Is Now The Time To Put Anton Oilfield Services Group (HKG:3337) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In contrast to all that, I prefer to spend time on companies like Anton Oilfield Services Group (HKG:3337), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Anton Oilfield Services Group

Anton Oilfield Services Group's Improving Profits

In the last three years Anton Oilfield Services Group's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a firecracker arcing through the night sky, Anton Oilfield Services Group's EPS shot from CN¥0.048 to CN¥0.095, over the last year. Year on year growth of 99% is certainly a sight to behold. That could be a sign that the business has reached a true inflection point.

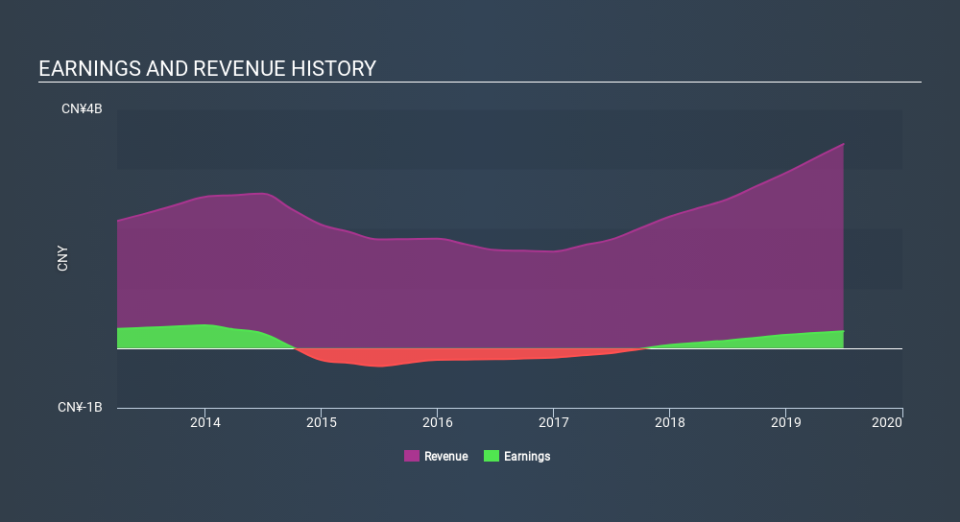

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). On the one hand, Anton Oilfield Services Group's EBIT margins fell over the last year, but on the other hand, revenue grew. So it seems the future my hold further growth, especially if EBIT margins can stabilize.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Anton Oilfield Services Group's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Anton Oilfield Services Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

One shining light for Anton Oilfield Services Group is the serious outlay one insider has made to buy shares, in the last year. In one fell swoop, Founder & Chairman Lin Luo, spent HK$10m, at a price of HK$0.82 per share. It doesn't get much better than that, in terms of large investments from insiders.

On top of the insider buying, it's good to see that Anton Oilfield Services Group insiders have a valuable investment in the business. Given insiders own a small fortune of shares, currently valued at CN¥680m, they have plenty of motivation to push the business to succeed. That holding amounts to 24% of the stock on issue, thus making insiders influential, and aligned, owners of the business.

Is Anton Oilfield Services Group Worth Keeping An Eye On?

Anton Oilfield Services Group's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Anton Oilfield Services Group deserves timely attention. Of course, just because Anton Oilfield Services Group is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

The good news is that Anton Oilfield Services Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance