Northern (NOG) Stock Rises 2.6% After Q3 Earnings & Sales Beat

Northern Oil and Gas NOG stock has gone up 2.6% since its third-quarter 2022 results were announced on Nov 8. The upside can be attributed to the independent oil and gas producer’s third-quarter earnings and revenues outperforming the consensus mark.

Behind The Earnings Headlines

Northern Oil reported third-quarter 2022 adjusted earnings per share (EPS) of $1.80, beating the Zacks Consensus Estimate of $1.70, primarily attributable to greater net production and continued high commodity prices. Moreover, the bottom line improved considerably from the year-ago profit of 84 cents.

The company's oil and natural gas sales of $534 million beat the Zacks Consensus Estimate of $413 million. The top line also skyrocketed from the year-ago figure of $259.7 million.

In good news for investors, Northern Oil instituted a 20% dividend hike compared with the previous quarter. It declared a regular quarterly cash dividend for NOG’s common stock of 30 cents per share, payable on Jan 31, 2023, to stockholders of record as of the close of the business on Dec 29, 2022. Its adjusted EBITDA rose about 7% sequentially to $292.4 million.

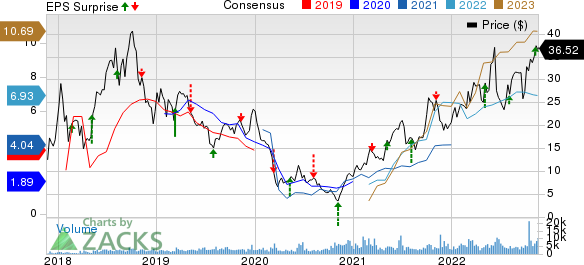

Northern Oil and Gas, Inc. Price, Consensus and EPS Surprise

Northern Oil and Gas, Inc. price-consensus-eps-surprise-chart | Northern Oil and Gas, Inc. Quote

Production & Price Realizations

The third-quarter production (comprising 57% oil) surged about 37.2% from the year-ago level to 79,123 barrels of oil equivalent per day (Boe/d) and surpassed the Zacks Consensus Estimate of 76,579 Boe/d. While the oil volume came in at 45,107 barrels per day (up 32.5% year over year), natural gas totaled 294,096 thousand cubic feet per day (up 44%).

The average sales price for crude oil in the third quarter was $90.54 per barrel, reflecting a 39.5% hike from the prior-year realization of $64.91. The average realized natural gas price was $8.43 per thousand cubic feet compared with $4.33 in the year-earlier period.

Financial Position

Excluding working capital, cash flow from operations jumped roughly 7% from the last quarter’s figure to $269.3 million, while Northern Oil's organic drilling and development capital expenditure totaled $136.6 million. The company's free cash flow for the quarter was $110.6 million.

As of Sep 30, the owner of non-operating, minority interests in thousands of oil and gas wells had $9.13 million in cash and cash equivalents. The company had long-term debt of around $1.17 billion.

Guidance

Northern Oil's output for 2022 is now anticipated in the 74,500-78,000 Boe/d range compared with the previous guidance in the band of 73,000-77,000 Boe/d.

NOG updated its total capital spending guidance for 2022 from the $405-$470 million range to the $460-$510 million band.

Moreover, the company also updated this year's oil-mix guidance from the 59.5-61.5% range to the 59-60.5% range.

Zacks Rank

Currently, Northern Oil has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Releases

Devon Energy Corp. DVN reported third-quarter 2022 adjusted earnings of $2.18 per share, beating the Zacks Consensus Estimate of $2.13 by 2.4%.

The Zacks Consensus Estimate for DVN’s 2022 earnings implies year-over-year growth of 149.3%. Devon Energy witnessed an average surprise of 8.5% in the last four reported quarters.

TotalEnergies SE TTE reported third-quarter 2022 operating earnings of $3.83 (€3.78) per share, lagging the Zacks Consensus Estimate of $3.91 by 2.04%.

The Zacks Consensus Estimate for TTE’s 2022 earnings implies year-over-year growth of 115.7%. TotalEnergies posted an average surprise of 10.9% in the last four reported quarters.

CNX Resources Corporation CNX reported a third-quarter 2022 adjusted loss of 54 cents per share, which missed the Zacks Consensus Estimate for earnings of 72 cents by 175%.

CNX Resources’ long-term (three to five years) earnings growth is currently pegged at 26.1%. The Zacks Consensus Estimate for CNX’s 2022 earnings implies year-over-year growth of 24.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Devon Energy Corporation (DVN) : Free Stock Analysis Report

CNX Resources Corporation. (CNX) : Free Stock Analysis Report

Northern Oil and Gas, Inc. (NOG) : Free Stock Analysis Report

TotalEnergies SE Sponsored ADR (TTE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance