Orion Energy (OESX) Q4 Earnings Miss Estimates, Improve Y/Y

Orion Energy Systems, Inc.’s OESX shares declined 9.2% on Jun 4, after it reported disappointing fourth-quarter fiscal 2020 (ended Mar 31, 2020) results. Both its top and bottom lines missed the respective Zacks Consensus Estimate.

Orion Energy’s business was adversely impacted by coronavirus-led shutdowns. Some customers and projects belong to areas where travel restrictions have been imposed by government officials. Such customers have either closed or reduced on-site activities, and increased timelines for the completion of multiple projects.

Despite the continuation of operations of U.S.-based manufacturing businesses that have been deemed essential, the company experienced a curtailment of activity in the past few weeks of fiscal 2020. Nonetheless, it took proactive measures to reduce overhead and operating costs for the challenging business climate in the near term.

Delving Deeper

In the quarter under review, the company reported net loss of 2 cents per share that improved 33.3% from the year-ago reported figure of a loss of 3 cents. The consensus estimate for fiscal fourth-quarter earnings was 3 cents per share.

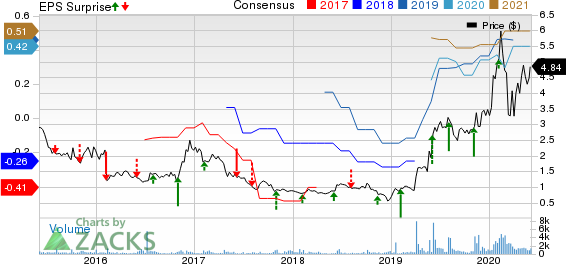

Orion Energy Systems, Inc. Price, Consensus and EPS Surprise

Orion Energy Systems, Inc. price-consensus-eps-surprise-chart | Orion Energy Systems, Inc. Quote

Net sales during the quarter totaled $25.9 million, which lagged the consensus mark of $28.6 million by 9.5%. However, the reported figure increased 15.6% from $22.4 million in the prior-year quarter. The uptrend was driven by increased product and service revenues, mainly related to turnkey LED lighting retrofit solutions provided to a major national account. Product revenues grew 9.3% and service revenues increased 39.4% year over year, reflecting increased installation and services activity during the quarter.

Notably, the company believes that fiscal fourth-quarter revenues would have been approximately $5 million higher than the reported numbers, barring the impact of COVID-19.

Operating Highlights

Gross margin improved 280 basis points (bps) on a year-over-year basis to 22.3%. The improvement can be attributed to stronger revenue mix and volume than the year-ago period.

Operating expenses increased 21.2% from the prior-year period. The increase was primarily due to incremental investments in sales and marketing activities, including increased commissions based on higher sales volumes.

Adjusted EBITDA in the quarter was $114 million versus the year-ago figure of negative $49 million.

Financials

As of Mar 31, 2020, the company had cash and cash equivalents of $28.8 million compared with $8.7 million at the end of fiscal 2019. In fiscal 2020, cash provided by operating activities totaled $20.3 million against cash used in operations of $5.1 million in fiscal 2019.

Fiscal 2021 Outlook

Given uncertainty related to the COVID-19 pandemic, it is currently unable to provide the financial outlook for fiscal 2021. The company anticipates more challenging business conditions, particularly in the first two quarters of fiscal 2021, wherein revenues are likely to fall from a year ago. Yet, it projects revenues to gain on a sequential basis in the third and fourth quarters on increased customer activity. It also anticipates business to return to profitability in the second half of fiscal 2021.

Zacks Rank

Orion Energy — which shares space with Acuity Brands, Inc. AYI, Energy Focus, Inc. EFOI and LSI Industries Inc. LYTS in the same industry — currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

LSI Industries Inc. (LYTS) : Free Stock Analysis Report

Orion Energy Systems, Inc. (OESX) : Free Stock Analysis Report

Acuity Brands Inc (AYI) : Free Stock Analysis Report

Energy Focus, Inc. (EFOI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance