Is Now The Time To Put Cipher Pharmaceuticals (TSE:CPH) On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Cipher Pharmaceuticals (TSE:CPH), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Cipher Pharmaceuticals

Cipher Pharmaceuticals's Improving Profits

In the last three years Cipher Pharmaceuticals's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like the last firework on New Year's Eve accelerating into the sky, Cipher Pharmaceuticals's EPS shot from US$0.16 to US$0.30, over the last year. You don't see 86% year-on-year growth like that, very often.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While revenue is looking a bit flat, the good news is EBIT margins improved by 3.2 percentage points to 60%, in the last twelve months. That's a real positive.

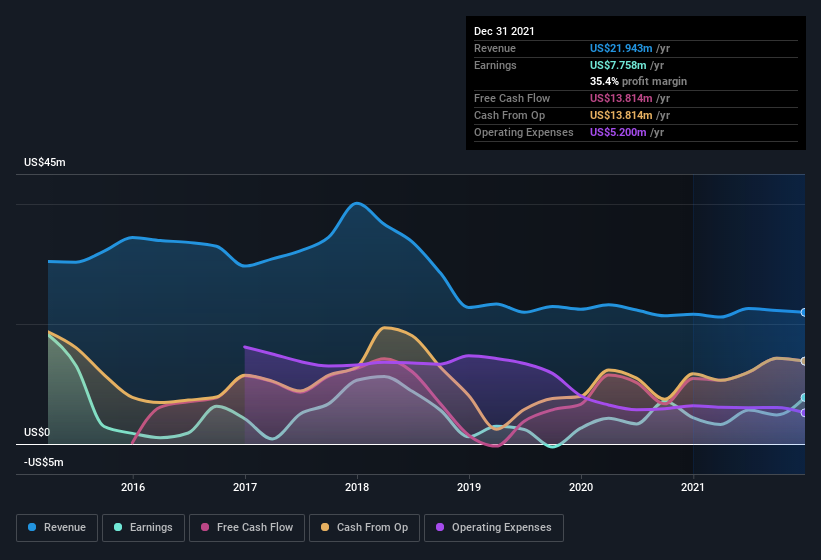

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Cipher Pharmaceuticals's future profits.

Are Cipher Pharmaceuticals Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for Cipher Pharmaceuticals shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that Christian Godin, the Independent Director of the company, paid US$27k for shares at around US$1.19 each.

On top of the insider buying, we can also see that Cipher Pharmaceuticals insiders own a large chunk of the company. In fact, they own 43% of the shares, making insiders a very influential shareholder group. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. With that sort of holding, insiders have about US$27m riding on the stock, at current prices. That's nothing to sneeze at!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Craig Mull is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalizations under US$200m, like Cipher Pharmaceuticals, the median CEO pay is around US$159k.

The CEO of Cipher Pharmaceuticals was paid just US$23k in total compensation for the year ending . You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Is Cipher Pharmaceuticals Worth Keeping An Eye On?

Cipher Pharmaceuticals's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Cipher Pharmaceuticals deserves timely attention. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Cipher Pharmaceuticals that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Cipher Pharmaceuticals, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance