Noble Corp. (NE) Down 22.7% Since Q1 Earnings: Here's Why

Since the announcement of weaker-than-expected first-quarter earnings on May 6, Noble Corporation plc NE has seen a 22.7% decline in share price. Demand destruction caused by coronavirus-induced lockdowns and travel bans has kept crude prices in the bearish territory, thereby hurting upstream companies. This has reduced demand for offshore drillers like Noble Corp. The market outlook seems bearish at the moment.

Weaker-Than-Expected Q1 Earnings

Noble Corp. reported first-quarter 2020 loss of 34 cents per share, excluding one-time items, wider than the Zacks Consensus Estimate of a loss of 31 cents. However, the quarterly loss was narrower than the year-ago loss of 39 cents per share.

Total revenues fell to $281.3 million from $282.9 million in the prior-year quarter. However, quarterly revenues beat the Zacks Consensus Estimate of $268 million.

The company’s weaker-than-expected earnings can be attributed to lower average dayrate, partially offset by an increase in total rig fleet utilization and operating days.

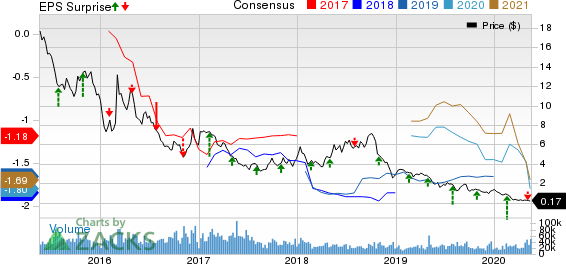

Noble Corporation Price, Consensus and EPS Surprise

Noble Corporation price-consensus-eps-surprise-chart | Noble Corporation Quote

Operating Highlights

Total average rig utilization increased to 77% from the year-ago level of 76%. However, overall average dayrate decreased to $155,526 from $172,305 in the year-ago quarter. Overall operating days increased to 1,719 from 1,570 in the year-ago period.

The average dayrate for the company's jackups was $131,253, up from $127,150 in the prior-year quarter. Moreover, average capacity utilization rose to 94% from the year-ago level of 93%.

The average dayrate for its floaters was $196,759 compared with $236,715 in the prior-year quarter. Moreover, average capacity utilization fell to 58% from the year-ago level of 60%.

Costs & Expenses

Total contract drilling service costs decreased to $161.1 million in the quarter from $171.7 million in the year-ago period. General and administrative costs rose to $17.8 million from $16 million in first-quarter 2019. Total operating costs and expenses surged to $1,413.9 million from the year-ago figure of $306.7 million, primarily due to huge impairment charges.

Backlog

As of Mar 31, 2020, the offshore drilling contractor’s total revenue backlog was $1.5 billion. Of the total, $1 billion resulted from the floating fleet while the remaining $500 million was from the jack up fleet.

Financials

Capital expenditure in the reported quarter totaled $25 million.

At first quarter-end, the company had a cash balance of $175.9 million, up from the fourth-quarter level of $104.6 million. Its long-term debt declined to $3,692.5 million from $3,779.5 million in the fourth quarter. The company has a debt-to-capitalization of 58.7%.

Outlook

Energy demand destruction stemming from coronavirus-induced lockdowns and the oversupplied crude market is affecting upstream companies. This, in turn, is reducing demand for the services provided by companies like Noble Corp. As such, the outlook for the offshore drilling industry seems gloomy.

An estimated 51% of its available rig days remaining in the year were contracted.

Zacks Rank & Stocks to Consider

Currently, Noble Corp. has a Zacks Rank #3 (Hold). Some better-ranked players in the energy space include EnLink Midstream LLC ENLC, CNX Resources Corporation CNX and Comstock Resources, Inc. CRK, each holding a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

EnLink Midstream’s 2020 earnings per share are expected to rise 97.9% year over year.

CNX Resources beat earnings estimates thrice and met once in the last four quarters, with average positive surprise of 111.5%.

Comstock Resources’ 2020 sales are expected to gain 32.7% year over year.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Comstock Resources, Inc. (CRK) : Free Stock Analysis Report

CNX Resources Corporation. (CNX) : Free Stock Analysis Report

Noble Corporation (NE) : Free Stock Analysis Report

EnLink Midstream, LLC (ENLC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance