Oil & Gas US E&P Outlook: Bearish Signals Abound

The Zacks Oil and Gas - US E&P industry consists of companies based in the United States focused on exploration and production (E&P) of oil and natural gas. These firms are engaged in finding hydrocarbon reservoirs, drilling oil and gas wells, and producing and selling these materials to be refined later into products such as gasoline.

Some of the prominent stocks in this industry are Apache Corporation (APA), Devon Energy Corporation (DVN), EOG Resources Inc. (EOG), Noble Energy Inc. (NBL), Concho Resources Inc. (CXO) and Cimarex Energy Co. (XEC).

Let’s take a look at the industry’s three major themes:

There is increasing evidence that a fundamental change is occurring in the oil market. WTI crude, the U.S. benchmark, popped above $76 a barrel and was trading at multiyear highs in early October last year. A looming shortage of the commodity on Iran sanctions helped in driving oil prices higher. Now, in a reversal, oil is facing a two-pronged attack: rising domestic supply and fears of a global economic slowdown against the backdrop of the U.S.-China trade war. This, by extension, translates into a bearish demand growth outlook. Currently trading at around $56 a barrel, crude is down approximately 15% from its 2019 peak back in April. While the future direction of crude's movement is anybody's guess, it might be prudent for investors to maintain caution in these uncertain times — either withdraw for a while or look for fundamentally sound stocks.

Meanwhile, bearishness continues to grip the natural gas market. Prices recently fell to levels not seen in more than three years, reflecting a steady, albeit slow, descent. Market participants are worried that even a spike in heating demand might not be enough to stop the commodity's collapse below the psychologically important $2 per MMBtu level shortly. Agreed, the fundamentals of natural gas consumption continue to be favorable on growing demand by electrical utilities, booming exports to Mexico, large-scale liquefied gas export facilities and higher usage from industrial projects. However, record-high production in the United States and expectations for healthy growth through 2020 means that supply will keep pace with demand. Therefore, natural gas prices are likely to trade sideways but for weather-driven movements. In other words, any powerful turnaround looks unlikely at the moment.

Over the past few years, energy producers worked tirelessly to cut costs to a bare minimum and look for innovative ways to churn out more oil and gas. And they managed to do just that by improving drilling techniques and extracting favorable terms from the beleaguered service producers. Moreover, driven by operational efficiencies, most E&P operators have been able to reduce unit costs and live within their cash flows. All of these factors, together with production growth and capital discipline have resulted in healthy free cash flows. With cash generation expected to remain robust even at relatively low oil prices, there is strong potential for greater return of capital to shareholders through dividend growth and stock buybacks.

Zacks Industry Rank Indicates Bleak Outlook

The Zacks Oil and Gas - US E&P is a 72-stock group within the broader Zacks Oil - Energy sector. The industry currently carries a Zacks Industry Rank #200, which places it in the bottom 22% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates dim near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s position in the bottom 50% of the Zacks-ranked industries is a result of negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are pessimistic on this group’s earnings growth potential. While the industry’s earnings estimates for 2019 have decreased 55% in the past year, the same for 2020 have slumped 49.4% over the same period.

Despite the bleak near-term prospects of the industry, we will present a few stocks that you may want to consider for your portfolio. But it’s worth taking a look at the industry’s shareholder returns and current valuation first.

Industry Lags Sector & S&P 500

The Zacks Oil and Gas - US E&P industry has lagged the broader Zacks Oil - Energy Sector as well as the Zacks S&P 500 composite over the past year.

The industry has declined 48.4% over this period compared to the S&P 500’s marginal gain of 0.9% and broader sector’s decrease of 21.5%.

One-Year Price Performance

Industry’s Current Valuation

Since oil and gas companies are debt-laden, it makes sense to value them based on the EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization) ratio. This is because the valuation metric takes into account not just equity but also the level of debt. For capital-intensive companies, EV/EBITDA is a better valuation metric because it is not influenced by changing capital structures and ignores the effect of noncash expenses.

On the basis of the trailing 12-month enterprise value-to EBITDA (EV/EBITDA) ratio, the industry is currently trading at 6.35X, lower than the S&P 500’s 10.89X. It is, however, well above the sector’s trailing-12-month EV/EBITDA of 4.62X.

Over the past five years, the industry has traded as high as 17.08X, as low as 4.75X, with a median of 7.86X.

Trailing 12-Month Enterprise Value-to EBITDA (EV/EBITDA) Ratio

Bottom Line

Despite OPEC's continued production cut pledge, the bearish price action indicates speculators are betting on weak demand. Indeed, the closely watched monthly reports from three key agencies (EIA, OPEC and the IEA) raised concerns about demand, primarily citing a slowing economic backdrop amid the U.S.-China trade spat. Even heightened geopolitical tensions in the Middle East has done little to prop up prices.

However, certain industry observers believe that the current selloff is too severe and expect prices to recover gradually. The drawdown in inventories in recent months indicates that the market is tighter than everyone thinks. Moreover, greater financial discipline practiced by the energy companies have raised expectations that supply growth could slow down sooner than later.

Natural gas futures, meanwhile, are likely to remain sedate on surging supplies.

Despite the downbeat mood in the industry, we are presenting a stock with a Zacks Rank #2 (Buy) that is well positioned to gain amid the prevailing challenges. There are also three stocks with a Zacks Rank #3 (Hold) that investors may currently retain in their portfolio.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Montage Resources Corporation (MR): Montage Resources is an Appalachian Basin-focused oil and gas explorer. Over 30 days, the Irving, TX-headquartered company – carrying a Zacks Rank #2 – has seen the Zacks Consensus Estimate for 2019 surge 25.7%.

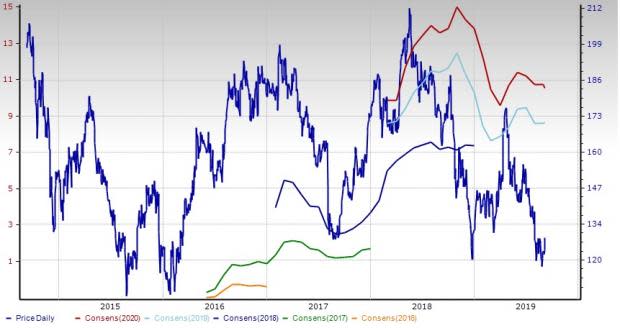

Price and Consensus: MR

Diamondback Energy, Inc. (FANG): This Midland, TX-based upstream operator has key operations in the Delaware and Midland regions of the Permian Basin. Diamondback Energy carries a Zacks Rank #3 and has an attractive expected earnings growth of 22.8% for this year.

Price and Consensus: FANG

Pioneer Natural Resources Company (PXD): Pioneer Natural Resources, another premier Permian producer, carries a Zacks Rank #3 and has an attractive expected earnings growth of 33.1% for this year.

Price and Consensus: PXD

Cabot Oil & Gas Corporation (COG): Cabot is an independent gas explorer with producing properties mainly in the continental U.S. The Houston, TX-based company carries a Zacks Rank #3 and has an attractive expected earnings growth of 48.7% for this year.

Price and Consensus: COG

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cimarex Energy Co (XEC) : Free Stock Analysis Report

Pioneer Natural Resources Company (PXD) : Free Stock Analysis Report

Noble Energy Inc. (NBL) : Free Stock Analysis Report

Eclipse Resources Corporation (MR) : Free Stock Analysis Report

Diamondback Energy, Inc. (FANG) : Free Stock Analysis Report

EOG Resources, Inc. (EOG) : Free Stock Analysis Report

Devon Energy Corporation (DVN) : Free Stock Analysis Report

Concho Resources Inc. (CXO) : Free Stock Analysis Report

Cabot Oil & Gas Corporation (COG) : Free Stock Analysis Report

Apache Corporation (APA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance