Nutanix (NTNX) to Post Q3 Earnings: What Lies in Store?

Nutanix NTNX is scheduled to release third-quarter fiscal 2020 results on May 27.

The company anticipates third-quarter fiscal 2020 revenue growth of 8-10% year over year to $312-$317 million. The Zacks Consensus Estimate for revenues in the fiscal third quarter stands at $314.52 million, indicating 9.35% year-over-year growth.

Nutanix estimates non-GAAP loss of 89 cents per share for the quarter. The Zacks Consensus Estimate for loss is pegged at 86 cents per share, indicating a 53.57% year-over-year decline.

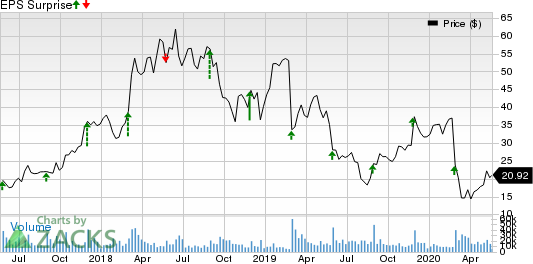

Its earnings beat estimates in the trailing four quarters, the average positive surprise being 9%.

Nutanix Inc. Price and EPS Surprise

Nutanix Inc. price-eps-surprise | Nutanix Inc. Quote

Factors at Play

Nutanix continues to witness a strong adoption of its products. This trend is likely to have aided its to-be-reported quarter’s performance. An increasing AHV (Acropolis Hypervisor Virtualization) adoption rate is expected to have boosted the top line.

The rise in the work-from-home trend, driven by the social distancing norms related to the coronavirus pandemic, is leading to increased demand for virtual desktop infrastructure (VDI) and Daas solutions. This is likely to have been a positive for Nutanix in the quarter under review.

In its preliminary third-quarter fiscal 2020 results, the company noted that it is continuing to witness steady demand for its hybrid cloud solutions. This has helped mitigate the negative impact of the pandemic on its business in the third quarter to some extent.

Moreover, the company’s business continuity program, FastTrack, is helping channel partners and global system integrators adapt to the changing demand patterns and the remote working environment in the wake of the pandemic. This is likely to have helped Nutanix gain more buyers for its solutions in the quarter-to-be-reported.

Besides, Nutanix is managing expenses with various cost-reduction methods. This is expected to have been a tailwind to margins.

However, the company narrowed its revenue and total contract value (TCV) guidance range in its preliminary results to account for the impacts of the pandemic and its ongoing transition from hardware sales to a subscription-based business model. Thus, the company updated its third-quarter fiscal 2020 revenue guidance range to $312-$317 million from $300-$320 million guided earlier.

Moreover, TCV revenues are expected between $307 million and $312 million compared with the earlier guidance of $300-$320 million. Also, TCV billings guidance was updated from a range of $365-$385 million to $371-$376 million. These give us an idea about the challenges faced by the company in the fiscal third quarter.

What Our Model Says

The proven Zacks model predicts an earnings beat for Nutanix this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Nutanix has an Earnings ESP of +1.68% and a Zacks Rank #1.

Other Stocks to Consider

Here are a few other stocks you may consider, as our model shows that these too have the right combination of elements to beat on earnings this season:

Adamas Pharmaceuticals Inc. ADMS has an Earnings ESP of +4.86% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

NVIDIA Corporation NVDA has an Earnings ESP of +0.15% and a Zacks Rank of 2.

Palo Alto Networks, Inc. PANW has an Earnings ESP of +4.13% and a Zacks Rank #3.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

Adamas Pharmaceuticals, Inc. (ADMS) : Free Stock Analysis Report

Nutanix Inc. (NTNX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance