Oil prices may crash further because of oil producers' high debt levels

Robert Cianflone/Getty Images

A key driver of the 70% plunge in oil prices since the summer of 2014 is over-supply.

But according to Jaime Caruana, a General Manager at the Bank for International Settlements, the price of oil could crash even further — because of oil producers' high debt. Oil companies have $1.6 trillion in outstanding debt, Caruana says, triple the amount they carried eight years earlier. Companies are incentivised to keep pumping oil and gas, even if their margins are low, because they need the cashflow to service that debt.

On the main issue of supply first — Saudi Arabia is arguably to blame for the supply glut because, as a "swing producer," it produces so much oil that it can shift market prices on its own. Basically, there's too much oil on the market and the Saudis refuse to cut the amount they produce.

Low prices hurt the Saudi economy but the country is more interested in trying to kill off oil production competition in the US than keeping its own economy afloat.

It's working — major oil companies like Shell and BP saw their profits crater over 50%. Thousands of oil jobs will be lost. On top of that, producers plan to scrap nearly 150 oil platforms in the North Sea over the next 10 years, according to various reports, including the BBC.

However, Caruana said in a lecture for the London School of Economics and Political Science on February 5, oil producers' high debt could lead to even lower prices:

To be sure, the price of oil is determined by a complex set of factors, not least views about the evolution of production and consumption.

And its fall over the past couple of years has clearly been influenced by major changes in supply conditions, such as the behaviour of OPEC. However, the common thread that ties together EME oil firms and US shale producers is the extent of leverage in the oil sector.

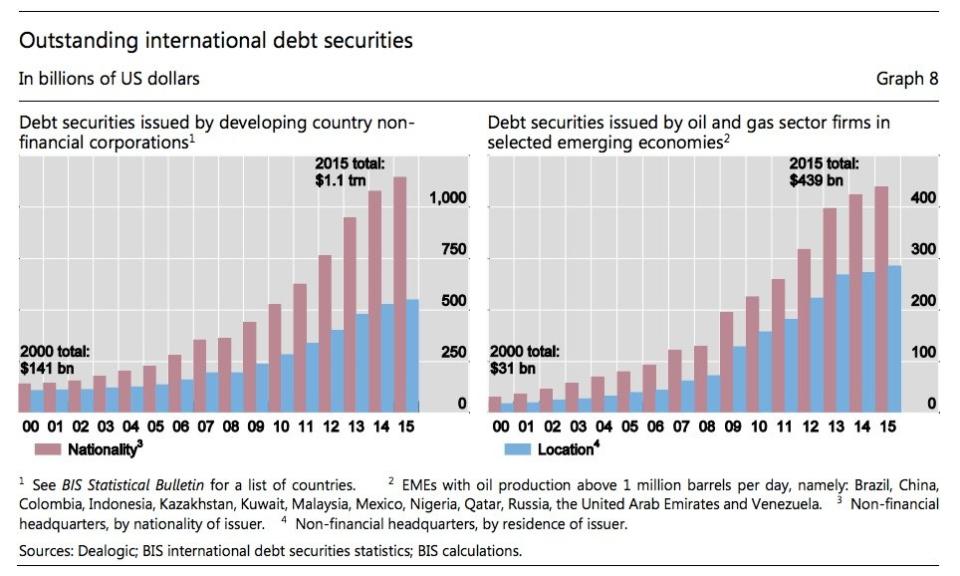

The greater willingness of investors to lend against oil reserves and revenue had enabled oil firms to borrow large amounts in a period when debt levels have increased more. Companies in the oil sector borrowed both from banks and in bond markets. Issuance of debt securities by oil and other energy companies far outpaced the substantial overall issuance by other sectors.

Oil and gas companies’ bonds outstanding increased from $455 billion in 2006 to $1.4 trillion in 2014, an annual growth rate of 15%. Energy companies also borrowed heavily from banks. Syndicated loans to the oil and gas sector in 2014 amounted to an estimated $1.6 trillion, an annual increase of 13% from $600 billion in 2006.

Here's a chart that illustrates oil companies indebtedness:

Robert Cianflone/Getty Images

Now here is where it gets interesting.

Obviously, if you are an oil company with lots of debt, you need to make a profit in order to make those debt payments.

But as BIS' Caruana points out, "Lower prices will tend to reduce profitability, increase the risk of default and lead to higher financing costs."

If you're a company and you're not making a profit and you're struggling to pay your debt, that leads to a whole host of issues that you'll have to deal with. This includes:

Spreads on energy high-yield bonds widening.

A lower price of oil reducing the cash flows associated with current production and increasing the risk of liquidity shortfalls in which firms are unable to meet interest payments. Such strains may affect the way firms respond to lower oil prices in two main ways.

Robert Cianflone/Getty ImagesSo all-in-all, one would assume that if a company is struggling because low oil is hitting profitability and therefore making it difficult for firms to service debt, leading to a sell-off of assets, then production would wane and reduce supply on the market.

Actually, that's not necessarily true, says Caruana.

And here is the key part of his lecture (emphasis ours):

More pertinently for the price of oil, there is an impact on production.

Highly leveraged producers may attempt to maintain, or even increase, output levels even as the oil price falls in order to remain liquid and to meet interest payments and tighter credit conditions.

Second, firms with high debt levels face stronger imperatives to hedge their exposure to highly volatile revenues by selling futures or buying put options in derivatives markets, so as to avoid corporate distress or insolvency if the oil price falls further.

While highly-indebted oil producers may end up hurting from low prices which should incentivize a cut in production, their hands are tied and they must keep producing to make debt repayments.

So, it may take prices longer to recover to normal levels.

NOW WATCH: How Peyton Manning makes and spends his money

See Also:

This man's morning starts at 3 a.m. but he doesn't go to bed early — here's how he does it

BANK OF ENGLAND: The oil price plunge is 'net good' for the UK economy

SEE ALSO: This chart shows how Saudi Arabia is willing to kill off its stocks by keeping oil prices low

Yahoo Finance

Yahoo Finance