company’s Product segment revenues are expected to be $180-$190 million.

Furthermore, annual adjusted EBITDA for 2019 is anticipated in the range of $375-$385 million compared with $370-$380 million projected earlier, with no Puna-related EBITDA.

Zacks Rank

Ormat Technologies has a Zacks Rank #4 (Sell).

Recent Oils-Energy Releases

TOTAL S.A. TOT reported second-quarter 2019 operating earnings of $1.05 per share (€0.94 per share), which missed the Zacks Consensus Estimate of $1.23 by 14.6%. The company carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Anadarko Petroleum Corporation APC generated second-quarter 2019 adjusted earnings of 51 cents per share, which beat the Zacks Consensus Estimate of 46 cents by 10.87%. The company carries a Zacks Rank of 3.

Devon Energy Corp. DVN reported second-quarter 2019 adjusted earnings of 43 cents per share, which surpassed the Zacks Consensus Estimate of 36 cents by 19.4%. The company carries a Zacks Rank #3.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 7 stocks to watch. The report is only available for a limited time.

See 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TOTAL S.A. (TOT) : Free Stock Analysis Report

Anadarko Petroleum Corporation (APC) : Free Stock Analysis Report

Devon Energy Corporation (DVN) : Free Stock Analysis Report

Ormat Technologies, Inc. (ORA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance