Oil & Gas Stocks' Q2 Earnings Due on Aug 2: CVX, XOM & IMO

The second-quarter earnings season appears to be lackluster for oil and gas stocks, owing to softness in commodity prices. Notably, the slowdown of global economy, fueled by intensifying trade tensions between Washington and Beijing, significantly hurt energy demand.

Second-Quarter Commodity Pricing Scenario

The second-quarter pricing scenario of West Texas Intermediate crude (WTI) was weaker than the year-ago period. Notably, in April, May and June, WTI averaged $63.86, $60.83 and $54.66 per barrel, respectively, per the U.S. Energy Information Administration. In comparison, WTI averaged $66.25, $69.98 and $67.87 per barrel in the year-ago respective months of 2018. Also, natural gas prices in the to-be-reported quarter were weaker than the year-ago period. This is because the tariff war between the two big economies of the world, the United States and China, hurt clean energy demand.

How’s the Pricing Environment Affecting Companies?

This year-over-year decline in commodity prices is primarily discouraging for upstream companies, as it will reduce their profit levels. Energy infrastructure providers — who usually have long-term contracts with exploration and production companies — are not expected to be affected by short-term fluctuations in commodity prices. However, given surging hydrocarbon output (powered by North American shale boom) and the lack of transportation facilities, pipeline companies have missed out on a bunch of stable fee-based revenue-providing contract signing opportunities.

Refineries and downstream companies, nevertheless, are expected to reap short-term benefits from lower prices. Lower commodity prices usually mean low cost of production for these companies. As such, downstream companies are expected to earn more profits in the June quarter.

Picture Thus Far

The latest Earnings Outlook shows that the Oil/Energy sector’s profit is expected to fall 36.2% year over year in second-quarter 2019, following a 22.4% decline in the first quarter. The Energy sector is thus poised to see two consecutive quarters of earnings deterioration, after strong earnings growth in each of the four quarters of 2018.

Among the major energy players that have already reported results are Schlumberger SLB, Kinder Morgan, Inc. KMI and ConocoPhillips COP.

Oilfield service behemoth Schlumberger reported second-quarter 2019 earnings of 35 cents per share, in line with the Zacks Consensus Estimate, aided by robust international activities.

ConocoPhillips — an upstream major — reported second-quarter 2019 adjusted earnings per share of $1.01, missing the Zacks Consensus Estimate of $1.04 due to lower realized commodity prices.

Midstream energy player, Kinder Morgan posted second-quarter 2019 adjusted earnings of 22 cents per share, missing the Zacks Consensus Estimate by a penny. However, the bottom line improved from the year-ago quarter’s 21 cents. The lower-than-expected results were owing to reduced contribution from the KM Crude & Condensate Pipeline, along with lower terminal volumes. This was partially offset by higher earnings from the company’s natural gas pipelines.

Energy Stocks Reporting on Aug 2

Let us take a look at how the following three energy players are placed ahead of their second-quarter earnings release tomorrow.

Chevron Corporation CVX is scheduled to release quarterly results before the opening bell.

Our research shows that for companies with the combination of a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP, the chances of beating earnings estimates are high. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Meanwhile, we caution against stocks with a Zacks Rank #4 and 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

In the last reported quarter, the integrated oil and gas company beat the consensus mark for earnings by 10.32% on the back of output gains. However, the bottom line fell from the year-ago quarter amid lower year-over-year oil prices. As far as earnings surprises are concerned, the San Ramon, CA-based U.S. energy major surpassed the Zacks Consensus Estimate thrice in the last four quarters, with average positive surprise of 2.33%.

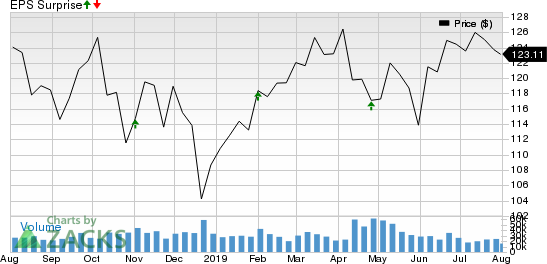

Chevron Corporation Price and EPS Surprise

Chevron Corporation price-eps-surprise | Chevron Corporation Quote

Chevron is unlikely to deliver a positive surprise in second-quarter 2019 as it does not have the favorable combination of the key ingredients. The company has an Earnings ESP of 0.00% and a Zacks Rank #3.

The Zacks Consensus Estimate for second-quarter earnings is pegged at $1.74 on revenues of $41.7 billion. Both bottom- and top-line expectations indicate a deterioration from the year-ago figures of $1.78 a share and $42.2 billion, respectively. Although the company’s upcoming results are set to benefit from increasing output from top-tier assets in Permian and Gulf of Mexico, as well as the Wheatstone LNG plant in Australia, we remain concerned about oil and gas prices that declined amid rising fuel inventories, slowdown of global economy and trade tensions.

Exxon Mobil Corporation XOM is set to release quarterly results before the opening bell. The company’s earnings surpassed the Zacks Consensus Estimate in two of the last four quarters, delivering an average positive surprise of 2.5%.

Exxon Mobil Corporation Price and EPS Surprise

Exxon Mobil Corporation price-eps-surprise | Exxon Mobil Corporation Quote

Our proven model does not conclusively predict an earnings beat for the company in the quarter to be reported, as it has an Earnings ESP of 0.00% and a Zacks Rank #5.

The Zacks Consensus Estimate for second-quarter earnings of 68 cents has been revised downward in the past 30 days. The projected figure suggests a decline of 26.1% from the year-ago reported figure. The consensus estimate for revenues is pegged at $65.8 billion, indicating a drop of 10.5% from the prior-year quarter. Overall lower commodity prices and natural gas demand in Europe are expected to affect the company’s upcoming results.

The Zacks Consensus Estimate for the company’s daily refinery throughput is pegged at 3,973 thousand barrels, which indicates a fall from the year-ago reported figure of 4,105 thousand barrels. Importantly, ExxonMobil is expecting heavy turnaround activities to hurt the chemical businesses.

Imperial Oil Limited IMO is set to release quarterly results before the opening bell. This subsidiary of ExxonMobil is one of the largest integrated oil companies of Canada, mainly engaged in oil and gas production, petroleum products refining and marketing, and chemical business. It reported first-quarter 2019 earnings per share of 29 cents, missing the Zacks Consensus Estimate of 38 cents. The underperformance can be attributed to weaker contribution from the downstream segment. As far as earnings surprises are concerned, the company missed the Zacks Consensus Estimate twice in the last four quarters, with average negative surprise of 11.9%.

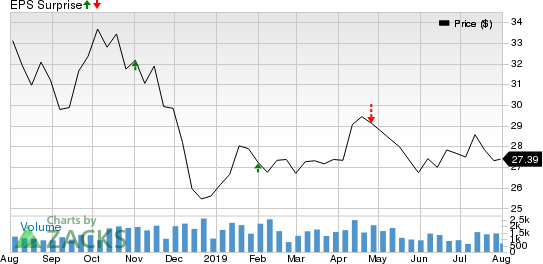

Imperial Oil Limited Price and EPS Surprise

Imperial Oil Limited price-eps-surprise | Imperial Oil Limited Quote

Our proven model does not conclusively show that it is likely to deliver a positive surprise in second-quarter 2019 as it has an Earnings ESP of 0.00% and a Zacks Rank #4.

The Zacks Consensus Estimate for second-quarter earnings of 60 cents has been revised downward in the past 30 days. The projected figure, however, suggests an increase from the year-ago reported figure of 19 cents. Notably, its earnings are likely to be boosted by downstream activities. The consensus estimate for revenues is pegged at $6.7 billion, indicating a drop of 10% from the prior-year quarter due to lower realized commodity prices.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Imperial Oil Limited (IMO) : Free Stock Analysis Report

Schlumberger Limited (SLB) : Free Stock Analysis Report

Chevron Corporation (CVX) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Kinder Morgan, Inc. (KMI) : Free Stock Analysis Report

ConocoPhillips (COP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance