A. O. Smith (AOS) Q3 Earnings Meet, Decline Y/Y on Lower Sales

A. O. Smith Corporation’s AOS third-quarter 2022 adjusted earnings (excluding 2 cents from non-recurring items) of 69 cents per share were in line with the Zacks Consensus Estimate. The bottom line declined in double digits year over year.

Net sales of $874.2 million marginally outperformed the Zacks Consensus Estimate of $874.1 million. The top line dipped 4.4% year over year due to residential water heater de-stocking activity.

Segmental Details

A. O. Smith’s quarterly sales in North America (comprising the United States and Canada water heaters and boilers) were flat year over year at $652.9 million. Weak residential water heater demand hurt performance. Strong demand for commercial gas water heater and boiler products aided performance. The Giant Factories acquisition added $25 million to North American sales in the quarter.

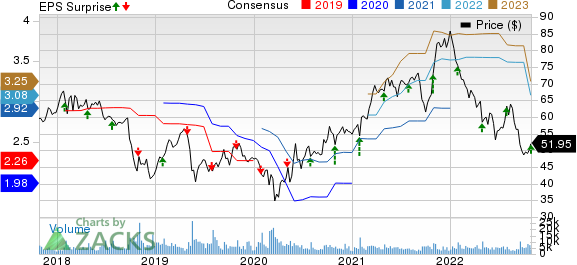

A. O. Smith Corporation Price, Consensus and EPS Surprise

A. O. Smith Corporation price-consensus-eps-surprise-chart | A. O. Smith Corporation Quote

Adjusted segment earnings decreased 11% year over year to $132.9 million. The downside was due to lower residential water heater volumes and high raw material costs.

Quarterly sales in the Rest of the World (including China, India and Europe) decreased 13% year over year to $230.2 million. The decline in sales was primarily due to lower consumer demand in China, thanks to COVID-19-related lockdowns. However, strong demand for water heaters and water treatment products in India boosted sales by 16%.

The segment’s earnings were $21.8 million, down 19% year over year. The downside was due to lower volumes in China as a result of lockdowns.

Margin Details

In the reported quarter, A.O. Smith’s cost of sales was $569.2 million, down approximately 1% year over year. Selling, general & administrative expenses were $155.5 million, down 12.4%.

Gross profit decreased 10.4% year over year to $305 million with a margin of 34.9%, down 2.3 percentage points. Interest expenses surged more than 100% to $2.4 million.

Liquidity & Cash Flow

As of Sep 30, 2022, A.O. Smith’s cash and cash equivalents totaled $358.8 million compared with $443.3 million at the end of December 2021.

At the end of the reported quarter, long-term debt was $281 million compared with $189.9 million at December 2021-end.

In the first nine months of 2022, cash provided by operating activities totaled $214.7 million compared with $376.8 million in the year-ago period.

Share Repurchases

In the first nine months of 2022, A.O. Smith repurchased shares worth $282 million, up 33% year over year. In 2022, the company expects to repurchase shares worth $400 million. In the first nine months of 2022, AOS paid dividends worth $131.1 million, up 4.5% year over year.

2022 Outlook Reiterated

A.O. Smith maintained its recently revised earnings and sales forecast for 2022. The company continues to expect sales in the band of $3,715-$3,785 million for 2022. The mid-point of the guided range — $3,750 million — is in line with the Zacks Consensus Estimate.

The company expects earnings of $1.29-$1.39 for 2022. Adjusted earnings are estimated to be $3.05-$3.15 for 2022. The mid-point of the guided range — $3.10 — lies above the Zacks Consensus Estimate of $3.08.

Zacks Rank & Key Picks

A.O. Smith currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks within the broader Industrial Products sector are as follows:

Enerpac Tool Group Corp. EPAC presently sports a Zacks Rank #1 (Strong Buy). The company delivered a four-quarter earnings surprise of 3.4%, on average. You can see the complete list of today’s Zacks #1 Rank stocks.

Enerpac Tool has an estimated earnings growth rate of 44.6% for the current fiscal year. The company’s shares gained 25.5% in the past six months.

iRobot Corporation IRBT presently has a Zacks Rank of 2 (Buy). IRBT’s earnings surprise in the last four quarters was 59.1%, on average.

iRobot has an estimated earnings growth rate of 36.6% for the current year. The stock has rallied 11.4% in the past six months.

Titan International, Inc. TWI presently carries a Zacks Rank of 2. Its earnings surprise in the last four quarters was 47%, on average.

Titan International has an estimated earnings growth rate of 157.7% for the current year. The stock has jumped 2.6% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Titan International, Inc. (TWI) : Free Stock Analysis Report

iRobot Corporation (IRBT) : Free Stock Analysis Report

Enerpac Tool Group Corp. (EPAC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance