Omnicom (OMC) to Report Q4 Earnings: What's in the Cards?

Omnicom Group Inc. OMC is scheduled to release fourth-quarter 2019 results on Feb 11, before market open.

Over the past year, shares of Omnicom have gained 2.5% against 1.4% decline of the industry it belongs to and 22.1% rise of the Zacks S&P 500 composite.

Let’s check out the expectations in detail.

Top Line Likely to Decline Year Over Year

The Zacks Consensus Estimate for the company's fourth-quarter revenues is pegged at $4.08 billion, suggesting a 0.2% decline from the year-ago quarter’s actual figure. The top line is expected to reflect the impact of decline in acquisition revenues, net of disposition revenues and unfavorable impact of foreign exchange movements, partially offset by higher organic revenue growth.

In third-quarter 2019, revenues of $3.62 billion decreased 2.4% year over year. Acquisition revenues, net of dispositions revenues declined 3.1% and foreign currency translation had a negative impact of 1.5%. In the same period, organic revenue growth was 2.2%.

Bottom Line Likely to Improve Year Over Year

The Zacks Consensus Estimate for earnings is pegged at $1.87, indicating a year-over-year increase of 5.7%. The bottom line is expected to have benefited from the change in business mix resulting from the disposition of several non-strategic or underperforming agencies over the past year. Also, operational efficiency efforts through investments in real estate, back-office services, procurement and IT are expected to get reflected in the bottom-line number.

In third-quarter 2019, adjusted earnings of $1.32 per share increased 6.5% on a year-over-year basis.

What Our Model Says

Our proven Zacks model does not predict an earnings beat for Omnicom this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Omnicom has an Earnings ESP of -0.27% and a Zacks Rank #3.

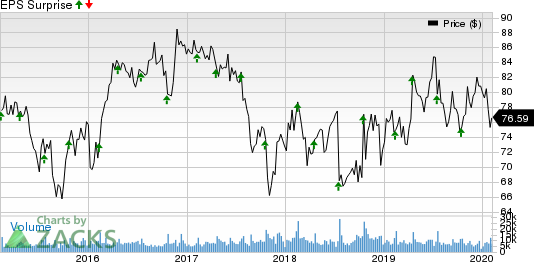

Omnicom Group Inc. Price and EPS Surprise

Omnicom Group Inc. price-eps-surprise | Omnicom Group Inc. Quote

Stocks to Consider

Here are a few stocks from the broader Zacks Business Services sector that investors may consider as our model shows that these have the right combination of elements to beat on fourth-quarter 2019 earnings:

Waste Management (WM) has an Earnings ESP of +4.19% and a Zacks Rank #2. The company is slated to report results on Feb 13. You can see the complete list of today’s Zacks #1 Rank stocks here.

Republic Services Inc. (RSG) has an Earnings ESP of +3.54% and a Zacks Rank #2. The company is slated to release results on Feb 13.

Fidelity National Information Services, Inc. (FIS) has an Earnings ESP of +0.30% and a Zacks Rank #2. The company is slated to release results on Feb 13.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.7% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

Fidelity National Information Services, Inc. (FIS) : Free Stock Analysis Report

Waste Management, Inc. (WM) : Free Stock Analysis Report

Republic Services, Inc. (RSG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance