NuStar (NS) Q1 Earnings Miss, Distribution Coverage Soars

Oil pipeline operator NuStar Energy L.P. NS reported first-quarter adjusted earnings per unit of 39 cents, below the Zacks Consensus Estimate of 46 cents. The partnership’s bottom line was unfavorably impacted by a non-cash impairment of $225 million. However, NuStar’s earnings compared favorably with the year-ago loss of 6 cents on the back of increased Permian Basin volumes.

Meanwhile, NuStar Energy reported revenues of $392.8 million that missed the Zacks Consensus Estimate of $400 million but rose 12.9% year over year.

NuStar recorded an operating loss of $93.1 million compared to a profit of $73.6 million in the last year’s corresponding quarter. This downside could be attributed to non-cash impairment losses of $225 million associated with its Pipeline unit, which drove costs and expenses 77.2% higher to $485.9 million.

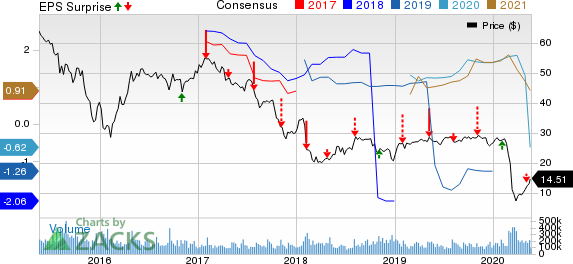

NuStar Energy L.P. Price, Consensus and EPS Surprise

NuStar Energy L.P. price-consensus-eps-surprise-chart | NuStar Energy L.P. Quote

Segmental Performance

Pipeline: Total quarterly throughput volumes were 2,126,478 barrels per day (Bbl/d), up 39.7% from the year-ago period. Throughput volumes from crude oil pipelines jumped 50.4% from the year-ago quarter to 1,532,046 Bbl/d while throughput from refined product pipelines witnessed an increase to 594,432 Bbl/d from 503,485 Bbl/d. In particular, volume ramp up at NuStar’s Permian crude system lrd to the big bump in pipeline throughputs. As a result, the segment’s revenues rose 25.2% year over year to $195.7 million. However, a $225 million impairment charge meant that the partnership’s Pipeline unit reported an operating loss of $122.9 million compared to operating income of $67.3 million in the year-ago period.

Storage: Throughput volumes soared to 678,830 Bbl/d from 364,854 Bbl/d in the prior-year quarter. The unit’s quarterly revenues increased to $123.2 million from $103.5 a year ago owing to surging throughput terminal revenues (from $21.7 million to $38.7 million). NuStar’s Storage segment benefited from a full quarter's contribution from the new Taft 30-inch pipeline and other expansion projects. Consequently, the segment’s operating income came in at $48.6 million compared with $32.2 million in the corresponding quarter of 2019.

Fuels Marketing: Product sales decreased to $73.9 million from $88.1 million in the year-ago quarter. On a positive note, cost of goods dropped 21.7% from the prior-year period to $67 million. Moreover, NuStar delivered strong margins from its bunkering business and robust performance from its butane blending and transmix operations. The segment recorded earnings of $6.4 million in the quarter under review compared with $1.9 million in first-quarter 2019.

Cash Flow, Debt and Guidance

First-quarter 2020 distributable cash flow available to limited partners was $122.3 million (providing 2.80x distribution coverage), significantly higher than $67.4 million (1.04x) in the year-ago period. A coverage ratio far in excess of 1 implies that the partnership is generating more than enough cash in the period to cover its distribution.

As of Mar 31, the partnership’s total consolidated debt was $3.4 billion.

Taking into account the impact of the historic oil market crash and the coronavirus-induced demand destruction for the fuel, NuStar now anticipates 2020 adjusted EBITDA in the band of $665-735 million, around 6% lower at the midpoint of its previous guidance. The partnership also announced a cut to its 2020 capital spending plan by 45% from its prior projection, to a range of $165 to $195 million. NuStar expects distribution coverage ratio for the year to come in between 1.6x to 1.8x.

Zacks Rank & Kay Picks

NuStar Energy has a Zacks Rank #4 (Sell).

Among other players in the energy sector that already reported first-quarter earnings, the bottom-line results of Cheniere Energy Inc. LNG, Murphy USA Inc. MUSA and Williams Companies Inc. WMB beat the respective Zacks Consensus Estimate by 204.3%, 4.3% and 4%. While Cheniere Energy and Williams Companies carry a Zacks Rank #2, Murphy sports a Zacks Rank #1 (Strong Buy).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NuStar Energy L.P. (NS) : Free Stock Analysis Report

Williams Companies, Inc. The (WMB) : Free Stock Analysis Report

Cheniere Energy, Inc. (LNG) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance