NWQ Managers Cuts Landec Corp Amidst Small Recovery

NWQ Managers (Trades, Portfolio) revealed a reduction in its holding of Landec Corp. (NASDAQ:LNDC) by 53.69% according to GuruFocus' Real-Time Picks.

NWQ is a value-oriented money management firm with several fund products and more than $54 billion under management. The firm does bottom-up research on companies and industries focusing on qualitative factors such as restructuring, management strength, shareholder orientation and the ability to capitalize on improving industry fundamentals. In addition, a broad range of quantitative valuation screens are applied. They focus on three factors: attractive valuation, downside protection and identifying catalysts and inflection points.

The firm has been reducing its holding of Landec since the second quarter of 2019. On June 30, the firm sold 1.03 million shares of the company for an overall impact of 0.33% on their portfolio. The shares were sold at an average price of $7.96 and GuruFocus estimates the firm has seen a total estimated loss on the holding of 22.56%.

Portfolio overview

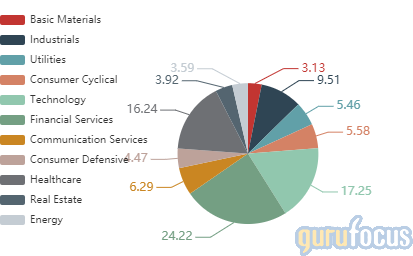

At the end of the first quarter, NWQ's portfolio contained 154 stocks, of which 26 were new holdings. By weight, the portfolio is most invested in the financial services (24.22%), technology (17.25%) and health care (16.24%) sectors.

New holdings at the end of the first quarter included Comcast Corp. (NASDAQ:CMCSA), Walmart Inc. (NYSE:WMT) and Walgreens Boots Alliance Inc. (NASDAQ:WBA).

Landec

Landec designs, develops, manufactures and sells differentiated health and wellness products for food and biomaterials markets, and licenses technology applications to partners. It has two proprietary polymer technology platforms,iIntelimer polymers and hyaluronan biopolymers. The company also sells specialty packaged branded Eat Smart and GreenLine and private label fresh-cut vegetables and whole produce to retailers, club stores and foodservice operators.

On July 13, the stock was trading at $8.24 per share with a market cap of $238.72 million. According to the Peter Lynch chart, the stock was trading well above its intrinsic value and was overvalued by the middle of 2019.

GuruFocus gives the company a financial strength rating of 3 out of 10, a profitability rank of 5 out of 10 and a valuation rank of 8 out of 10. The current cash-to-debt ratio of 0.01 places the company lower than 96.26% of the consumer packaged goods industry. Negative operating and net margin percentages contribute to the average profitability rank. The company shows price-book and price-sales ratios that are higher than the majority of their competitors.

Top guru shareholders include Wynnefield Capital Inc. (Trades, Portfolio), Legion Partners Asset Management LLC (Trades, Portfolio), Russell Investments Group Ltd. (Trades, Portfolio), Dimensional Fund Advisors LP (Trades, Portfolio) and BlackRock Inc. (Trades, Portfolio).

Disclaimer: Author owns no stocks mentioned.

Read more here:

Dodge & Cox Boosts Stake in TE Connectivity

Detroit's Big 3 Automakers Fall Flat With Low Sales

California Law Set to Boost Tesla and Nikola

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance