Nucor's (NUE) Earnings, Sales Surpass Estimates in Q4

Nucor Corporation’s NUE profits declined year over year in fourth-quarter 2019. The steel giant logged net earnings of $107.8 million or 35 cents per share, down from $646.8 million or $2.07 in the year-ago quarter.

Barring one-time items, earnings per share came in at 52 cents, which topped the Zacks Consensus Estimate of 34 cents.

Nucor recorded net sales of $5,131.7 million, down 18.5% year over year. The figure beat the Zacks Consensus Estimate of $5,012.4 million.

2019 Results

For 2019, net earnings were $1.3 billion or $4.14 per share, down from $2.4 billion or $7.42 per share recorded in 2018.

Net sales for the year went down 9.9% year over year to $22.6 billion.

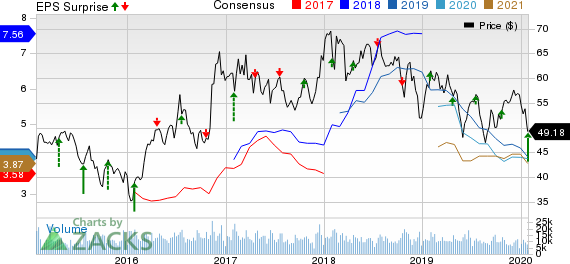

Nucor Corporation Price, Consensus and EPS Surprise

Nucor Corporation price-consensus-eps-surprise-chart | Nucor Corporation Quote

Operating Figures

Total steel mills shipments in the fourth quarter were 5,779,000 tons, down 2% year over year. Total tons shipped to outside customers were down 3% year over year to 6,486,000 tons. Average sales price declined 16% year over year.

Steel mill operating rates remained were 83% in the fourth quarter compared with 88% a year ago.

Segment Highlights

Profitability in the steel mills segment fell sequentially in the fourth quarter due to lower steel prices witnessed at the end of the third quarter. Also, the domestic scrap metal prices surged during the fourth quarter. As such, the company’s plate, sheet, structural and bar mills have implemented price hikes.

The performance of steel products unit fell modestly in the fourth quarter compared with third-quarter levels. This was mainly due to normal year-end seasonality.

Performance in the raw materials division was affected by the Louisiana DRI plant's planned outage. Losses in the segment widened considerably in the fourth quarter compared with third-quarter levels. Notably, the planned outage was completed in mid-November.

Financial Position

Nucor ended 2019 with cash and cash equivalents of around $1.5 billion, up 9.7% year over year. Long-term debt was $4,291.3 million, up 1.4% year over year.

Net cash generated from operating activities rose 17.4% year over year to $2.8 billion.

The company repurchased around 1.9 million shares of its common stock during the fourth quarter and roughly 5.3 million shares in 2019. As of Dec 31, 2019, the company had around 301,812,000 shares outstanding and roughly $1.20 billion remaining for repurchases under its authorized share repurchase program.

Outlook

Nucor expects earnings to increase sequentially in first-quarter 2020.

Profitability in the steel mills unit is expected to increase sequentially in the first quarter. This is expected to be driven by price increases and expected rise in volumes. Notably, the company expects a more stable pricing environment in 2020 after the severe inventory destocking, which occurred in 2019.

Earnings of steel products unit are expected to decline sequentially in the first quarter due to normal seasonality.

The company expects performance of the raw materials unit to improve sequentially in the first quarter. This is expected to be driven by an improvement in pricing for raw materials. Also, the absence of the impairment charge associated with its natural gas well assets and no planned non-routine outages at the Louisiana DRI plant are forecast to support performance.

Price Performance

Shares of Nucor have lost 15.9% in the past year compared with the industry’s 16.8% decline.

Zacks Rank & Key Picks

Nucor currently carries a Zacks Rank #4 (Sell).

Few better-ranked stocks in the basic materials space are Daqo New Energy Corp. DQ, Royal Gold, Inc. RGLD and BHP Group BHP, each currently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Daqo New Energy has projected earnings growth rate of 326.3% for 2020. The company’s shares have rallied 45.2% in the past year.

Royal Gold has an estimated earnings growth rate of 83.5% for fiscal 2020. Its shares have returned 37.5% in the past year.

BHP has an expected earnings growth rate of 10.9% for fiscal 2020. The company’s shares gained 9.4% in the past year.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DAQO New Energy Corp. (DQ) : Free Stock Analysis Report

Royal Gold, Inc. (RGLD) : Free Stock Analysis Report

BHP Group Limited (BHP) : Free Stock Analysis Report

Nucor Corporation (NUE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance