Occidental (OXY) Q1 Loss Wider Than Expected, Revenues Top

Occidental Petroleum Corporation OXY reported first-quarter 2020 loss of 52 cents per share, wider than the Zacks Consensus Estimate of a loss of 50 cents. The company had recorded earnings of 84 cents per share in the prior-year quarter.

Total Revenues

Occidental's total revenues were $6,451 million, beating the Zacks Consensus Estimate of $5,224 million by 23.5%. The top line also increased 57.8% from $4,089 million in the year-ago quarter. The year-over-year improvement was driven by higher oil and gas revenues.

Production & Sales

Occidental’s total production volume in the first quarter was 1,416 thousand barrels of oil equivalent per day (Mboe/d), which came ahead of the guided range of 1,375-1,395 Mboe/d. The strong production volumes were attributed to higher volumes from the Permian Resources region. Permian Resources production in the first quarter was 474 Mboe/d, which exceeded the midpoint of the guided range by 13 Mboe/d.

In the quarter under review, total sales volume was 1,417 Mboe/d compared with 713 Mboe/d recorded in the year-ago period.

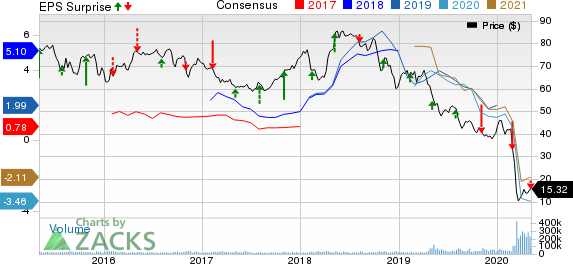

Occidental Petroleum Corporation Price, Consensus and EPS Surprise

Occidental Petroleum Corporation price-consensus-eps-surprise-chart | Occidental Petroleum Corporation Quote

Weak Realized Prices

Realized prices for crude oil in the first quarter decreased 10.5% year over year to $47.08 per barrel on a worldwide basis. Worldwide realized NGL prices decreased 29.3% from the prior-year quarter to $12.82 per barrel. Worldwide natural gas prices were also down 14.8% from the year-ago quarter to $1.32 per thousand cubic feet.

Highlights of the Release

Occidental, similar to other oil and gas companies, was adversely impacted by a steep decline in oil prices and significant drop in demand. Crude oil hedges provided some support to the company amid the falling commodity prices.

Selling, general and administrative expenses in the first quarter were $260 million, up 85.7% from $140 million in the year-ago period.

Interest expenses in the reported quarter were $352 million compared with $98 million in the year-ago period. The higher interest expenses were due to an increase in debt levels to fund the acquisition of Anadarko.

Financial Position

As of Mar 31, 2020, Occidental had cash and cash equivalents of $2,021 million compared with $3,032 million in the corresponding period of 2019.

As of Mar 31, 2020, the company had a long-term debt (net of current portion) of $36,058 million compared with $38,537 million on Dec 31, 2019. The increase in debt level was due to the loan taken by the company to fund the acquisition of Anadarko. It has been taking steps to lower debt level. The company lowered long-term debt by $2.5 billion in the first quarter.

In first-quarter 2020, cash from operations was $1,414 million, down from $1,832 million in the prior-year period.

In first-quarter 2019, Occidental’s total capital expenditure was $1,293 million, up 2.7% from $1,259 million invested in the year-ago period.

Guidance

To preserve liquidity amid the unprecedented economic crisis as a result of the novel coronavirus pandemic, Occidental decided to lower 2020 capital expenditure by more than 50% to the range of $2.4-$2.6 billion.

The company continues to carry out cost-saving initiatives, and identified $1.2 billion in operating and overhead cost reductions to be realized in 2020.

Occidental decided to withdraw its 2020 guidance on account of the market disruption caused by the spread of the novel coronavirus.

Zacks Rank

Currently, Occidental carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Releases

Devon Energy Corp. DVN reported first-quarter 2020 adjusted earnings per share of 13 cents against the Zacks Consensus Estimate of a loss of 18 cents.

National Fuel Gas Company NFG posted second-quarter fiscal 2020 operating earnings of 97 cents per share, on par with the Zacks Consensus Estimate.

TOTAL TOT reported first-quarter 2020 adjusted earnings per share of 66 cents, which beat the Zacks Consensus Estimate of 55 cents by 20%.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TOTAL SA (TOT) : Free Stock Analysis Report

Devon Energy Corporation (DVN) : Free Stock Analysis Report

Occidental Petroleum Corporation (OXY) : Free Stock Analysis Report

National Fuel Gas Company (NFG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance