NextGen (NXGN) Behavioral Health Suite to Focus on Mental Health

NextGen Healthcare, Inc. NXGN announced that CHE Behavioral Health Services had chosen NextGen Behavioral Health Suite to support its growing network. The NextGen Behavioral Health Suite is a comprehensive solution that provides access to a single, integrated physical and behavioral health record to treat a patient.

Carlsbad, CA-based CHE Behavioral Health is currently licensed to provide services in 47 states across the United States. However, it will initially begin using NextGen Behavioral Health Suite in 14 states.

With the latest adoption, NextGen is likely to solidify its foothold in the mental health treatment space across the nation, thereby boosting its Enterprise domain.

Significance of the Adoption

Per NextGen’s management, recent data has provided a concerning insight into the prevalence of mental health concerns in the U.S. adult population. It has revealed that nearly 21% of adults confirmed experiencing mental illness, and 15% of adults were diagnosed with a substance use disorder in the past year. Management believes that the partnership with CHE Behavioral Health Services will enable it to expand its reach to offer life-changing access to care and meet the rapidly growing demand.

CHE Behavioral Health’s management believes that implementing NextGen Behavioral Health Suite will enable it to work with a solution provider that understands the complexities of delivering quality mental health care.

Industry Prospects

Per a report by Prophecy Market Insights published on GlobeNewswire, the global mental health market accounted for $381.98 billion in 2020 and is anticipated to reach $527.44 billion by 2030, seeing a CAGR of 3.4%. Factors like the rise in elderly population, the increase in prevalence of mental disorders and the growing number of people seeking mental health support are likely to drive the market.

Given the market potential, the latest adoption of NextGen’s product is expected to significantly boost its business.

Notable Developments

Last month, NextGen announced that Mindful Care had selected NextGen Behavioral Health Suite to support its short- and long-term goals.

In March, NextGen announced the launch of Mirth Cloud Connect, a cloud-based solution that provides interoperability as a managed solution, at the ViVE 2023. Mirth Cloud Connect is built upon NextGen’s popular Mirth Connect.

In February, NextGen announced that Compass Health Network had chosen NextGen Behavioral Health Suite to provide whole-person care.

Price Performance

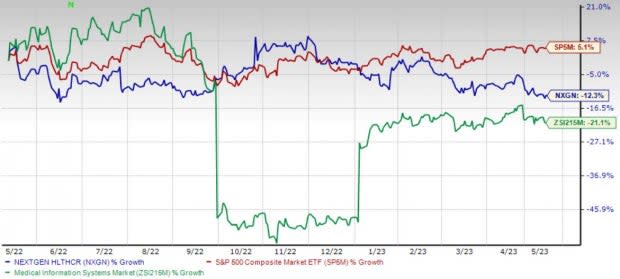

Shares of NextGen have lost 12.3% in the past year compared with the industry’s 21.1% decline and against the S&P 500's 5.1% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Currently, NextGen carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space are AmerisourceBergen Corporation ABC, Merit Medical Systems, Inc. MMSI and Cardinal Health, Inc. CAH.

AmerisourceBergen, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 8.9%. ABC’s earnings surpassed estimates in all the trailing four quarters, the average being 3.1%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AmerisourceBergen has gained 12.3% compared with the industry’s 11.8% rise in the past year.

Merit Medical, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11%. MMSI’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 20.2%.

Merit Medical has gained 47.1% compared with the industry’s 11.8% rise over the past year.

Cardinal Health, carrying a Zacks Rank #2 at present, has a long-term estimated growth rate of 12.4%. CAH’s earnings surpassed estimates in three of the trailing four quarters and missed in one, the average surprise being 12.3%.

Cardinal Health has gained 54.6% compared with the industry’s 11.8% rise over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

AmerisourceBergen Corporation (ABC) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

NEXTGEN HEALTHCARE, INC (NXGN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance