New Wells Fargo CEO will again run a West Coast-based company from NYC

Incoming Wells Fargo CEO Charles Scharf will have the new task of repairing the reputation of the scandal-ridden bank, with the old task of running a San Francisco-based company from the other side of the country.

On Friday morning, Wells Fargo (WFC) announced that Scharf would become the new leader of the company effective October 21. In its announcement, Wells Fargo said Scharf would oversee the bank from New York, where his family is based.

Scharf was the CEO of San Francisco-based Visa Inc (V) from 2012 to 2016, when he abruptly resigned from the company, saying that he felt he could “no longer spend time in San Francisco necessary to do the job effectively.”

Shortly after leaving Visa, Scharf was recruited to head the Bank of New York Mellon (BK), where he served as CEO.

Although Scharf will not have to move across the country for the new job, analysts are wondering if he will be able to run the company effectively from almost 3,000 miles away.

“I think Charlie Scharf is a solid appointment but not a perfect one,” said Portales Partners LLC’s Charles Peabody on Yahoo Finance’s On the Move. Peabody said Scharf’s issues with Visa, despite the advent of video conferencing and communications, could carry over to his new responsibilities at Wells Fargo.

Scharf addressed analysts on a conference call Friday morning, in which the second question was about his cross-country work arrangement. Scharf said Wells Fargo’s presence, with corporate offices across the U.S., means that he would not have spent much time in the San Francisco office even if he relocated there.

“I don't think anyone would ever say in the places I've worked that I've not been present,” Scharf said. “I think it's just the opposite.”

Turnaround effort underway

Scharf’s unique challenge with Wells Fargo is repairing the reputation of a company damaged by a series of scandals over the past few years.

In 2016, Wells Fargo paid fines for opening millions of fake deposit and credit card accounts without customers’ consent. In the time that followed, the company faced other fines for improperly repossessing servicemembers’ cars and squeezing customers on auto insurance policies they had never signed up for.

In February 2018, the Federal Reserve announced an unprecedented asset cap on Wells Fargo’s growth, citing “widespread consumer abuses and compliance breakdowns.”

In July, Fed Chairman Jerome Powell said Wells Fargo’s problems are “deep-seated” and will not be “fixed quickly,” suggesting that the bank is still some time from having its asset cap lifted.

Wells Fargo hopes that hiring Scharf will finally bring some stable leadership to the company, which saw the ouster of CEO John Stumpf in 2016 and then the departure of Tim Sloan in March of this year. Since March, the bank’s general counsel C. Allen Parker had been serving as interim CEO.

Banking background

Although Scharf’s CEO resume began with Visa, he earned his stripes in the consumer banking space. In 1987 he joined Commercial Credit, the consumer finance company helmed by Jamie Dimon and Sandy Weill (who would go on to head JPMorganChase and Citigroup, respectively).

Scharf told analysts Friday that the businesses at Wells Fargo are “extraordinary” and said the company has a “damn good base” to build from in getting past its regulatory issues.

“We know we have a series of regulatory issues that we need to complete the work on, that is clearly the first priority,” Scharf said. Per its agreement with regulators, the Office of the Comptroller of the Currency gave Wells Fargo the green light on Scharf’s appointment to become the next CEO.

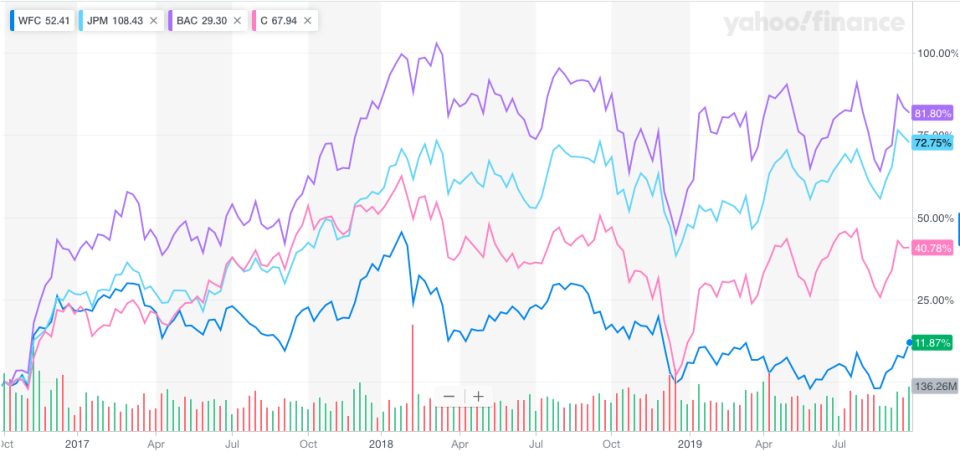

Scharf has his work cut out for him. Shares of Wells Fargo have underperformed against the other peer banks in the big four: JPMorgan Chase (JPM), Bank of America (BAC) and Citigroup (C).

Peabody says a turnaround at a major bank takes about five years, and guessed that Wells Fargo still needs another two to three years to improve its “operational fundamentals.”

The company has faced higher expenses as it attempts to improve compliance and risk management, a critical step to lifting its asset cap but at a cost that damages the company’s profitability.

Hiring Scharf is the first big step, one that Wells Fargo Chairman Elizabeth Duke says was long overdue. Duke acknowledged that stakeholders found the six months of search “frustrating,” but said she thinks Scharf is the right person for the job.

“Somebody asked me to grade our progress, and I said ‘this is a pass-fail exercise,’” Duke told analysts Friday morning. “And I think we have passed with flying colors.”

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Boston Fed’s Rosengren: Lower rates could expose co-working companies like WeWork

St. Louis Fed's Bullard: 'Prudent risk management' would have been a 50 basis point cut

Powell faces record dissent as Fed splits further on interest rates

‘The weirdest place in the world’: What the Fed missed in Jackson Hole

Read the latest financial and business news from Yahoo Finance

Yahoo Finance

Yahoo Finance