NiSource's (NI) Clean Energy Goals & CAPEX Plans Bode Well

NiSource Inc.’s NI focus on strengthening its existing infrastructure and efforts to increase production of clean energy are likely to boost its performance. Its strong liquidity position is a boon.

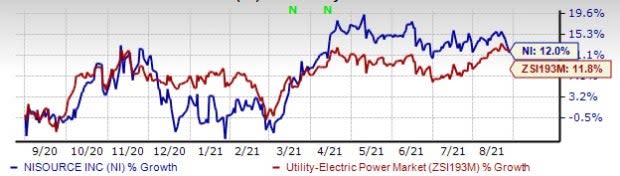

The Zacks Consensus Estimate for 2021 earnings is pegged at 10 cents per share, indicating growth of 11.11% from the year-ago reported figure. The consensus mark for current-year revenues stands at $1 billion, suggesting 10.82% growth from the prior-year reported number. The company’s long-term (three to five years) earnings growth is pegged at 6.16%. In the past year, shares of NiSource have rallied 12%, outperforming the industry's growth of 11.8%.

One Year Price Performance

Image Source: Zacks Investment Research

What’s Driving the Stock?

NiSource is working on its long-term utility infrastructure modernization program, and aims to invest in the range of $9.6-$10.7 billion during the 2021-2024 time frame. The company has 100% regulated business model and more than 75% of its capital expenditure starts providing returns in less than 18 months of investment. This will drive its earnings per share, seeing a 7-9% CAGR in the above-mentioned period.

Through cost-saving initiatives, the utility plans to cut its operating and maintenance expenses. In the first half of 2021, the same declined 6.3% from the year ago period’s level. Such measures will boost the company’s margins over the long term. It had $2.2-billion worth liquidity at the end of second-quarter 2021, adequate enough to meet its debt obligations.

The currently Zacks Rank #3 (Hold) company aims to curb its greenhouse gas emissions by 90% within 2030 from its 2005 baseline. The utility is planning to retire its 100% coal-generating sources by 2028 to replace the same with reliable and cleaner options at lower costs. It will retire its 1,300 MW R.M. Schahfer Generating Station by 2023 and replace the same with clean and renewable energy source. NiSource apart, utilities like Duke Energy DUK, DTE Energy DTE and Xcel Energy XEL among others are undertaking measures to supply clean energy.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Headwinds

The utility is exposed to variability in cash flows associated with volatility in natural gas prices, which acts as an overhang on the stock. Despite efforts made to maintain its assets, the old machineries may turn defunct, causing unplanned outages and adversely impacting the company’s operations.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Xcel Energy Inc. (XEL) : Free Stock Analysis Report

NiSource, Inc (NI) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

DTE Energy Company (DTE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance