NETGEAR (NTGR) Shares Fall Due to Wider-Than-Expected Q1 Loss

NETGEAR, Inc NTGR reported first-quarter 2023 non-GAAP loss of 19 cents per share compared with the non-GAAP loss of 28 cents recorded in the year-ago quarter. However, it came in wider than the Zacks Consensus Estimate loss of 10 cents per share.

NETGEAR generated net revenues of $180.9 million, down 14.1% year over year. The downtick resulted from the weakness in the retail and service segment of the connected home business and small and medium business (SMB) inventory reduction by its largest e-commerce partner. Also, the top line missed the consensus estimate by 6.5%.

Region-wise, net revenues from the Americas were $121.9 million (67% of net revenues), down 15.7% year over year. Europe, the Middle East and Africa revenues (22%) were $39.2 million, up 6.3%. The Asia Pacific Region revenues (11%) were down 31.8% to $19.8 million.

NETGEAR, Inc. Price, Consensus and EPS Surprise

NETGEAR, Inc. price-consensus-eps-surprise-chart | NETGEAR, Inc. Quote

NETGEAR ended the quarter with 772,000 paid service subscribers. The company aims to reach 875,000 subscribers by the end of 2023.

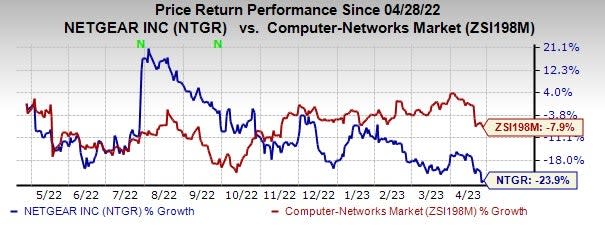

Following the announcement, shares of the company went down 13.8% in the pre-market trading on Apr 27, 2023. Shares of the company have lost 23.9% compared with the sub-industry’s decline of 7.9% in the past year.

Image Source: Zacks Investment Research

Segmental Performance

Connected Home (including Orbi, Nighthawk, Nighthawk Pro Gaming, Armor, and Meural Brands) delivered revenues of $102.7 million, down 21.2% year over year. The downtick was due to softness in the retail and service business, which had witnessed pandemic-led elevated consumer demand in the prior-year period. However, the segment witnessed strong demand for premium Wi-Fi mesh systems and 5G mobile hotspots.

Orbi 8 and Orbi 9 Wi-Fi mesh products and 5G mobile hotspots helped the company to improve its connected home business. The company is likely to benefit from the ongoing Wi-Fi 7 upgrade cycle. The company also plans to launch the U.S. version of the unlocked Nighthawk M6 Pro 5G mobile hotspots to further grow its CHP business.

NETGEAR holds about 39% share in the U.S. retail Wi-Fi market, including mesh, routers, gateways and extenders.

In the quarter under review, the company announced a new addition to its Nighthawk line, the Nighthawk RS700 Router, the first Wi-Fi 7 router in the market.

Despite the strong demand for ProAV-managed switched products, revenues from SMB declined 2.6% year over year to $78.2 million. The downtick was caused by anticipated channel inventory reductions and unanticipated inventory reductions at its largest e-commerce channel partner, owing to a volatile macroeconomic environment.

Other Details

The adjusted gross margin increased to 33.6% from 28.2% year over year. The non-GAAP operating loss margin was 3.9% compared with 4.4% in the year-ago quarter.

Cash Flow & Liquidity

As of Apr 2, 2023, NETGEAR generated $9.1 million in cash from operations. The company also had $143.2 million in cash and cash equivalents and $317.7 million of total current liabilities compared with $146.5 million and $345.9 million, respectively, in the quarter that ended Dec 31, 2022

The company did not repurchase any shares in the quarter under review.

Q2 Outlook

For the second quarter of 2023, NETGEAR anticipates net revenues of $150-$165 million as the company remains optimistic that SMB and the CHP service provider channel will gain momentum amid volatile macroeconomic conditions.

The GAAP operating margin is estimated to be between (13.4)% and (10.4)%.

The non-GAAP operating margin is expected to be between (9)% and (6)%.

Zacks Rank & Other Stocks to Consider

NETGEAR currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader technology space are Arista Networks ANET, Asure Software ASUR and Salesforce CRM. Asure Software and Salesforce currently sport a Zacks Rank #1 (Strong Buy), whereas Arista Networks carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Arista Networks’ 2023 earnings has increased 1.2% in the past 60 days to $5.83 per share. The long-term earnings growth rate is anticipated to be 14.2%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 14.2%. Shares of ANET have increased 29% in the past year.

The Zacks Consensus Estimate for Asure Software’s 2023 earnings has increased 25% in the past 60 days to 35 cents per share. The long-term earnings growth rate is anticipated to be 25%.

Asure Software’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 445.8%. Shares of ASUR have increased 122.4% in the past year.

The Zacks Consensus Estimate for Salesforce’s 2023 earnings has increased 21.5% in the past 60 days to $7.11 per share. The long-term earnings growth rate is anticipated to be 16.8%.

Salesforce’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average surprise being 15.6%. Shares of the company have increased 3.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

NETGEAR, Inc. (NTGR) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance