Newcrest Mining (ASX:NCM) Shareholders Have Enjoyed An Impressive 163% Share Price Gain

Want to participate in a research study? Help shape the future of investing tools and earn a $60 gift card!

When you buy a stock there is always a possibility that it could drop 100%. But when you pick a company that is really flourishing, you can make more than 100%. One great example is Newcrest Mining Limited (ASX:NCM) which saw its share price drive 163% higher over five years. It's also good to see the share price up 23% over the last quarter.

View our latest analysis for Newcrest Mining

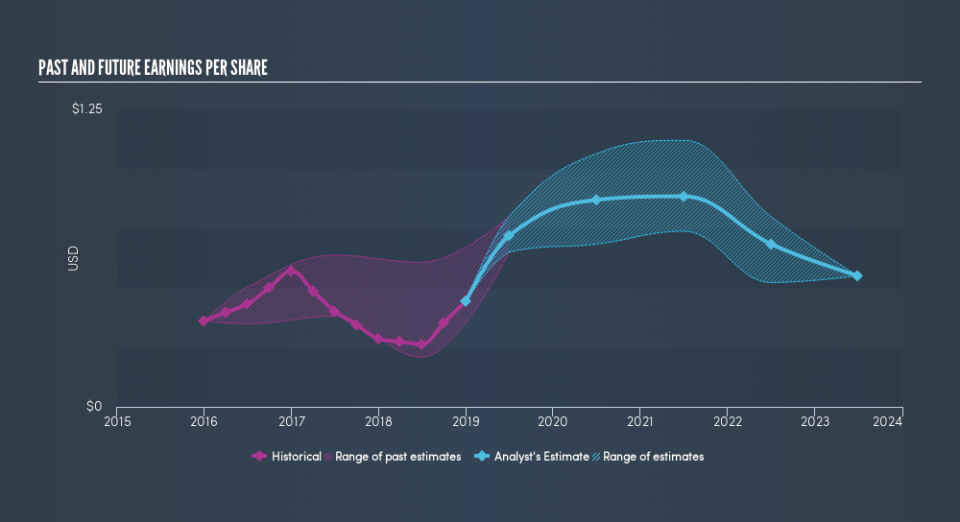

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years of share price growth, Newcrest Mining moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. We can see that the Newcrest Mining share price is up 53% in the last three years. Meanwhile, EPS is up 7.1% per year. This EPS growth is lower than the 15% average annual increase in the share price over three years. So one can reasonably conclude the market is more enthusiastic about the stock than it was three years ago.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Newcrest Mining has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Newcrest Mining will grow revenue in the future.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Newcrest Mining's TSR for the last 5 years was 171%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's good to see that Newcrest Mining has rewarded shareholders with a total shareholder return of 34% in the last twelve months. That's including the dividend. That gain is better than the annual TSR over five years, which is 22%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. If you would like to research Newcrest Mining in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course Newcrest Mining may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance