Norwegian Cruise Line (NCLH) Q2 Earnings Beat, Improve Y/Y

Norwegian Cruise Line Holdings Ltd. NCLH performed very well in the second quarter of 2018, reporting better-than-expected earnings per share and revenues. The company’s earnings (excluding 20 cents from non-recurring items) of $1.21 per share outpaced the Zacks Consensus Estimate of $1.03. The bottom line also increased 18.6% on a year-over-year basis. Higher revenues aided the quarterly results.

Revenues came in at $1,522.2 million, which surpassed the Zacks Consensus Estimate of $1,506.7 million and improved 13.3% on a year-over-year basis. The upside was aided by a 14.8% increase in passenger ticket revenues to $1,077 million. The same from onboard and other sources was up 9.6% on a year-over-year basis to $445.12 million. Gross yield (total revenue per Capacity Day) increased 4.3% in the quarter on a year-over-year basis.

Net yield grew 4% on a constant-currency basis. The measure was up 4.7% on a reported basis. Fuel price per metric ton (net of hedges) increased 2.6% to $481 in the reported quarter. Total cruise operating expenses were up 14.7% to $822.78 million, courtesy of the 8.6% increase in Capacity Days.

Marketing, general and administrative expenses also increased year over year to $226.54 million. Gross Cruise Costs (sum of cruise operating expenses and marketing, general and administrative cost) per Capacity Day increased 6% in the second quarter due to higher expenses on maintenance and repairs among other. The company has repurchased shares worth more than $450 million in the first half of the year. We are impressed by the company's efforts to reward shareholders.

Notably, another cruise line operator — Royal Caribbean Cruises Ltd. RCL — had also reported had also reported better-than-expected second quarter earnings per share in August.

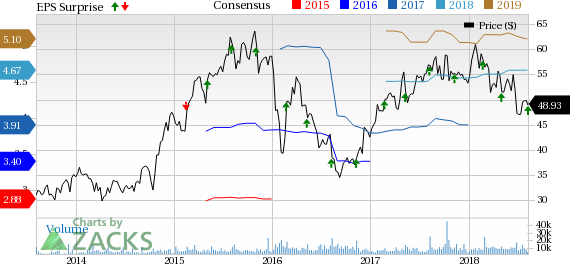

Norwegian Cruise Line Holdings Ltd. Price, Consensus and EPS Surprise

Norwegian Cruise Line Holdings Ltd. Price, Consensus and EPS Surprise | Norwegian Cruise Line Holdings Ltd. Quote

Guidance

Norwegian Cruise Line expects earnings per share (excluding special items) of approximately $2.20 in the third quarter of 2018. The Zacks Consensus Estimate currently stands at $2.28 per share.

For 2018, the company anticipates earnings per share (excluding special items) in the band of $4.70-$4.80 (earlier guidance: $4.55-$4.70). The Zacks Consensus Estimate of 4.67 per share is below the company’s guided range.

Fuel price per metric ton, net of hedges, is projected at $505 for the third-quarter and 2018.

Zacks Rank & Stocks to Consider

Norwegian Cruise Line has a Zacks Rank #3 (Hold).

Better-ranked stocks in the broader Consumer Discretionary sector are Guess?, Inc. GES and SeaWorld Entertainment, Inc. SEAS carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Shares of Guess? and SeaWorld Entertainment have gained 62.6% and 98.3%, respectively, in a year’s time.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Norwegian Cruise Line Holdings Ltd. (NCLH) : Free Stock Analysis Report

SeaWorld Entertainment, Inc. (SEAS) : Free Stock Analysis Report

Guess?, Inc. (GES) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance