NETSTREIT (NYSE:NTST) investors are sitting on a loss of 7.3% if they invested a year ago

Most people feel a little frustrated if a stock they own goes down in price. But in the short term the market is a voting machine, and the share price movements may not reflect the underlying business performance. So while the NETSTREIT Corp. (NYSE:NTST) share price is down 10% in the last year, the total return to shareholders (which includes dividends) was -7.3%. That's better than the market which declined 11% over the last year. NETSTREIT may have better days ahead, of course; we've only looked at a one year period. The last month has also been disappointing, with the stock slipping a further 12%. But this could be related to poor market conditions -- stocks are down 7.5% in the same time.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they've been consistent with returns.

See our latest analysis for NETSTREIT

While NETSTREIT made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

NETSTREIT grew its revenue by 71% over the last year. That's a strong result which is better than most other loss making companies. While the share price is down 10% in the last year, not too bad given the weak market. Given the strong revenue growth, it may simply be that the stock is suffering from market conditions. For us, this sort of situation smells of opportunity - the share price is down but the revenue is up. Either way, we'd say the mismatch between the revenue growth and the share price justifies a closer look.

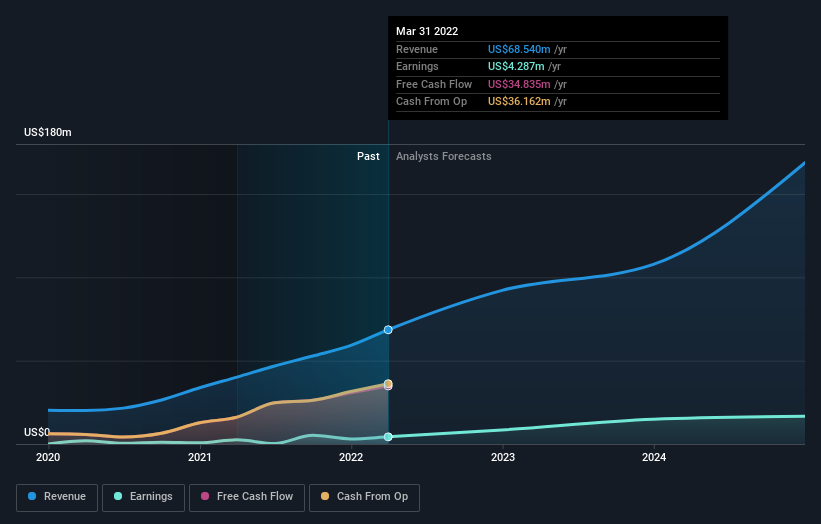

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at NETSTREIT's financial health with this free report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, NETSTREIT's TSR for the last 1 year was -7.3%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Given that the broader market dropped 11% over the year, the fact that NETSTREIT shareholders were down 7.3% isn't so bad. The falls have continued up until the last quarter, with the share price down 6.4% in that time. This doesn't look great to us, but it is possible that the market is over-reacting to prior disappointment. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for NETSTREIT you should know about.

Of course NETSTREIT may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance